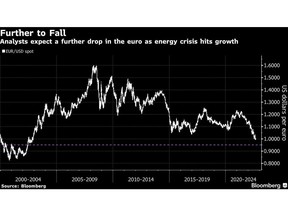

The intensifying energy crunch in Europe may further depress the euro after Russia shut off key gas taps, signaling a cold and difficult winter ahead for businesses and households.

Article content

(Bloomberg) — The intensifying energy crunch in Europe may further depress the euro after Russia shut off key gas taps, signaling a cold and difficult winter ahead for businesses and households.

Article content

Key European nations led by Germany announced measures over the weekend to tackle a cost-of-living crisis and spiraling energy prices after Russian state gas producer Gazprom PJSC Friday said it would indefinitely halt supplies through a key pipeline to Western Europe.

Article content

The shared currency was slightly lower in Sydney as a new trading week got under way, easing less than 0.1% against the greenback to $0.9949. Markets are now focusing on the $0.9901 trough hit in August. A break below that level would see the pair at its weakest since December 2002.

“The outlook is poor for Europe — it started to get choppy at the tail end of last week, and it is almost certainly going to get worse,” said Gordon Shannon, a portfolio manager at TwentyFour Asset Management LLP.

Article content

Read More:Throttled Trade Gives Euro Bears Even More Reason to Hit Sell

The energy crisis has been deepening since Russia’s invasion of Ukraine pushed commodity prices sharply higher and damaged relations between the Kremlin and Europe. This was a significant factor pushing the euro to parity with the US dollar last month for the first time since 2002. The new strains on energy supplies ahead of the winter threaten to put a further drag on the regional economy at a time when soaring consumer prices are putting pressure on the European Central Bank to tighten monetary policy.

Read More: Europe’s Energy Crisis Deepens After Russia Keeps Pipeline Shut

“The ECB had only just started to catch up with the Fed in terms of hiking rates, but if we are going into a prolonged recession, I think this slows down their attempts,” Shannon said.

Article content

Lagarde’s Challenge

There are growing expectations for the ECB to raise rates by 75 basis points as soon as Thursday. The decision remains a challenging one as chief Christine Lagarde and her colleagues manage the twin problems of high inflation and an impending recession.

In a sign of the severity of the problem, Germany unveiled Sunday a relief plan worth about 65 billion euros ($65 billion) while Finland said it would stabilize the power market with a $10 billion program. Sweden on Saturday announced a $23 billion emergency backstop for its utilities as it seeks to head off a broader financial crisis.

Read More: Nordic Utilities Get $33 Billion Backstops as Power Markets Fray

Goldman Sachs analysts led by Kamakshya Trivedi, meanwhile, shifted down their forecasts for the euro to 97 cents over the next three months from 99 cents previously, they said in a note Friday before the various relief packages were announced. They also believe the euro will remain below parity with the dollar over a six-month period. Previously they forecast a recovery to 1.02 dollars per euro.

“While the euro area has made good progress in amassing gas storage for the coming winter, this has come at the cost of significant demand destruction via production cuts, and does not totally eliminate the risk of a more severe disruption over the winter,” they said in the note.

(Updates euro’s move, adds link to story on Europe’s energy intervention)

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.