It’s been a rough year for cannabis company stocks, even as more states in the US move to legalise or decriminalise marijuana.

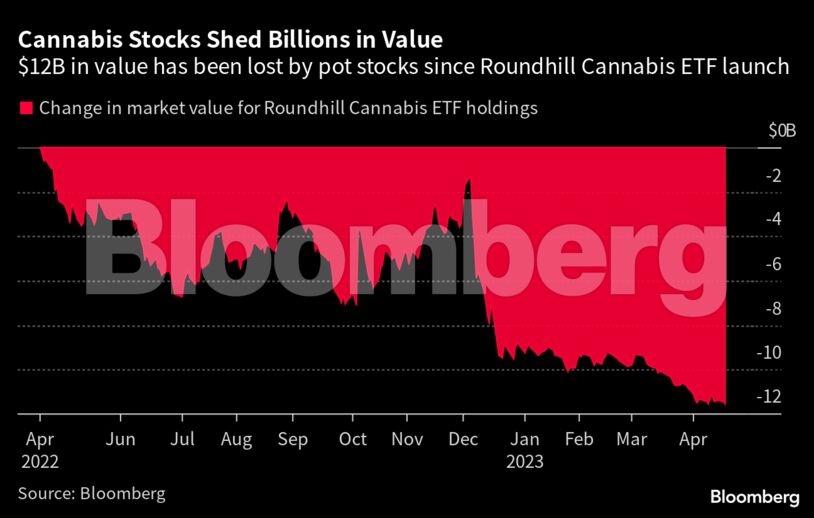

The Roundhill Cannabis ETF (Weed) has declined nearly 72% since its launch one year ago on 420 Day — an unofficial pot holiday — as the stocks it holds have lost investors nearly $12 billion in value. The MJ PurePlay 100 Index, which includes 100 cannabis-related stocks, has shed 65% in the same timeframe.

Pot stocks have struggled this year after the industry was dealt a major blow in December when legislation that would’ve allowed more banks to work with legal cannabis companies was taken out of a roughly $1.7 trillion funding measure. It was the third failed attempt to attach the legislation, called the SAFE Banking Act, to a bill last year.

Without the passage of SAFE, banks are largely prohibited from working with marijuana-linked companies because the substance is illegal on the federal level. This forces many companies to work in cash or invent ways around the banking system. The pot lobby will makes its case on Capitol Hill on Thursday.

Cannabis companies are also subject to the same tough market, potentially weakening economic outlook and rising interest-rate environment that’s weighing on other stocks. Curaleaf Holdings Inc., for instance, has cut some staff, had a New Jersey license renewal declined and this week said it misstated revenue in 2022 and 2021 financial statements, adding to the 62% drop from a year earlier.

Still, Wall Street is still largely bullish on cannabis companies and the industry in the long-term. Curaleaf has 15 buy ratings, 2 holds and 0 sells, according to data compiled by Bloomberg.

That’s because if regulatory hurdles go away, the stocks would be poised for growth, said Gerald Pascarelli of Wedbush, adding that it may take years.

But looking at the relative valuations of the stocks, how new the industry is and the growth prospects, “there’s certainly upside,” he said.

© 2023 Bloomberg

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.