(Bloomberg) —

Article content

(Bloomberg) —

Advertisement 2

Article content

The history books may not judge it as such, but the UK is sliding into a recession in all but name in 2022.

While statistical quirks, including the presence of an extra bank holiday for the Queen’s Diamond Jubilee, mean the nation may avoid two consecutive quarters of contraction, almost every other economic metric is screaming recession.

That leaves post-pandemic Britain on course to underperform every other major leading economy next year, posing a severe headache for both Bank of England Governor Andrew Bailey and Prime Minister Boris Johnson.

Consumer confidence is already below levels seen in any economic downturn since at least the 1970s, even before the full effects of the fastest inflation in decades kicks in. And a government intervention to cut energy bills will only go so far to help. Until then, households had been facing the biggest fall in living standards since the 1950s.

Advertisement 3

Article content

Even the housing market, a clear demonstration of people’s sense of their own wealth and a pillar of strength in recent years, is showing some signs of cooling, with demand for mortgages dropping as interest rates rise.

With inflation set to peak in double digits in October, five times the BOE’s 2% target, Bailey and his colleagues have little option but to keep raising interest rates, even if means making the cost of living crisis worse in the short run.

For Johnson, who came close to being ousted by his own Conservative Party in a confidence vote on Monday, rescuing the economy is vital if he’s survive much longer. It was no coincidence that his first speech since the ballot stressed the need for tax cuts and floated lower tariffs to tackle the cost of living crisis.

Advertisement 4

Article content

Sign of the mounting pressures on households and businesses are expected to be revealed in data this week.

The economy expanded just 0.1% in April, according to the median forecast in a Bloomberg survey, following zero growth over the previous two months. Retail sales are thought to have fallen in May, and economists expect the labor market lost momentum with employers adding little more than half the number of payrolls they did in April.

Sandwiched between the reports, the BOE on Thursday is expected to deliver an unprecedented fifth consecutive hike to take interest rates to the highest since 2009.

What Bloomberg Economics Says…

“We expect policy makers to vote 6-3 in favor of a rate hike to 1.25%, from 1% currently. Michael Saunders, Catherine Mann and Jonathan Haskel are likely to favor 50 basis points, as they did in May and February. We also think the tight labor market and extra fiscal support will convince the two members of the committee who didn’t sign up to the guidance in the May minutes to vote for a 25-bp hike this month.”

Advertisement 5

Article content

—Dan Hanson. Click here for the full preview

Money market are betting on rates topping 3% next year, marking the fastest tightening cycle in history.

The fragility of the economy as it emerges from the pandemic and Brexit means that the UK is facing a long period in the doldrums, hobbled by continued feeble productivity growth, rather than a short, sharp downturn.

In May, the BOE saw a major drop in output of around 1% in the final quarter of this year, followed by a small contraction in 2023 and stagnation in 2024. A new £15 billion ($18.5 billion) support package subsequently announced by Chancellor Rishi Sunak offers only temporary relief.

The OECD said last week that it sees no growth in the UK next year — the worst outlook among major nations. Households will take on debt to “to keep up with the rising cost of living;” businesses will cut investment in the face of higher borrowing costs.

Advertisement 6

Article content

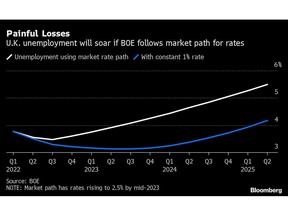

All that adds up to one of the bleakest periods for the UK economy in decades, certainly outside of the major shocks of the financial crisis and Covid, with only the resilient labor market providing any solace for the government and consumers. Even there, the BOE expects around half a million more jobseekers will be out of work within the next two years.

“It’s less about whether we get a technical recession, and more about whether the jobs market turns,” said James Smith, and economist at ING. “When you look back over history, severe downturns are marked by whether or not we get a pronounced rise in unemployment.”

For ordinary Britons, the vagaries of economic statistics, or a few basis points of growth here or there, will matter very little in the months ahead.

Advertisement 7

Article content

Plunging household living standards, shattered confidence and little or no growth mean it will feel like a recession for some, whatever the official data show. And, say poverty campaigners, the help provided by Sunak, welcome as it is, does nothing to address the fundamental problems facing those on low incomes.

“Even before this period of high inflation, there were a lot of people who were in debt, a lot of people experiencing poverty — it doesn’t even start to attack those longer-term issues,” Rebecca McDonald, senior economist at the Joseph Rowntree Foundation, told lawmakers last week.

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Advertisement

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.