The UK this week will face up to surging inflation and labor strikes as well as a rising risk of recession in a series of setbacks that have echoes of the 1970s.

Article content

(Bloomberg) — The UK this week will face up to surging inflation and labor strikes as well as a rising risk of recession in a series of setbacks that have echoes of the 1970s.

Advertisement 2

Article content

Strikes are likely to halt at least half of all trains for three days in the worst disruption to mass transit since Margaret Thatcher was prime minister. The teachers union also is set to ballot its members on a strike, adding to the list of professions considering action.

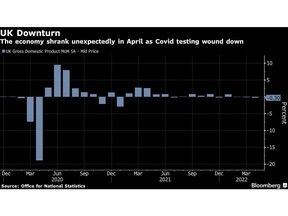

On Wednesday, inflation is set to rocket to a new 40-year high with the cost of goods leaving factories already racing ahead at a double-digit pace. Last week, the government confirmed the economy shrank in the three months through April, the weakest performance since a coronavirus lockdown.

Prime Minister Boris Johnson’s government and the Bank of England are confronting the deteriorating outlook by keeping tight control on pay and signaling quicker interest-rate increases. That could tip the economy into a more protracted downturn.

Advertisement 3

Article content

The BOE “may have to force a recession in order to get inflation out of the economy,” Paul Johnson, director of the Institute for Fiscal Studies, said on Times Radio on Sunday.

City of London financiers are worried about a damaging recession, the Financial Times reported, citing its network of 50 senior executives. “It’s not pretty,” Amanda Blanc, CEO of the insurer Aviva, told the newspaper. “The risk of a recession looks real . We see a weak outlook for growth. Stagnation is a clear possibility.”

The backdrop increasingly recalls the 1970s, when strikes, inflation and energy shortages put industry on a three-day week. The malaise culminated in a bailout of the public finances by the International Monetary Fund in 1976 and the “winter of discontent” where trash piled up in streets in 1979 shortly before Thatcher took office.

Advertisement 4

Article content

The biggest feature of the current bout of misery is wages growing more slowly than the cost of goods and services across the economy.

That’s prompted the biggest fall in real incomes in two decades and reawakened union anger about low pay settlements. The sentiment is widely held across the public services, with junior doctors, postal workers and traffic wardens also considering action.

Mick Lynch, the head of the RMT union coordinating the train strikes, urged broader action across the economy and raised the possibility of the first nationwide strike since 1926.

“I would take a general strike if we could get one,” Lynch told BBC radio on Sunday.

Transport Secretary Grant Shapps rejected comparisons with the 1970s, noting that unemployment is much lower now than it was then.

Advertisement 5

Article content

“What we’ve got now is an economy which is fortunately with very high levels of employment and very low unemployment,” Shapps said on Sky News.

The opposition Labour Party said Johnson’s government is trying to distract voters from its ineptitude in dealing with the problems at hand.

“The government has got to get round the table with the cleaners and the ticket office staff and the station workers to resolve this,” Lisa Nandy, the Labour member of Parliament who speaks on “leveling up” policies, said on Sky News. “The biggest problem that this country has is not militant workers. It’s a militant government.”

The Treasury on Monday will announce two new measures aimed at softening the impact of surging prices, which have led to a the biggest drop in real wages in two decades.

Advertisement 6

Article content

It’s tightening rules on buy-now-pay-later financing to make loan promotions more transparent. And it’s starting an online tool to help workers see the impact of a £6 billion ($7.3 billion) tax cut coming into effect in July.

“This new tool will show hard-working Brits how much more of their pay will be going directly into their pockets,” Chancellor of the Exchequer Rishi Sunak. “The tax cut, combined with £400 off energy bills and direct payments of £1,200 to 8 million families will help shield people from rising prices.”

Overshadowing that aid is the government’s increasingly acrimonious dispute with rail unions. Shapps blamed “militant” unions for rebuffing talks and efforts to modernize the rail network.

Advertisement 7

Article content

Lynch said rising inflation means worker pay is falling behind and that most of his members haven’t had a raise in at least two years. He’s also upset about plans to extend the working week from 35 hours to 40.

“They told our maintenance staff that 3,000 jobs will go,” Lynch said on Sky News. “You have more hours for less money. We’ve got a real crisis. They are trying to restore profit in a way that makes workers pay.”

Inflation figures on Wednesday are set to underscore the scale of the problem. Economists expect a reading of 9.1% for May, and the BOE says that will accelerate past 11% later this year — more than five times the 2% target.

The central bank has responded by lifting interest rates to the highest since 2009. Last week, Chief Economist Huw Pill signaled policy makers could move rates higher in half-point steps if they see signs of price pressures seeping into wages.

Advertisement 8

Article content

The National Education Union is pressing for higher pay and plans to ballot its 460,000 members if the government doesn’t come up with a higher offer by Wednesday, the Observer newspaper reported.

“Teachers are suffering, not only from the cost-of-living crisis, which the whole country is grappling with, but 12 years of real terms pay cuts,” Patrick Roach, general secretary of the teaching union NASUWT, said in a statement.

Read more:

- UK Braces for Travel Chaos From Biggest Rail Strike in Decades

- Wounded Johnson Seeks to Direct UK Tory Ire Onto Common Enemies

- Bank of England and Sunak Set to Step Up Fight Against Inflation

- UK Jobs Market May Be Loosening With Surprise Drop in Median Pay

- UK Real Wages Post Their Biggest Drop in Two Decades

- UK Economy Shrinks Unexpectedly as Covid Testing Winds Down

Advertisement

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.