Turkey’s new finance minister has vowed to return to “rational” policies after years in which President Recep Tayyip Erdoğan’s unconventional strategy put the country’s $900bn economy under intense strain and sent the lira to record lows.

“Transparency, consistency, predictability and compliance with international norms will be our basic principles in achieving the goal of raising social welfare,” Mehmet Şimşek said on Sunday at a handover ceremony with his predecessor Nureddin Nebati.

“Turkey has no choice but to return to a rational basis,” he said, adding: “We will prioritise macro financial stability.”

Şimşek previously served as deputy prime minister and finance minister before leaving government in 2018. Erdoğan brought him back into the cabinet on Saturday as part of a shake-up that has raised expectations Turkey will shift away from the unorthodox policies that have made worse a severe cost of living crisis and sent foreign investors fleeing the market.

“The choice of Mehmet Şimşek . . . increases the likelihood that monetary policy will shift towards a more orthodox direction,” Goldman Sachs said in a note to clients on Saturday.

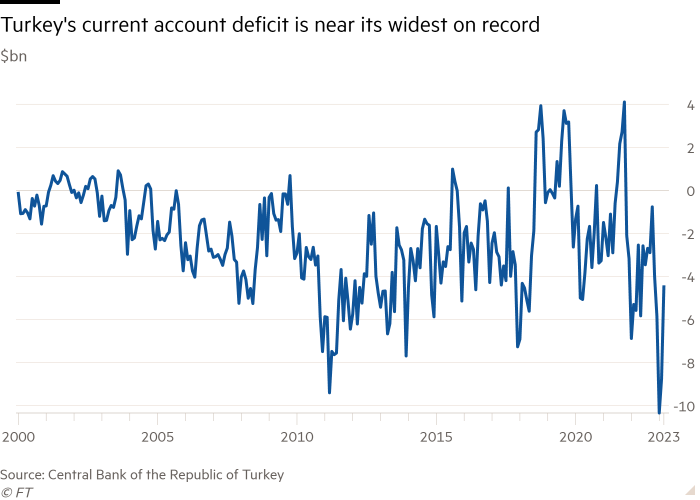

Şimşek and other officials appointed to steer the economy face significant challenges in setting Turkey on a more sustainable path. Inflation is running at more than 40 per cent and foreign currency reserves have been severely depleted in an attempt to prop up the lira and finance a huge current account deficit.

Despite attempts to stem the lira’s fall, the currency has tumbled 67 per cent against the dollar in the past three years.

“Reducing inflation to single digits in the medium term . . . and accelerating the structural transformation that will reduce the current account deficit are of vital importance for our country,” Şimşek said on Sunday.

Under a “lira-isation” policy pursued by Nebati, the government launched a series of measures that gave a strong incentive to businesses and consumers not to hold foreign currency. One of the highest-profile tools was the launch in 2021 of savings accounts that protected depositors against a depreciation in the lira, at the government’s expense.

About $125bn is held in the accounts and some economists are concerned that a significant weakening of the lira would rapidly hit government finances.

Other measures have included managing the ability of businesses to purchase foreign currencies, which some analysts have likened to capital controls.

Erdoğan’s government also sought to stimulate the economy ahead of the election, boosting the minimum wage and public sector pay, and handing out a month’s worth of free petrol. Many economists warn the measures have added to inflation pressures.

A test will be the extent to which Erdoğan, a longtime opponent of high borrowing costs, will allow interest rates to rise, investors and economists say. Erdoğan pushed the central bank to cut rates from 19 per cent two years ago to 8.5 per cent at present despite surging inflation.

The gap between the central bank’s policy rate and inflation has pushed “real” interest rates deep into negative territory — one of the reasons for the lira’s severe depreciation.

Investors are now waiting to see whether Erdoğan will reshuffle the leadership at the central bank. Incumbent Şahap Kavcıoğlu has overseen a series of sharp rate cuts at the behest of the president since taking the helm in March 2021.

Another issue is whether Erdoğan will be willing to stick to the programme if the central bank implements the sharp rate rises economists say are needed.

Goldman forecasts the lira will weaken sharply from slightly less than TL21 to the dollar to TL28 over the next year even with Şimşek steering economic policy.

Şimşek, a former senior Merrill Lynch bond strategist who is well-regarded by foreign investors, left his post as deputy prime minister in 2018 when the president appointed his own son-in-law Berat Albayrak as finance minister.

Albayrak was blamed for burning through tens of billions of dollars in foreign exchange reserves during his two years in the role in an unsuccessful attempt to stem a currency crisis, while the central bank sharply reduced interest rates.

Economists worry a similar situation could occur again if Erdoğan loses patience with an economic adjustment programme.

“Will any policy shift include greater central bank independence and higher interest rates or will this be a half-baked effort?” said Liam Peach at Capital Economics in London. “Presumably Şimşek has demanded tighter monetary policy as part of his agreement, but it would still be a surprise to us if Erdoğan relinquished full control.”

Additional reporting by Funja Güler

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.