A case is building for Indonesia and India — this year’s leading stock markets in emerging Asia — to maintain their edge.

Article content

(Bloomberg) — A case is building for Indonesia and India — this year’s leading stock markets in emerging Asia — to maintain their edge.

Advertisement 2

Article content

Both markets are benefiting from domestic demand that’s rebounding as the pandemic’s impact wears off, with the latest earnings season bringing positive surprises in key sectors. Slowing growth and macro risks in China is another reason for investors’ preference for these two destinations.

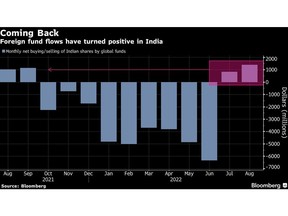

Beyond these common drivers, India is seeing a return of foreign investors that’s supercharging a market buoyed by an unprecedented retail investing boom. In Indonesia, the central bank has so far bucked the global tightening wave to keep rates at a record low, providing growth support as a commodities export boom offers a tailwind.

The Jakarta Composite Index has gained almost 8% so far in 2022, steadily leading the pack throughout the year. India’s NSE Nifty 50 Index has surged 10% in just the past month to be little changed for the year, still bucking the 19% slide in the MSCI EM Asia Index.

Advertisement 3

Article content

“I would be surprised if from here, either on local currency or dollar terms, the two countries don’t outperform,” said Vikas Pershad, a portfolio manager at M&G Investments. “The bottom-up earnings story seems pretty constructive and the top-down flows story in the region and relative macro uncertainty seems less.”

The resilience of the two markets stands out given that Asian stocks as a whole have lagged their US and European peers this year, and MSCI Inc.’s gauge of global stocks has also fallen by double digits.

A stronger dollar and rising global rates have hit tech-heavy markets like South Korea and Taiwan, while China has yet to find a bottom as its Covid Zero strategy, a property crisis and unpredictable regulations weigh on share prices.

Advertisement 4

Article content

READ: Taiwan Risk Brings Another Torrid Day for China’s Stock Market

India and Indonesia are the only two Asian markets with “China insulation,” as they have posted a negative return correlation with the MSCI China Index over the past two years based on monthly returns, Goldman Sachs Group Inc. strategists wrote in an Aug. 3 note.

Other banks have cited Indonesia, with its large domestic market and energy-export strength, as having weathered US downcycles in the past. India’s advance has gathered momentum in recent weeks as foreign flows turned positive for the first time in months.

READ: Top-Performing Asia Market Will Likely Go Higher: Taking Stock

Several banks in India — a sector that makes up more than a fourth of the Nifty 50 gauge — beat profit estimates for the latest quarter on higher mortgage and loan demand. After dipping from their July highs, forward earnings estimates for the Nifty gauge have started climbing once again.

Advertisement 5

Article content

READ: Recession Fears See $85 Billion Fund Manager Bet on India Stocks

To be sure, with the Reserve Bank of India’s half-point rate hike on Friday, the central bank’s hawkish stance and inflationary pressures are headwinds.

In Indonesia, though, the economy appears to be in a rare sweet spot. Core inflation is below 3%, giving the central bank room to hold rates for a little longer. And with last quarter’s growth beating estimates on reopening and booming exports, it’s got the highest net foreign inflows this year among developing Asian markets — $3.8 billion. Forward earnings estimates for the equity benchmark have also stabilized.

“Better results, better flows in the case of India, a depreciating but not wildly volatile currency in Indonesia sets the stage for why these two economies are outperforming,” said Zhikai Chen, head of Asian and global emerging market equities at BNP Paribas Asset Management.

Advertisement

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.