If you stay invested for the long term you are more likely to be protected against your own worst behaviour. We saw this in March 2020 during the brief ‘Covid crash’ when many investors panicked, moving out of equities to cash, thereby missing out on one of the fastest recoveries in history.

Had they stayed invested, they would have ridden out the crash and enjoyed the market boom that followed.

This kind of short-term knee-jerk reaction to market moves has been fatal to portfolios.

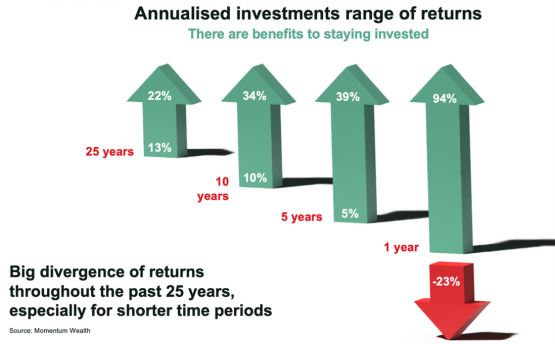

Research by Equilibrium shows how the difference in returns of clients widens the shorter the time horizon, and highlights the benefit of staying invested.

Over one year, that divergence ranged between -23% and +94%. Over 10 years, however, that divergence is much narrower: between +10% and +34%. The divergence over 25 years is even narrower, at between +13% and +22%.

Source: Momentum Wealth

Until recently, most portfolio managers had 70% to 80% exposure to value as an investment style, and that worked well in the prevailing market conditions, but may not be the best option going forward.

The use of discretionary fund managers (DFMs) has become a major trend in a market demanding better outcomes-based investment returns.

“This is driven in part by the complexity facing advisors in researching and monitoring thousands of unit trusts, not to mention the increasingly fraught compliance, reporting and admin requirements,” says Florbela Yates, head of Equilibrium, which has more than R13 billion in assets under management.

The rise of DFMs is explained in part by the challenge of matching individual clients’ objectives with an appropriate investment strategy.

For some clients, that objective may be to beat consumer inflation. Historically, that objective would be met by slotting the client into a fund designed to beat inflation, but without considering issues such as fund management, consistency of performance, portfolio construction, asset allocation or succession planning at the asset management house. Research has demonstrated that team instability can materially impact performance over time.

“The first part of our process is benchmarking, which involves looking at peer group performance, but that’s only part of it,” says Yates.

“More important is consistency of performance, and matching investment objectives to the appropriate benchmark. For example, some clients want to outperform CPI [consumer price index], but we will drill down into the funds and look at the team, its management, asset allocation and other factors that will deliver the kind of consistency we expect.

“Outcomes-based performance is not about beating CPI or outperforming a benchmark. It’s about the consistency of meeting the client’s investment objectives, and that involves a very personalised approach, commencing with the advisor.”

Defining the time horizon and determining the acceptable level of risk are critical inputs. That information is fed from the advisor to Equilibrium, and is then translated into an ideal portfolio for that client.

Asset allocation is a key part of the process, but here again, the devil is in the detail.

“Once we determine the appropriate asset mix for clients based on their objectives, we hone in on those assets most likely to achieve consistent returns. It’s the consistency of performance in line with client objectives that is most cherished in this market, both by clients and advisors,” says Yates.

There are other good reasons for the swing towards DFMs. Rathbones in conjunction with CoreData in 2018 in the UK found that more than 70% of advisors saw an uplift in client portfolio performance, while 66% cited improvements in their clients’ risk/return profile after engaging with a DFM. The same study also found that as client relationships improved, higher fees were generated for advisors.

For advisors looking to grow a book, or acquire or sell one, it is better with a simplified investment offering with six or seven underlying funds rather than 100. That’s a key benefit of using a DFM, says Yates.

It has been shown that where advisors engaged with DFMs, clients tend to stay invested, and this not only benefits the client, but assists advisors planning to grow or sell their book. DFMs are also better positioned to advise a formal or loose network of advisors in particular aspects of market research and portfolio construction.

For more information, contact Equilibrium.

Follow Equilibrium on LinkedIn.

Brought to you by Equilibrium. Enabling your advice outcomes.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.