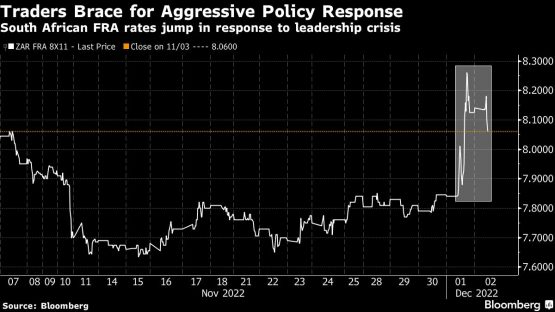

Rate traders are bracing for an aggressive policy response by South Africa’s central bank to the leadership crisis that sent the rand into a tailspin this week.

Forward-rate agreements, used to speculate on interest rates, are now pricing in 90 basis points of rate hikes by July next year, up from 60 basis points at the start of the week. That would see the repo rate peak at about 8%, which would be the highest since the global financial crisis.

Borrowing costs are currently at 7% with the central bank’s forecasting model suggesting it has front-loaded its fight against inflation, with the key rate seen at 6.55% at the end of next year.

Top leaders of South Africa’s governing party will gather on Friday to discuss their response to an advisory panel’s finding that President Cyril Ramaphosa may have violated the constitution. The meeting comes a day after Ramaphosa considered resigning over the panel’s report that investigated his alleged failure to properly report a robbery at his game farm. Investor concern that he might step down over the scandal triggered the rand’s worst one-day loss since May and the biggest selloff of government bonds since 2015.

“While investors await answers, the rand is likely to remain under the gun,” economists at FirstRand Group Ltd.’s Rand Merchant Bank said in a note Friday. “The repo rate could reach 8% in response to recent events. If the rand continues to weaken, there will likely be a more aggressive policy response than that.”

The currency stabilised on Friday, gaining 1% against the dollar to trade at R17.47 by 11:09 a.m. in Johannesburg. It’s set for a 2.4% loss this week, compared with the 1.5% advance in the MSCI EM Currency Index.

© 2022 Bloomberg

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.