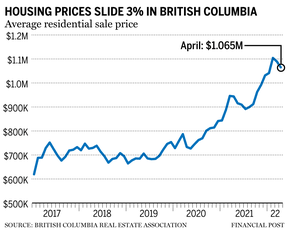

The average price of a residential home slid nearly 3% to $1.065 million last month

Article content

Rising interest rates are putting British Columbia’s housing market on ice as prices and sales cooled from their pandemic highs in April.

Advertisement 2

Article content

The average price of a residential home in the province slid nearly three per cent month-over-month to $1.065 million last month, according to data from the British Columbia Real Estate Association. While the prices mark a sequential decline, the association noted that prices are still roughly 13 per cent ahead of last April’s reading of $943,765.

Article content

Home sales fell approximately 35 per cent year over year to 8,939 unit sales in April and slid 22 per cent month-over-month. Sales dollar volumes also slumped 26.5 per cent to $9.5 billion since last year.

“Canadian mortgages have sharply increased, surpassing four per cent for the first time in a decade,” said BCREA chief economist Brendon Ogmundson in a release. “With interest rates rising, demand across B.C. is now on a path to normalizing. However, given existing levels of supply, market conditions remain tight.”

Advertisement 3

Article content

Active listings across the province were also about 7.5 per cent lower in the latest reading compared to last year.

B.C. joins other major markets seeing a slowdown in real estate as rising rates reduce demand. Toronto prices slid around three per cent month-over-month to $1.254 million as the exuberance was pulled out of the market, according to data from the Toronto Regional Real Estate Board.

-

![Reverse mortgages typically function like home equity lines of credit and allow Canadians to put up the equity in their home in exchange for a lump sum of cash or a consistent flow of payments.]()

Reverse mortgages take off in Canada as more seniors look to ‘age in place’

-

![Equitable Group Inc. will hike its quarterly dividend after recording its best-ever quarter on the back of strong loan-origination growth.]()

Equitable posts best earnings ever as mortgage business stays strong

-

![The Blackstone Inc. headquarters in Manhattan, New York.]()

Blackstone opens Toronto office in Canadian real estate push

It is a trend that Don Kottick, president and chief executive officer of Sotheby’s International Realty Canada, discussed during a May 5 interview with The Financial Post’s Larysa Harapyn.

“(If) you look at where we have been in the last little while, we’ve had a very frothy market,” Kottick said. “I think the best way to summarize (is) the froth is really coming out of the market. It’s taking a little bit longer to sell the property, the days on market are increasing. But relative to historic trends, it’s just really almost a return to a normalized market.”

• Email: [email protected] | Twitter: StephHughes95

Advertisement

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.