Earlier this year, the UK-based fintech company Revolut ended its banking relationship with a significant customer. Soon after, a strategic partnership manager at Revolut pasted wording from a complaint by the client about its treatment into an internal messaging board, visible to a large number of employees.

The company’s global head of sales replied on the public Slack channel, asking the name of the company. “OnlyFans Ltd,” the original poster replied, referring to the company best known for hosting adult content. The post earned him 37 smiley face emojis, based on a screenshot seen by the Financial Times.

In a statement, Revolut acknowledged the information was handled improperly, but said “no sensitive information was discussed” and that every employee receives annual confidentiality training.

But one Revolut staffer who read the exchange at the time describes it as a “particularly egregious” example of how the fintech shared widely information on clients “when it was not appropriate”. While it was not illegal, the person adds, it risked embarrassing the client and making Revolut look unprofessional. OnlyFans declined to comment.

The way this client communication was handled seems characteristic of a streak of immaturity that runs through the business, judging from interviews with more than a dozen former Revolut staffers, many of whom left in the past year, and others who have dealt with the company.

The internal lack of restraint has not prevented them winning more than 25mn customers who use the Revolut platform for everything from payments to foreign exchange, and a far higher valuation than its neobank rivals.

But after seven years in operation, the challenges facing Revolut suggest it’s time to grow up. The company is staring down the prospect of tougher regulation by the European Central Bank as it pursues European banking ambitions. UK regulators are yet to grant Revolut the banking licence it applied for in January last year, which chief executive Nik Storonsky says is key to the company’s broader ambitions.

The fintech is also trying to address what insiders say are undesirable cultural and operational issues at the firm.

The UK’s Financial Conduct Authority, which along with the Bank of England, holds the key to the banking licence, last year carried out a review of the company’s culture, which raised alarms within Revolut. The FT has also learnt of a separate review requested by the FCA in 2020 into risk management at the firm.

In 2019, before it applied for bank status, financial control was a “weak point,” says one former Revolut executive. “[It] was a classic company that had grown very fast and didn’t have a lot of people with the necessary financial services and regulator experience.”

Revolut denied that allegation and said it “takes its obligations in relation to financial crime extremely seriously. We continue to invest significantly in both our people and systems to further develop and strengthen our controls.”

Now, as a recession looms which has already battered valuations at peers, Revolut must convince the gatekeepers of global banking systems that it is ready to take the next step in its development.

‘A known issue with culture’

Revolut has a brutally frank internal culture, by its own admission. The company’s website boasts of being “radically truthful about each other’s performance”, and giving honest feedback in a way that “might hurt sometimes”.

The company puts a sharp focus on meeting targets, which some say inspired excessive risk taking. “It drives bad behaviours . . . and makes people very combative against each other. Normally nice people,” says another former staffer.

“There’s definitely a known issue with culture,” says one former executive at Revolut group, describing a “cut-throat” environment that prevailed. Revolut said it has a “high performance culture” that is “diverse, supportive, and encourages people to be the best.”

Turnover seems sizeable. Publicly available data from LinkedIn suggests the median tenure is about 0.8 years, lower than figures for those at rival fintechs such as UK neobanks Starling and Monzo or Swedish payments pioneer Klarna.

Revolut said it did not accept Linkedin’s data, and said its own records show average tenure is a year and a half. In exit interviews, they said, 80 per cent of respondents say their experience of working there was positive.

The cultural tone is set from the very top, insiders say, by Storonsky, the company’s 38-year-old Russia-born co-founder.

“He is incredibly focused and incredibly determined and makes no excuses for who he is. And for a lot of people that’s really hard to stomach,” says Nick Hungerford, the Nutmeg founder who got to know Storonsky through the UK fintech scene they both came up in.

Storonsky made a virtue of his plainspokenness and outsider status, saying that when he and his co-founder started Revolut “we just didn’t know much about payments at all . . . We just had this idea that we want to do it for free. So we jumped in.” In mid-June, he publicly lambasted the UK regulators making him wait indefinitely for a banking licence.

Hungerford says he doesn’t support every comment Storonsky has made, but says his frankness has produced admirable results. “If he was more . . . reserved we wouldn’t get what we get with his ferocity of development.”

Storonsky’s management style raised some hackles internally. “There was a lot of solo decision-making versus group decision-making,” a former group executive says.

A decision to close key businesses in Ireland in 2021, for example, was “all Nik,” the person says. While the decision was sound, they add, the process around making it was not.

“I found out about [Revolut planning to offer] UK mortgages when Nik announced it at a conference somewhere,” says another former senior executive involved in the UK bank application.

In 2019, Revolut appointed Martin Gilbert, former co-chief executive of asset manager Abrdn, as its inaugural chair, who said he was proud to bring his “deep experience of corporate governance” to the company. But the board was seen by some “as a hindrance more than anything,” in the view of the former group executive.

Asked to comment on Storonsky’s oversight and involvement in the firm, Revolut said: “Like most founder CEOs, Nik has a 360° view of the business and is actively involved in all aspects of Revolut.” He sits at a desk on an openplan floor, it added, and is contactable “at any time”.

On the question of the board, it noted that Storonsky meets with Gilbert weekly, and that collaboration is “tantamount to our collective success”.

Several former employees say that Storonsky unnerved executives by installing young graduates as “founder associates” to observe business lines and report directly back to him.

Sometimes these founder associates, usually men in their early 20s, were appointed to run divisions if Storonsky was unhappy with current management, say former executives. One was put in charge of data in 2019, and another given oversight of talent acquisition in early 2020.

Revolut said founder associates had been known as “operating principals” for the past year and provide “expertise on unique and complex projects, usually in the short-term”.

The FCA declined to comment on or confirm a cultural review of Revolut, but such assessments can examine issues of leadership and governance. The reviews are “very rare” and “definitely an indication the FCA is uncomfortable”, a person familiar with the regulator’s process says.

Revolut said that these kinds of cultural reviews are not unusual, and are part of its “ongoing supervisory relationship” with the FCA, which already oversees its UK payments business. “We welcomed the opportunity to showcase our healthy culture,” it said.

The company held internal presentations on work culture after the FCA’s review, two people tell the FT, and several say they were told when being interviewed that the fintech’s culture was changing.

Still, one executive who quit before the FCA review says he left Revolut in part because he couldn’t persuade Storonsky to change the culture in a more meaningful way.

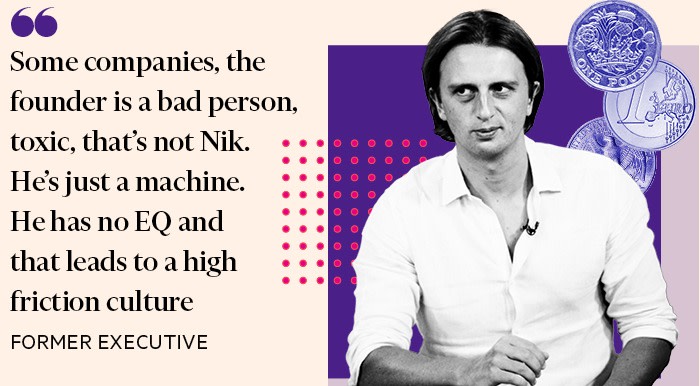

“Some companies, the founder is a bad person, toxic, that’s not Nik. He’s just a machine. He has no EQ and that leads to a high friction culture,” the person says, adding that he would speak to Storonsky at length on culture and the CEO “struggled to understand a course of action” to fix it.

A current Revolut executive suggests there wasn’t that much to fix anyway. “There has been no one single event [regulators] have been able to point at of so-called culture leading to a bad customer outcome,” the person says.

In a publicly streamed discussion with an investor on November 17, Storonsky compared his workforce to “elite athletes” who “want to win, want to be number 1,” and said he acts as a “coach” helping them reach their goals. “Being in the team means that you learn from the best, really fast.”

“No one will stay in the team forever,” he added. “Everyone understands and accepts it.”

Watching the watchdogs

The FCA’s cultural review is only the latest sign that UK regulators have been scrutinising Revolut more closely than before.

In 2020, the FCA requested an independent expert carry out a review of Revolut’s measures to prevent and detect financial crime, a process known as a section 166.

The regulator does not disclose details of section 166 requests, but says on its website it asks for such reviews “if we are concerned or want further analysis”.

The FCA did recently grant approval for Revolut to join a register of companies allowed to offer cryptocurrency services in the UK. The banking licence, however, remains elusive.

People familiar with Revolut’s regulatory dealings tell the FT that UK regulators expressed concerns about the company’s money laundering controls. There were also concerns about operational issues like the fact that the only way to contact Revolut is through its app, so non-customers who have concerns about fraud have almost no way to get in touch.

Storonsky’s personal interventions have not helped, says one regulatory source. “Having a go at the regulator is . . . not very effective.”

Revolut’s regulatory challenges have been exacerbated by a string of high-profile departures from its risk and compliance teams, and additional pressure from auditors after watchdogs warned of the “unacceptably high” risk of flaws in its accounts.

Asked how close Revolut is to having a full executive team at the UK bank, the company said: “The UK bank has the appropriate executives in place to deliver the bank licence and will of course have a full team upon authorisation.”

The FCA and BoE both declined to comment on the licence application.

European scrutiny

As the UK’s regulators clamoured for more information to support the banking licence, a common view within the fintech was “well, the Bank of Lithuania don’t need that”, two former Revolut insiders told the FT.

Revolut’s relationship with the Bank of Lithuania dates back to 2018, when it was awarded a licence to offer banking services such as current accounts and loans throughout the EU from its Vilnius-based operation.

Three years later, it merged its EU payments business with the Lithuanian bank, creating a much bigger pan-European company with a broader licence which was approved by the ECB.

Until now, Revolut’s European entity has been primarily overseen by the Bank of Lithuania. But after a review early next year, it is likely to meet the threshold for direct supervision by the ECB, which oversees the eurozone’s largest and most systemic banks.

When it falls under the full aegis of the ECB, Revolut will be treated to a “comprehensive assessment”, covering everything from asset quality to risk management and internal modelling. The review can also branch into areas like anti-money laundering controls.

Day-to-day activity will also be different. “Our supervisors are a bit more heavy handed,” one person familiar with the ECB’s approach said. “The amount of pressure, the information we ask for, there’s a clear difference [from national supervisors].”

Revolut will also have a lot less high-level access under the new regime. Its senior executives had audiences with the governor of the Bank of Lithuania; they are unlikely to spend much time with ECB president Christine Lagarde.

The company said it “proactively and voluntarily sought ECB consolidated supervision” and that the change will mean little to the company in terms of the nature of its oversight.

But it recently had a brush with its current European regulators. On November 16, the Bank of Lithuania censured Revolut’s European payments business for its failure to submit audited financial statements in time, and warned it over its handling of consumer complaints — including cases of “incomplete, unsubstantiated answers” and missed deadlines.

Revolut’s European bank, which merged with the payments business last summer, was fined €70,000 for the delayed financial statements.

The company said it had already taken steps to address the issues with customer complaints highlighted by the Bank of Lithuania. It said “technical reasons” that prevented it filing on time have since been resolved, so it will not happen again.

Licence to thrive

Cracking the home market in the UK remains the prize for Revolut, almost two years after making its banking licence submission.

“The biggest restrictor in not having a banking licence is that the funds customers have with Revolut have to be safeguarded,” says one former executive with knowledge of the business model. “When you become a bank, those restrictions go away . . . there’s a lot more freedom to do what you want with customer deposits.”

PitchBook analysts Rudy Yang and Robert Le say “further delays in obtaining a UK banking license could prevent Revolut from achieving higher profitability from lending to consumers”.

The UK delays are also hurting Revolut’s broader ambitions. “The UK is a bottleneck for other licences,” Storonsky told a conference in November. The company has drafted an application for a US banking licence, and is also eager to expand operations in Australia. But the CEO says regulators there could make their licences conditional on Revolut getting one in its home market.

Still, even with banking licences, experts say Revolut, like every other lender, will suffer as demand for credit dries up in a worsening economy.

The PitchBook analysts say Revolut’s payments business could also come under pressure from “lower spending volumes”.

Others offer a sunnier take. Gilles Chemla, finance professor at Imperial College, says Revolut can benefit from the downturn. “If Revolut continues to expand and is contrarian while everyone else shrinks you might expect them to be one of the winners.”

In a statement, Revolut says it is well-prepared for a declining economy. “We’re in a strong position to accelerate our growth, as managing money effectively becomes even more important.”

Unlike other big fintechs, Revolut hasn’t announced widespread lay-offs or a cost-cutting programme. But insiders say it had already launched a series of cost-saving initiatives before the economy began to turn.

A former executive says that in June 2021 all department heads were told to justify any open jobs. One former recruiter said she and her colleagues were ordered to suspend hiring in high-cost locations.

Whatever its challenges, Revolut has the luxury of handling them largely in private. The last set of meaningful accounts it filed date back to 2020. The next set won’t land until the end of the year.

“We’re not planning fundraising because we don’t really need it,” Storonsky told the Web Summit conference in November. “Obviously investors are nervous about their portfolios. It’s a difficult time for the venture industry.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.