South Africa’s rand tumbled the most among the world’s major currencies as the nation walked into a geopolitical tight corner just as everything from a domestic energy crisis to global monetary tightening is battering the currency.

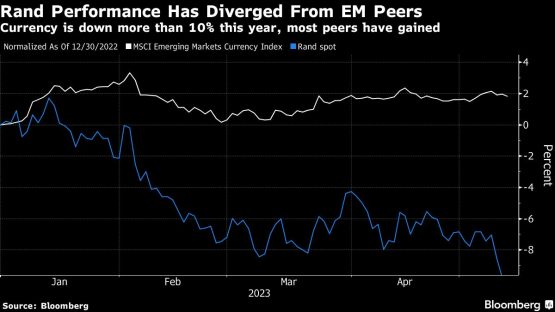

The rand, often seen as a bellwether for emerging-market risk, dropped as much as 2.4% to R19.34, coming within a whisker of its record low of R19.35 hit in 2020. News 24 cited the US ambassador to South Africa as saying the nation supplied weapons to Russia. With Thursday’s move, the currency has extended its losses this year to 11%, one of the worst-performances in the developing world.

The rand had been underperforming its peers even before the report as investors fretted over the country’s struggles with energy shortages and China’s growth hiccups. Mixed data from China have put paid to hopes of a smooth and straight-line recovery in the world’s second-largest economy, while the crippling power outages are threatening to erase any growth this year. Traders are now forced to consider geopolitical tensions as another risk factor.

“For many, the fortunes of the rand are becoming more overtly entwined with the political prospects of the African National Congress,” said Robert Hoodless, an analyst at InTouch Capital Markets. “President Cyril Ramaphosa seems nowhere to be seen. Perhaps this is because of yet another calamitous diplomatic decision over relations with Russia.”

The US is convinced that South Africa had supplied weapons and ammunition to Russia, despite Pretoria having taken a neutral stance on its invasion of Ukraine, News24 reported cited Ambassador Reuben Brigety as saying.

Concerns over the inability of authorities to resolve South Africa’s continuing power supply crisis are also weighing on the rand. The nation’s central bank is among those to have reduced growth projections for 2023 to near-zero because of the persistent energy shortages.

“No matter how hard one tries to shutter out the scenes, investors continue to tell us that the underlying issue for the rand is governance,” Hoodless said. “When the negativity builds so consistently, you often find a snap-back reversal — but no one really expects this in the rand, given what seems to be continued forex hedging needs and divestment.”

© 2023 Bloomberg

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.