Easing political turmoil in South Africa may help turn the rand from this month’s emerging-market pariah into an outperformer next year.

Strategists at Societe Generale SA and Credit Agricole CIB expect the currency to be in a sweet spot next year, given the rand has much in its favour: a healthy interest-rate differential with the dollar, a still-hawkish central bank, and rising demand for South Africa’s commodity exports as China reopens its economy.

“Despite the heightened political uncertainties, we remain positive on the rand,” SocGen strategists including Phoenix Kalen and Marek Drimal wrote in a note. “We expect two more rate hikes by the South African Reserve Bank and expect China’s reopening from zero-Covid will boost sentiment around the rand.”

South Africa’s Reserve Bank is seen lifting its policy rate by at least another 50 basis points to a peak of 7.5% by November next year, according to rates-market pricing.

Read: Poll: Sarb may end its tightening cycle in Q1

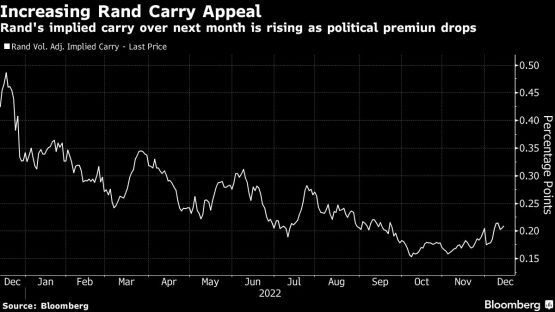

With the Fed widely expected to slow its pace of rate increases next year — or even halt them altogether — that would maintain the rand’s yield advantage over the dollar, boosting the rand’s carry appeal. The South African currency has already returned 7.5% since the beginning of November for investors who borrow the US currency to speculate in higher-yielding assets.

“When the dust settles” after this year’s high inflation and aggressive monetary tightening in the developed world, some markets “may present an attractive mix of high carry and stronger growth outlook,” Credit Agricole strategists including Sebastien Barbe and Olga Yangol wrote in a note. The rand’s “relatively high carry and terms-of-trade positioning” makes it one of the best EM prospects for 2023, they said.

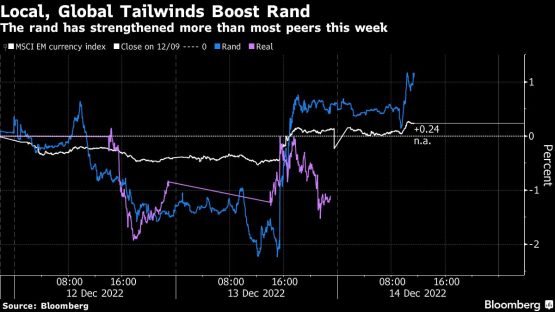

Rand bulls received a boost on Tuesday when South Africa’s lawmakers quashed an advisory panel’s report that recommended President Cyril Ramaphosa should face an impeachment hearing for possible breaches of the constitution. Softer-than-expected US inflation data also helped gains.

The currency has gained 2.5% in the past two days, erasing the losses it racked up after the Ramaphosa report was made public on Nov. 30 and the president considered resigning. Even so, the rand is the most undervalued in two years on a real-effective-exchange-rate basis, according to Bank for International Settlements data.

The rand has a “promising mix of carry/FX potential,” the Credit Agricole strategists wrote. The currency is “not expensive,” though politics remains “‘a swing factor and structural changes are needed,” they said.

© 2022 Bloomberg L.P.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.