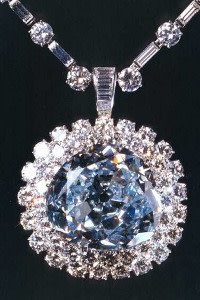

Rival members of Qatar’s royal family are battling for control of the world’s largest cut blue diamond in London’s High Court, with one side trying to force a $10mn sale of the opulent 70 carat “Idol’s Eye” gemstone.

The storied Indian diamond, whose past owners include a Sultan of the Ottoman Empire, is at the centre of a lawsuit filed by Qipco, a conglomerate run by Qatar’s big-spending art collector Sheikh Hamad bin Abdullah al-Thani.

The defendant in the previously unreported case is Guernsey-based Elanus Holdings Limited, which Qipco says is controlled by the heirs of the late Sheikh Saud bin Mohammed al-Thani, who led the acquisition of Qatar’s extensive national art collection.

Qipco, a private company that sponsors the UK’s Royal Ascot horse races, sued in November to force Elanus to sell the “Idol’s Eye” diamond, set in a 16th or 17th century necklace, for a price of at least $10mn under the terms of a 2014 contract between the entities.

Pinsent Masons, Qipco’s law firm, declined to comment. Elanus’s law firm Farrer & Co also declined to comment.

Sheikh Saud, who died aged 48 in 2014, was the biggest buyer in the global art market in the 2000s and was known for his prolific acquisitions across periods and genres. Such was his influence at auction sales that his 2005 detention by Qatari authorities investigating financial irregularities rocked the art world.

His legacy is found across Doha’s museums, where his wide-ranging collection is exhibited, as well as in his Jean Nouvel-designed Doha Tower in the city’s West Bay.

Qipco boss Sheikh Hamad, son of a former prime minister and first cousin of ruling emir Sheikh Tamim bin Hamad al-Thani, has in recent years emerged as Qatar’s pre-eminent collector, building a large collection that includes some of the finest Mughal jewellery.

His pieces have been shown in major museums worldwide and highlights are on display at bespoke galleries in Paris. His horse-breeding family own Dudley House on Park Lane, one of the most expensive private residences in the UK.

The lawsuit centres on a May 2014 deal for Elanus to loan the “Idol’s Eye” to Qipco for 20 years. The agreement gave Qipco the right to buy the jewel, if Elanus wanted to sell it. The price would be $10mn or the average of two valuations from major auction houses, whichever was the higher figure.

Elanus, which was set up as a vehicle for the transaction, has nominee directors and shareholders but is controlled by the late Sheikh Saud’s family through the Lichtenstein-registered Al-Thani Foundation, according to Qipco.

The lawsuit claims that in February 2020, a Swiss-based lawyer for the Al-Thani Foundation, Dr Dieter Neupert, notified Qipco by letter that the family wished to sell the “Idol’s Eye”. However, the following month he emailed Qipco to say they did not want to part with it.

The lawsuit quotes from an April 2020 email from Neupert to an Elanus representative suggesting the pandemic had influenced the alleged reversal. “Due to the Corona virus, the Family does not want to sell,” he wrote. Qipco has asked the High Court to require Elanus to complete the sale.

Neupert said he was unable to discuss the case as he was bound by attorney-client privilege. He added he could not speak for Elanus as he “never had a mandate to represent Elanus Holdings”.

It appears Elanus has yet to file a defence in the case through Farrer, which is best known for acting for the late Queen Elizabeth II. The Qipco lawsuit indicates that Farrer has argued Elanus never wanted to sell the diamond, that Neupert was not acting on its behalf, and that in any case Elanus withdrew any notice of sale.

The lawsuit is the latest action brought by Sheikh Hamad in London over disputed items of art. In November, Qipco won a £4mn case against UK art dealer John Eskenazi over forged sculptures it bought. The High Court ordered Eskenazi’s company to refund Qipco but dismissed an allegation of fraud.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.