Good Morning!

Bank of America strategists created a stir this week when their widely followed global fund managers’ survey flashed “full capitulation.”

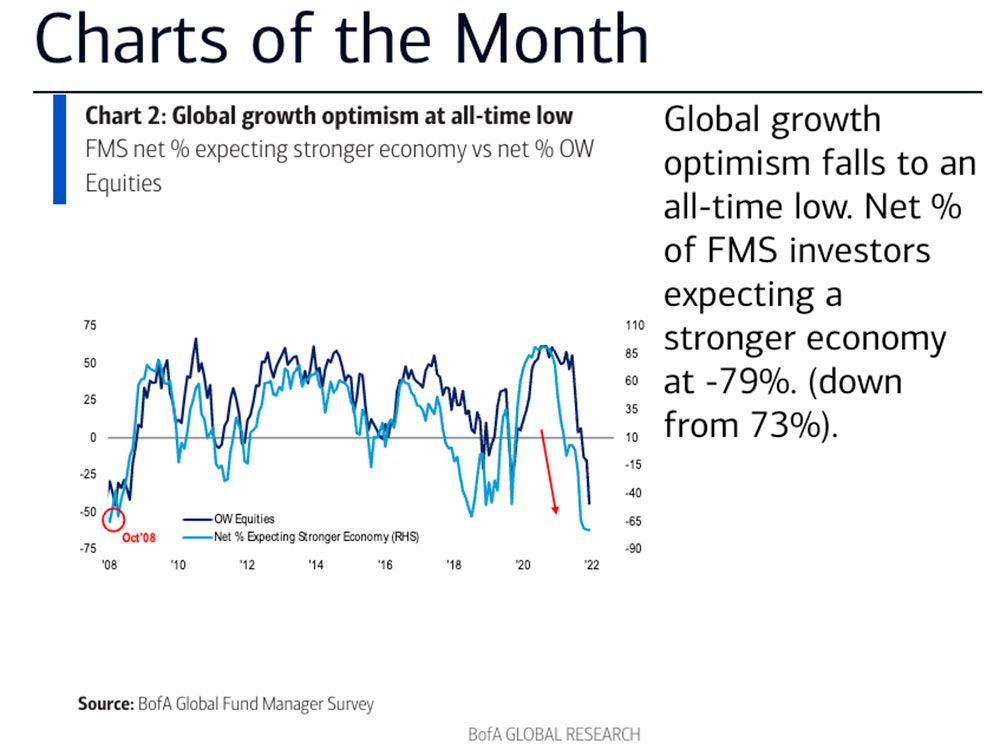

“Where’s Lehman? Global growth optimism, cash levels, equity allocation all worse than GFC [Great Financial Crisis] levels,” wrote strategist Michael Hartnett and his team.

The latest edition of the survey (the week through July 15th) showed “a dire level of investor pessimism.”

Global growth expectations sank to an all-time low, even lower than in October 2008, and expectations of a recession are now consensus, the survey found. The percentage of investors that expect profits to deteriorate is also at an all-time high, above peaks seen during the collapse of Lehman Brothers in 2008 and COVID highs, said BofA.

Investors say the biggest “tail risks” are inflation staying high (33%), a global recession (24%) and hawkish central banks (17%). Systemic credit events, the Russian-Ukraine conflict, civil unrest and a COVID-19 resurgence were also on the risk radar.

Sounds pretty grim, but if “full capitulation” has been reached it could actually be good news for markets.

Barron’s describes capitulation as the point where investors and traders are so pessimistic about the future that they toss up their hands and sell rather than hanging on in hopes the downturn will soon end. If there isn’t any fresh bad news to send stocks lower, this can be a signal that the market has hit bottom and the correction has either ended or is close to it.

Are we there yet?

There is no exact indicator for when capitulation arrives, so needless to say it’s contentious. But an important thing to watch, says Barron’s, is investors’ cash holdings.

BofA’s survey says cash levels as a percentage of a portfolio have surged to 6.1%, the highest since October 2001, while investor allocation to stocks plunged to the lowest since October 2008. A net 58% of fund managers say they are taking lower than normal risks, another record high for the survey, surpassing the financial crisis and Lehman levels.

All that money flowing out of the stock market has sent the S&P 500 into a bear market this year and European stocks into their worst six months since 2008.

Stock funds have seen US$181 billion in net inflows in 2022; bond funds, US$206 billion of outflows, said a BofA note last week, citing EPFR Global data.

Yet historically when fund managers hold more than 5% of their portfolios in cash, the S&P 500 posts a positive return for the following 12 months, said Barron’s. The higher that cash level is, the better the market return.

Not everybody believes we are at capitulation yet. In fact, Sanford C. Bernstein strategists say equity outflows, apart from Europe, may have just begun, Bloomberg reports.

With corporate earnings season gearing up, investors will be watching this for the next major trigger.

_____________________________________________________________

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.