Nigeria’s secret police took the nation’s suspended central bank governor into custody, hours after he was removed by the nation’s new president, as a power struggle in Africa’s biggest economy took a dramatic turn.

The State Security Service announced Godwin Emefiele’s detention on Saturday for “investigative reasons.” President Bola Tinubu revealed the governor’s dismissal in a brief statement that was issued after financial markets closed on Friday.

The secret police have been investigating Emefiele for alleged wrongdoing related to multibillion-dollar public lending programs initiated by the governor. Emefiele’s suspension is a “sequel to the ongoing investigation,” the presidency said, without providing further details, leaving it unclear whether its statement referred to the same probe.

The central bank and Emefiele didn’t immediately respond to requests for comment.

Tension between Emefiele and the president has escalated since campaigning began for an election that Tinubu won in February. Tinubu was sworn in as the leader of Africa’s most populous nation less than two weeks ago and used his inauguration speech to criticize the central bank, calling for an end to Nigeria’s multiple-currency regime and a reduction in interest rates to boost economic growth.

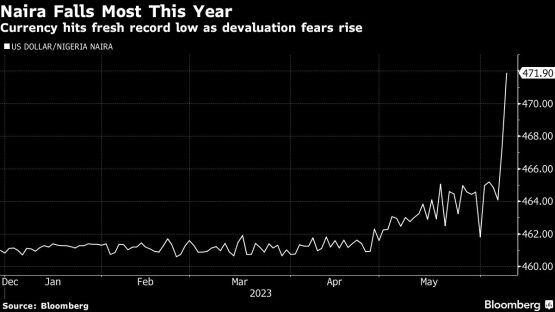

Nigeria’s currency has weakened 2.4% this year and touched a fresh record low on Friday of 471.92 naira to the dollar.

Losses have accelerated since Tinubu called for changes to the bank’s currency policy and urged it to close the gap between the official and unofficial exchange rates. The spread between the managed and parallel markets in Nigeria can be as wide as 60%.

Emefiele became one of the most influential figures in Nigeria under Tinubu’s predecessor, Muhammadu Buhari. The central bank made significant interventions in the economy, including lending unprecedented sums to the government and extending credit to multiple sectors.

Critics slammed the governor for paying undue attention to development finance and excessive regulation of banks at the expense of price stability. The nation’s monetary policy committee has raised borrowing costs by 700 basis points since May 2022 to contain an inflation rate that’s been at more than double the top end of its 6% to 9% target range for 11 months.

His most controversial policy was a demonetization program introduced in the run-up to Nigeria’s presidential elections in February. The attempt to replace high-denomination naira notes with new ones resulted in a shortage of bills that hobbled day-to-day business in the cash-dominant economy.

Politicians, including Tinubu and those backing his presidential campaign, accused Emefiele of pursuing the unpopular reform to damage the ruling party’s electoral prospects. State governors successfully challenged the policy at the Supreme Court, which nullified a deadline for phasing out the old notes.

Emefiele, who’s been at the helm of the regulator since 2014, will be replaced in an acting capacity by Folashodun Shonubi, a deputy governor in charge of operations at the bank.

Shonubi joined the central bank’s board in 2018 from the Nigeria Inter-Bank Settlement System Plc, where he was managing director, according to a profile published on the central bank’s website. He has more than three decades of experience in banking and served as the head of treasury at Citigroup Inc.’s Nigerian unit from 1990 until 1993.

© 2023 Bloomberg

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.