Morgan Stanley paid chief executive James Gorman $31.5mn for his work in 2022, down 10 per cent from $35mn a year earlier after the Wall Street bank reported lower revenues and profits.

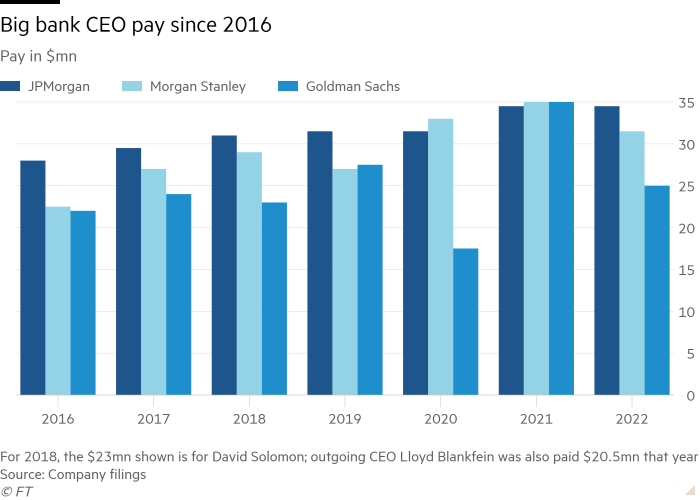

The smaller pay package means longtime JPMorgan Chase CEO Jamie Dimon out-earned Gorman for the first time since 2019. JPMorgan on Thursday said Dimon was paid $34.5mn in 2022, unchanged from the prior year.

Goldman Sachs, whose David Solomon last year was the highest-paid Wall Street bank CEO alongside Gorman with $35mn, has yet to disclose its executive pay plan for 2022.

In a regulatory filing on Friday, Morgan Stanley said Gorman earned a base salary of $1.5mn, a $7.5mn cash bonus, $4.5mn in deferred equity and a performance-based stock bonus worth $18mn.

In 2022, Morgan Stanley’s revenues fell 10 per cent year on year while net income dropped 27 per cent to $11bn. The bank reported a return on tangible common equity, a measure of profitability, of 15.3 per cent, below its longer term target of at least 20 per cent.

Morgan Stanley said its board of directors, in determining Gorman’s pay, considered that “in a challenging economic and market environment, firm performance for 2022 was not as strong as the prior year in which the firm achieved record financial performance”.

The bank’s spending on pay and benefits for employees in 2022 totalled $23bn, down 6 per cent year on year. This was despite its workforce growing 10 per cent to roughly 82,000 employees.

Amid falling profits, sparked by a broad slowdown in dealmaking activity, Morgan Stanley in December dismissed about 1,800 employees, or 2 per cent of its workforce.

Since taking over as CEO in 2010, investors have cheered Gorman’s strategy to broaden out from Morgan Stanley’s historical investment banking and trading strengths and invest in more stable businesses such as asset and wealth management.

This pivot has helped it open up a valuation gap on Goldman, its longtime rival which still derives most profits from trading and investment banking.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.