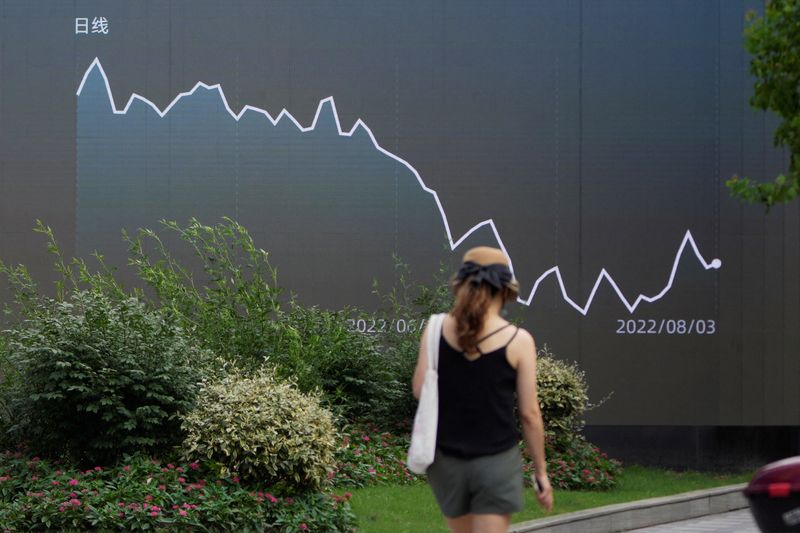

© Reuters. A pedestrian walks past a giant display showing a stock graph, in Shanghai, China August 3, 2022. REUTERS/Aly Song/File Photo

By Lisa Pauline Mattackal

(Reuters) – Financial markets should brace for further pain, with global economic health at its most precarious level in years, due to stubborn inflation, hawkish central banks and geopolitical tensions, veteran investor Jeremy Grantham said late Wednesday.

“This is a more dangerous looking moment in global economics than even the madness of the housing bubble of 2007,” Grantham, co-founder and chief strategist of asset manager GMO, told the Reuters Global Markets Forum (GMF).

Pockets of highly overvalued assets, which Grantham has termed “superbubbles,” peaked earlier last year, he said.

Markets will now have to cope with valuations of “hyper-inflated” growth stocks collapsing, inflation and potential turmoil in the global housing markets, as rising interest rates put pressure on homeowners, he said.

“The deterioration in fundamentals on a global basis looks absolutely shocking.”

World stocks have tumbled 20% since the start of the year, while the growth-heavy has dropped 24%.

Economic and market turmoil will likely test global central banks’ resolve to combat inflation through monetary policy tightening, Gratham said.

“(Central banks) will be spooked, they’ll do what they can, maybe.”

Based on its current trendline, Grantham thinks the could be trading around 3,000 points in a year from its current 3,979.87, but notes it could easily head “decently lower.”

Inflationary pressures are likely to be persistent, Grantham said, owing to climate change-related economic disruptions, a shrinking global workforce and limited commodity resources.

That will put further pressure on equity returns, he noted.

“People forget to adjust the S&P for inflation … your assets are worth 9% because of inflation in the last year.”

“That makes a marginal bear market a fairly serious bear market,” Grantham said.

(Join GMF, a chat room hosted on Refinitiv Messenger: https://refini.tv/33uoFoQ)

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.