What to watch in Asia today

Macau gaming bill: Macau’s legislature will conduct its first reading of a gambling bill. The proposal would increase government oversight of the lucrative industry, halve the duration of casino licences to 10 years and regulate junket operations in one of the biggest shake-ups in the casino hub.

Singapore: Singapore is set to release its consumer price index for December, which will give an indication of the pace of recovery in domestic economic activity.

Taiwan: Taiwan will release industrial production data for December following a coronavirus-related disruptions, such as staff shortages, to manufacturing activities.

Pakistan: The State Bank of Pakistan is expected to stand pat at its monetary policy announcement, on expectations that a global surge in commodity prices will ease as central banks turn hawkish.

Markets: Futures for Australia, Hong Kong and Japan signal the region’s main bourses are set to decline after global stock markets recorded their steepest weekly drops since the start of the pandemic as the Federal Reserve moves to tighten financial conditions.

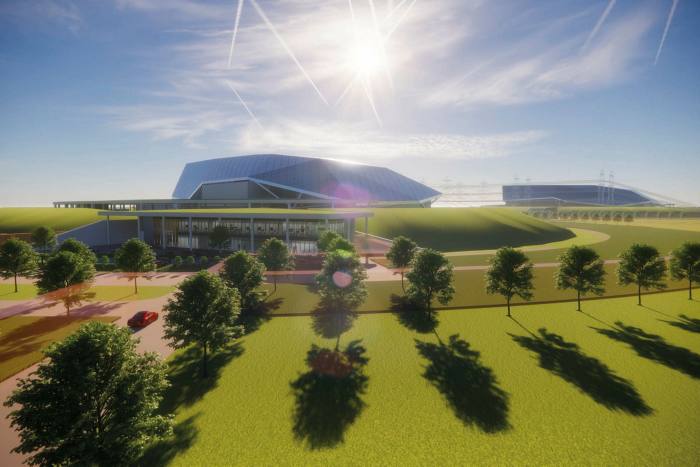

Rolls-Royce seeks bids for site to make small nuclear power plants

Rolls-Royce, the UK aero-engine maker, has launched a competition between regions in England and Wales to be the location of the main factory to build a planned fleet of small nuclear reactors.

An industry consortium led by Rolls-Royce has written to several of England’s regional development bodies and the Welsh government asking them to pitch for the manufacturing site, promising investment of up to £200m and the creation of up to 200 direct jobs.

The consortium secured £210m from the government last year towards the development of a fleet of mini-reactors after raising a similar amount of private sector funding.

UK prime minister Boris Johnson backed small modular reactors as part of his 10-point plan for a “green industrial revolution” to help meet the government’s 2050 net zero carbon target. The technology is viewed within the government as a good way to create manufacturing jobs as well as delivering on Johnson’s “levelling up” agenda to help less developed areas.

Under the plans, the reactors will be built in factories around the country and then assembled on site, reducing the risks and huge costs of construction of big nuclear power plants. The main factory will build the heavy pressure vessels that are part of the reactors.

Activist hedge fund Trian builds stake in Unilever

Nelson Peltz’s activist hedge fund Trian Partners has built a stake in Unilever, ratcheting up the pressure on the FTSE 100 company after its abortive pursuit of GlaxoSmithKline’s consumer health business.

People with direct knowledge of the matter told the Financial Times that the $8.5bn New York-based hedge fund had taken a position in the UK group’s shares, adding to the challenges facing chief executive Alan Jope.

The Unilever boss is already facing simmering shareholder discontent after its £50bn attempted takeover of GSK Consumer Health. He now confronts a fierce activist fund known for demanding streamlining and governance reforms at consumer goods groups including Procter & Gamble, Sysco and Mondelez.

The people with knowledge of the stakebuilding did not provide details on its size or when precisely it began.

The revelation comes after a tumultuous week for Unilever in which it was forced to acquiesce to shareholder demands that it halt its pursuit of GSK’s consumer health business after three failed bids.

The investor revolt last week drove Unilever’s share price down by as much as 11 per cent. It recovered part of the losses after the company said it would not raise its offer any further.

Fed expected to back first pandemic-era interest rate rise in March

The Federal Reserve is set to confirm its plans to raise interest rates in March for the first time since the onset of the pandemic, as the US central bank charts a more aggressive course towards monetary tightening in the face of sticky inflation.

Fed officials will convene this week for their inaugural policy meeting of 2022, the first since the central bank made its fight against rapid US consumer price growth its top priority.

The Fed has hardened its rhetoric in recent weeks about the risks posed by high inflation, with chair Jay Powell this month calling it a “severe threat” to a sustained economic expansion and a robust labour market recovery.

Its top policymakers have also made it clear that they are willing to act forcefully to ensure inflation does not become ingrained, by considering raising interest rates “sooner or at a faster pace” than anticipated and swiftly shrinking the Fed’s enormous balance sheet this year.

Coupled with mounting evidence that inflation is broadening out and the labour market is quickly healing, the central bank is well placed to move in March, many Fed officials and Wall Street economists argue.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.