WeWork’s $9bn flotation last month was met with bemusement at the head offices of IWG. Despite being larger and more profitable than its rival, IWG is valued at less than half that amount.

“The bottom line is that there’s no reason why the valuations should be different,” said one IWG insider. “Either we’re too low or they’re too high or both.”

Just weeks later, Mark Dixon, who founded, runs and owns almost a third of the UK-listed shared office provider, announced a strategic review designed to make IWG more attractive to investors.

The review is assessing the potential of splitting the business into three, spinning off a desk-booking app from the leasing business and bulking up a franchising operation, which is from where Dixon believes real growth can come.

“It’s clear we need to simplify the way the group is presented . . . The question is, will this be easier for future and current investors?” he said.

WeWork and IWG stand apart from other office space companies in terms of their global spread and number of customers, and historically have adopted similar approaches.

“What WeWork was fundamentally trying to do [when it was founded] 11 years ago was nothing different to what [IWG] was doing 20 years before that: buy up long leases, split them up and sell them on,” said Michael Donnelly, an analyst at Investec.

Both companies are confident the pandemic will lead to more flexible working patterns, and that employers will gravitate towards the short leases they offer.

But investors do not appear to be treating them equally.

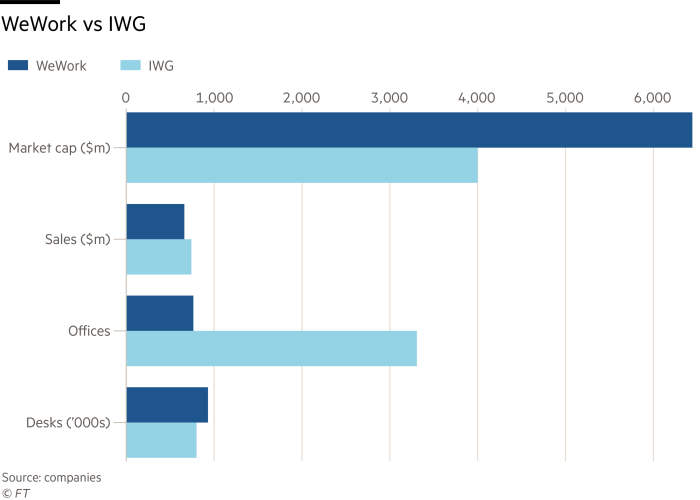

Founded in 1989, IWG has a long record of profits and steady growth. The company has a market capitalisation of just over $4bn, roughly 1.2 times its 2020 revenues.

WeWork, which has a roughly similar number of desks but far fewer offices and a more limited geographic spread than its rival, has opted for faster-paced growth and, as a result, is yet to make a profit. It racked up more than $6bn of losses in the 18 months to the middle of this year.

But its $6.4bn market capitalisation is double the $3.2bn revenues it reported in the last financial year.

IWG’s share price has lost a third of its value during the pandemic. WeWork’s rose as high as $13 in the days after it floated via a special purpose acquisition company for $10 a share — but has since dropped back to about $9.

“A lot of my investors can’t understand [IWG’s] valuation gap with WeWork,” said James Hanbury, partner and portfolio manager at Brook Asset Management, which is part of the Odey group and owns about 3 per cent of IWG. He suggested WeWork’s listing on the NYSE, which typically commands higher valuations than London, was one factor and that “investors have probably drunk a bit more of the Kool Aid with WeWork”.

Donnelly said investors were pricing IWG on current performance, which had been hampered by the pandemic. The company issued a profit warning in June as occupancy levels at its offices failed to recover as quickly as expected.

But, he added, investors in WeWork were looking to the bright future painted by new boss Sandeep Mathrani — who has embarked on a ruthless, $2bn-a-year cost-cutting drive — and SoftBank, the company’s Japanese backer.

WeWork this month posted a net loss for the third quarter of $844m but aims to book its first annual profit next year. It expects revenues to more than double to $7bn by 2024. “People value the fact there’s growth,” said one person close to the company.

Investors picking between the two groups are also making a bet on how people will work after the pandemic.

IWG has lots of sites in provincial and suburban areas, while WeWork has focused on central offices in major cities — one reason why its lease liabilities are higher than its rival’s.

Hanbury said IWG “used to get lambasted for these [suburban offices] being a liability but, post-Covid, this provincial and suburban network is incredibly important”.

Dixon, and some analysts, are bullish about a future in which smaller offices on town high streets form part of any big employer’s plans.

“A lot of companies have a centralised mother ship approach to their office and in the future this will be decentralised. IWG is a huge play on that,” added Hanbury.

Investors are also buying into starkly different cultures. Even after the departure of larger-than-life co-founder Adam Neumann in 2019 and his replacement by the more serious Mathrani, WeWork still cultivates the energy of a high-growth start-up.

Dixon, meanwhile, “has incredible attention to detail on costs, leases, the market and margins [but] he’s not good at sugar coating things from a presentation point of view,” said Hanbury.

Finding a more attractive way of presenting IWG’s franchise business, through which local partners operate its offices while paying a fee for the use of its brands, is another strategy to improve performance.

IWG’s current valuation suggests “no one believes Dixon can successfully refranchise the business”, according to a top-15 shareholder in the company.

Franchising deals stalled during the pandemic but IWG spun off its Japanese operations in 2019 for £320m, a multiple to sales that would imply a valuation for the entire business of £6bn, US investment bank Stifel said at the time.

WeWork insiders have argued that there are other reasons why the company might attract a higher valuation.

“The product is different: the interiors are a higher quality, the environment is a bit different,” said one.

However, one person close to IWG added that smarter desks should not necessarily mean a higher valuation. “What is valuable is your ability to convert your brands and what you do into cash flow. If you can’t, they are [worth] nothing. It’s old fashioned, but it’s basic economics.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.