April is usually a disrupted month in South Africa, packed with long weekends and school holidays. In the rest of the world, economic life continues, and recent developments give us clues as to how the market outlook could evolve.

Read: Godongwana rules out recession in 2023

This week, we look at five key charts that help illuminate this picture.

Chart 1: Core inflation in major economies

Source: Refinitiv Datastream

Inflation remains the number one thing investors should focus on. Unless and until inflation declines meaningfully, we remain in a higher-for-longer interest rate environment. As chart one shows, two decades of benign inflation in major economies also fell victim to Covid.

As a consequence, we now have the highest interest rates in developed economies in 15 years.

The good news is that the worst of the inflation shock is behind us, particularly in terms of commodity prices and key goods whose production was interrupted during the pandemic (notably microchips). But that doesn’t mean it’s smooth sailing ahead.

Inflationary pressures

There is still evidence of inflationary pressures persisting, which we can see by looking at core inflation, which excludes volatile food and energy prices. Core inflation rates have stabilised but remain elevated across the developed world, far away from the 2% target.

A key part of the story remains labour markets. Although there are signs of softening in labour demand and an improvement in labour supply (particularly in the US), an imbalance remains, and this is something central banks are watching with beady eyes.

Given all this, we are probably near the peak of the interest rate cycle in the US and other major developed economies.

But that doesn’t mean interest rate cuts are around the corner. The major central banks have made it clear that cuts are only likely once we know that inflation will decline to acceptable levels and stay there.

Alternatively, something else has to go badly wrong – for instance, a repeat of the banking panic of a few weeks ago but on a greater scale, or US debt ceiling negotiations taking a turn for the worst.

Either way, it places central banks in a tough spot. They are focused on fighting inflation and seem willing to accept collateral damage.

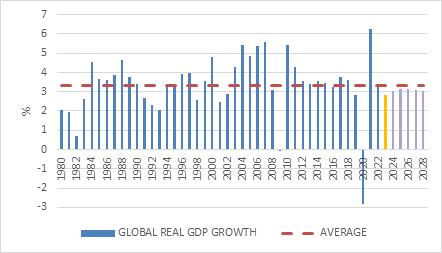

Chart 2: Global growth history with forecast

Source: International Monetary Fund

Speaking of the recent banking panic that led to the disappearance of Silicon Valley Bank, Signature and Credit Suisse as standalone entities, the acute phase of this episode seems to have passed without further contagion.

Read:

What is uncertain is the extent to which banks cut back lending to households and firms. According to the latest global economic growth forecast from the International Monetary Fund (IMF), the impact is likely to be modest, but it is early days.

The forecasts are far from rosy, and the IMF stresses that the risks are to the downside. It expects a 2.8% expansion of the global economy this year, down from 3.4% in 2022.

If realised, this will be one of the 10 weakest years since it started estimating global gross domestic product in 1980. The Eurozone economy is projected to expand by just 0.8% this year, down from 3.5% in 2022.

Read:

China to be top world growth source in next five years, IMF says

IMF trims world growth outlook as risks raise financial pressure

US growth is expected at 1.6% this year, down from 2.1% last year. A post-Covid rebound in China is a silver lining, with growth forecast to rise to 5.2% this year from 3% last year.

China’s longer-term outlook is less rosy, and with it, that of the entire global economy.

The IMF therefore does not expect a strong rebound in global growth in the years ahead, with growth set to remain below the longer term average of 3.4% over the forecast period (to 2028).

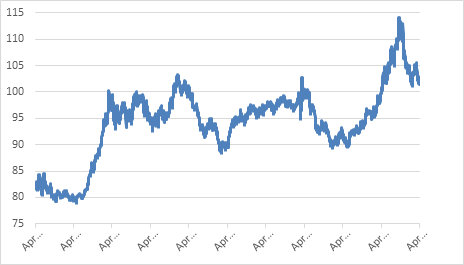

Chart 3: Brent crude oil price, $ per barrel

Source: Refinitiv Datastream

Three years ago, at the peak of the Covid panic, a key US oil futures contract traded at a negative price. The world was running out of storage and oil was being given away. It is a very different picture today, but not necessarily more certain.

The recovery from the pandemic saw steady gains in the oil price in 2021, while the Russian invasion of Ukraine in 2022 saw prices spike to triple-digit levels. Gas and coal prices shot up too, creating an energy crisis that squeezed households and businesses alike.

But in the end, the worst-case scenarios never materialised. Europe could replace Russian gas with other sources, and Russia found other customers for its oil. The net result is that energy prices today are lower than on the eve of the invasion, but not low in absolute terms.

This means we should start seeing fairly rapid declines in headline annual inflation rates (though not core rates), but that energy costs still eat into disposable incomes.

South Africa’s petrol price is a case in point. The Gauteng price peaked at R26.74 per litre in July last year, and is down to R22.97 today – still uncomfortably high, but 14% lower.

However, the recent surprise production cut from Opec+ adds a twist. If key producers are prepared to hold back supply, prices can continue rising. This could be a renewed source of global inflationary pressure. But it matters why they are doing it in the first place.

Is it all part of a geopolitical game (after all, Russia is the plus in Opec+, while Saudi-America relations have become very strained) or does it reflect fears that oil demand is fading?

If it is the latter, a higher oil price is the last thing you need. It will simply worsen the economic weakness but ultimately cause prices to fall.

Chart 3: Trade-weighted US dollar index

Source: Refinitiv Datastream

In the wake of the Russian invasion and increased US-China tension, the debate over the dollar’s role in the global economic and financial system has flared up again. Much has been made of recent announcements that Saudi Arabia will be selling oil denominated in yuan to China, for instance, while India will pay in rupees for Russian oil.

Dollar dominance is not popular among politicians outside the US, and even American politicians do not always appreciate that issuing the global reserve currency comes with costs as well as benefits.

Speaking in Beijing on a state visit, Brazilian President Lula da Silva became the latest politician to call for an end of dollar dominance in global trade. This is no surprise, particularly given how strong the dollar has been.

What is somewhat surprising is that just 13 years ago, his then finance minister Guido Mantega coined the phrase “currency wars” when he complained that quantitative easing and zero-interest rate policies in the US meant the dollar was too weak and his currency (the real) was too strong.

In other words, we need to separate the structural role of the US dollar in global finance and commerce from its cyclical movements.

The former matters more to politicians, the latter to investors. The structural role of the dollar is likely to shift gradually over time, but will remain subject to cycles irrespective. The dollar surged for most of last year, but has given back some of those gains, partly due the narrowing gap in expected interest rates between the US and other major economies.

The dollar is a symptom and a cause of global anxiety.

When there is fear, people seek the safety of the dollar. But a strong dollar in turn depresses global commercial activity and causes other currencies to fall and interest rates to rise. South Africa is of course a classic case.

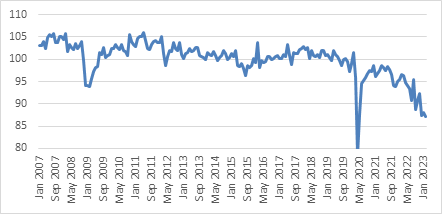

Chart 5: SA electricity production index, seasonally adjusted

Source: Stats SA

Staying in South Africa, President Cyril Ramaphosa’s annual investment conference took place against the unhappy backdrop of a return to Stage 6 load shedding.

Chart 5 shows the relentless decline in electricity production, with February hitting fresh 15-year lows (excluding 2020). March’s data might show a slight increase when it is released, but April so far is really not looking good.

Load shedding remains the local economy’s single biggest headwind, though the logistics crisis seems to be gaining ground.

The solution is not only government departments and agencies doing their job better, but also making space for the private sector to get involved.

This is happening in the electricity sector, though it will still take time to ease load shedding. It needs to increasingly happen in rail and ports too.

Read: Economy would’ve hit 10% growth in 2022 but for Eskom and Transnet

Organised crime is also taking an increased toll on business activity. If these issues are not urgently addressed, future investment conferences are going to be even more sombre and downbeat affairs.

The IMF has cut SA’s growth outlook for this year to just 0.1%, with only a modest recovery expected next year. This is similar to the South African Reserve Bank’s forecast and more pessimistic than most private sector projections are showing, but we need not split hairs. It is going to be a tough year.

People are increasingly writing off the country completely, but investors shouldn’t think in such binary terms – that a country is a failed state or not (whatever that might mean). Rather, the appropriate questions are whether the bad news is priced in, does the return potential match the risk, and what is the right position size in the context of a diversified portfolio?

In summary, there is a lot to think about and a lot of uncertainty. We’ve presented five key charts, but we could’ve shown 50. In the end, the market does the talking. Following last year’s sharp declines, global bonds and equities have rebounded.

Equities have rerated, meaning prices have risen even as earnings have fallen, while bond yields have fallen somewhat.

This comovement would make sense if both asset classes were pricing in lower interest rates. But given central banks’ commitment to inflation-fighting, rates will only decline if inflation falls rapidly.

There is a possibility that it can happen gradually by itself as all the Covid and war-related distortions dissipate – a so-called ‘immaculate disinflation’ or soft landing. But there is also the strong possibility that inflation only declines the old-fashioned way, namely through a recession.

The latter would clearly not be good for equities, although we also know that in practice, timing these things is extremely difficult and that the best investment opportunities often present themselves under such difficult conditions.

So again, the correct questions to ask now are what is priced in, does the return potential for each asset class justify the risk, and what is the appropriate allocation in a diversified portfolio given its objective and time horizon?

Izak Odendaal is an investment strategist at Old Mutual Wealth.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.