Enterprise technology titan Hewlett Packard Enterprise this afternoon reported Q4 revenue for the fiscal year ended in October that was in line with Wall Street’s expectations, and profit per share that came in higher than expected, but offered an outlook for this quarter’s profit that was below what analysts have been modeling.

The company’s strongest revenue growth was in its storage products, especially storage arrays using flash memory chips.

The report sent HPE shares down 4% in late trading.

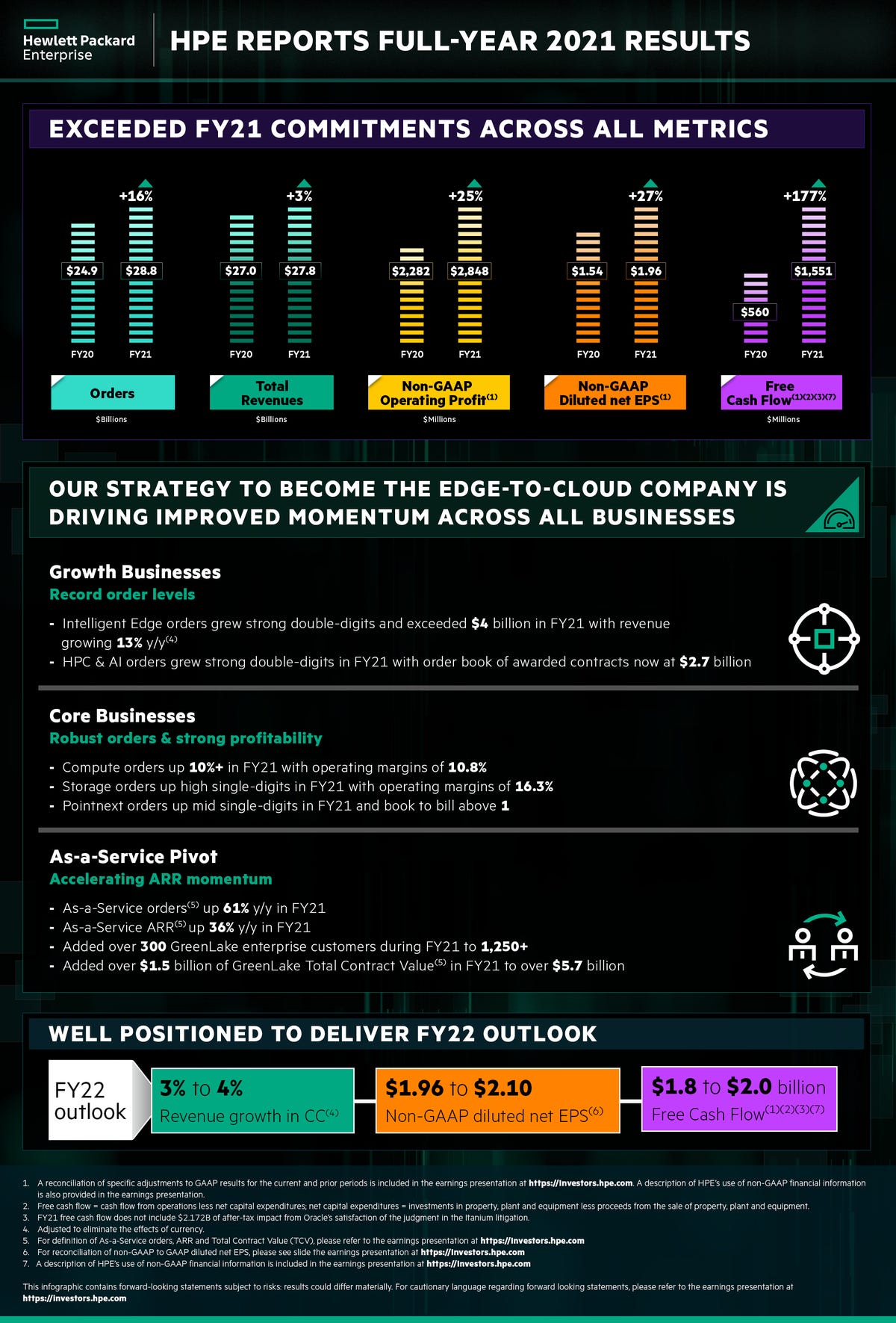

CEO Antonio Neri said in prepared remarks that the company had ended the year “with record demand for our edge-to-cloud portfolio,” adding that the company is “well positioned to capitalize on the significant opportunity in front of us.”

Added Neri, “In 2021, we accelerated our pivot to as a service, strengthened our core capabilities, and invested in bold innovation in high-growth segments.

As our customers continue to demand greater connectivity, access to solutions that allow them to extract value from their data no matter where it lives, and a cloud-everywhere experience, HPE is poised to accelerate our market leadership and provide strong shareholder returns.”

Revenue in the three months ended in October rose 2%, year over year, to $7.4 billion, yielding a net profit of 52 cents a share, excluding some costs.

Analysts had been modeling $7.38 billion and 48 cents per share.

HPE’s revenue growth was helped by currency shifts year-to-year. Excluding the impact of the currency shifts, HPE’s revenue was flat with the prior-year period.

HPE’s Storage products revenue rose 3% to $1.3 billion, lead by the company’s flash-based storage array products, hose sales rose 7%. HP said its Primera product had “strong double-digit” revenue growth.

HPE’s computer sales rose 1% to $3.2 billion.

HPE’s revenue from its “Intelligent Edge” products rose by 4%, year over year, to $815 million. The company’s high-performance computing products and artificial intelligence computing products, saw revenue rise 1% to $1 billion.

HPE’s financial services revenue rose by 1% to $858 million.

All of the reported growth rates reflect the benefit of the currency shifts, excluding which the year-over-year growth rates were lower.

HPE said its annualized revenue run-rate rose by 36%, year over year, to $796 million. The company’s orders for its products that are sold “as-a-Service” more than doubled.

The company said the “strong customer demand and growth in orders” meant it could reiterate a forecast made last month at its analyst meeting for the ARR to rise by 35 to 45%, compounded annually, from the fiscal year just ended though its fiscal year 2024.

For the current quarter, the company sees EPS, excluding some costs, in a range of 42 cents to 50 cents. That is below the average Wall Street estimate for a 49-cent profit per share, according to FactSet.

For the full fiscal year 2022, the company reiterated its previously offered forecast for EPS of $1.96 to $2.10, excluding some costs. That is slightly above Wall Street’s consensus for a $2.02 profit per share.

HPE also reiterated a forecast for cash flow from operations of $1.8 billion to $2 billion, and a pledge to buy back at least $500 million of its shares during the fiscal year.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.