St Augustine Distillery, a spirits company, has about 5,000 cases worth of vodka, gin, rum and whiskey sitting in tanks, waiting for the bottles needed to ship them to liquor store shelves.

The company prides itself on its custom packaging, from a strikingly fluted vodka bottle to a distinctive, flared container that shows off the rich amber of bourbon to full effect. But, across the US, a bottle shortage is threatening sales as the peak Christmas season approaches.

Florida-based St Augustine has resorted to using wine bottles to package almost a quarter of its production, sending apologetic notes with each shipment to explain the reason behind the alternative packaging.

Customers in its gift shop have been understanding, said co-founder and chief financial officer Mike Diaz, but wholesalers rejected the new bottles “because the size change would necessitate a change in the warehouse”.

The problems the Florida distillery is facing are playing out across the US wine and spirits industry, with companies as large as Brown-Forman, the maker of Jack Daniel’s whiskey, expressing concern in recent months over what glass supplies will mean for their outlooks.

The causes of shortages range from robust alcohol demand to the labour shortages and logistics problems at play in the broader economy. Jennifer Bisceglie, chief executive of supply chain risk consultancy Interos, said that some glass production had even been diverted to make vials for Covid-19 vaccines.

Diaz noted one of his suppliers had shut down its plant in Missouri and relocated to India, leaving St Augustine Distillery to rely on the spot market for bottles. Another spirits maker, Eastside Distilling, said its Mexican bottle supplier had told it this summer that its customised bottle would no longer be available, forcing it to hunt for alternative suppliers.

A liquor’s packaging is a part of its consumer appeal, yet distillers have become willing to use alternative vessels, because, as Diaz explained: “I can’t sell it till I get it in a bottle.”

The Glass Packaging Institute maintains that the issue is not just a simple glass shortage. US production of spirits bottles is up about 3 per cent year on year in the first nine months of 2021, while imports of 750ml bottles for wines and spirits are up 14 per cent.

Instead, GPI president Scott DeFife said the problems stemmed from “excessive demand” that has put strains on the entire supply chain, from trucking capacity to warehouse space.

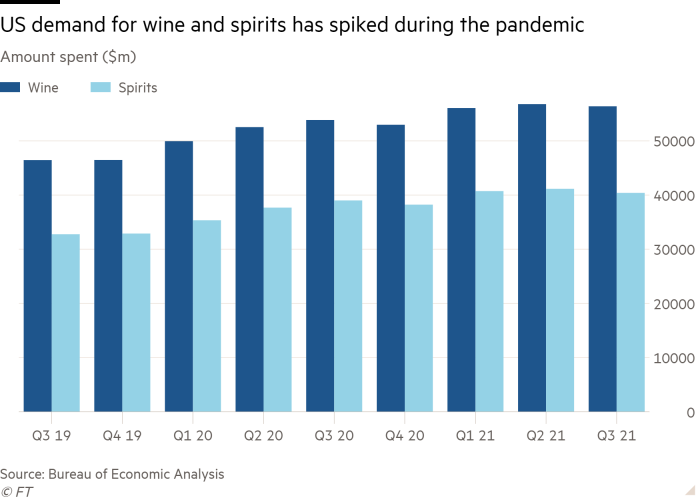

Spending on alcohol has increased during the pandemic, rising almost 13 per cent for wine and 14 per cent for spirits between the first quarter of 2020 and the third quarter of 2021, Bureau of Economic Analysis data showed.

Many drinks groups have responded to the dislocations by resorting to unconventional packaging, sometimes accepting smaller or bigger bottles than they would normally use — or plastic containers, said Lisa Hawkins, senior vice-president at the Distilled Spirits Council.

But, for many, the timing of the bottle shortages is now acute. “The holidays are a critical selling season for the spirits industry with entertaining and gift giving,” Hawkins noted.

A lack of bottles also poses a big challenge to wineries, which operate to fixed timetables, said Michael Kaiser, vice-president of government affairs for the National Association of American Wineries.

“If a winery does not have access to the bottles it needs, it will have problems when the wine that is in tanks or barrels needs to be bottled. The tanks and barrels have specific bottling schedules, and any altering to that can impact how a winery does business,” he said.

The shortages are taking a toll on profits. Vintage Wine Estates of California said in a recent press release that it had been unable to ship about $7m worth of products because glass shortages had delayed production and shipments to a major retailer.

Andres Lopez, chief executive of O-I Glass, one of the main US bottle suppliers, told analysts last month that demand for glass was “continuously increasing” but coming in peaks that were sometimes “difficult to serve”. Falling imports were compounding the challenge of tight inventories, he said.

As drinks groups rely more on bottle imports, they are worrying about rising shipping costs and extended delivery times. Jeff Quint, owner of Iowa-based Cedar Ridge Distillery, said that even though his custom bottles made in Taiwan and Europe were ready to be shipped, snarled global supply chains were forcing him to use alternatives.

Some overseas manufacturers had temporarily halted production after running out of storage space, adding to the problems, he said.

Cedar Ridge’s shipping costs have jumped from approximately $3,000 a container to $13,000. “It’s certainly affecting the cost of our product,” Quint said.

Diaz said his company was considering a price increase in the next quarter as its shipping costs have risen from just under $4,000 per container to more than $18,000.

Many wineries and distillers said they expected the problems to persist until the second half of next year.

In the short term, however, industry executives are telling consumers to get their holiday orders in early. “If you have got a spirit that you like or a product that you like, you better get it now,” Diaz said, “because nobody can guarantee the availability of the product because nobody can guarantee the availability of glass.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.