Kwasi Kwarteng is drawing up a debt reduction plan to reassure febrile financial markets that Liz Truss’s government can be trusted with the UK’s public finances. Scheduled for November 23, the chancellor wants to bring it forward to this month if possible, according to his aides.

The chancellor’s tax-cutting “mini” Budget left investors demanding higher interest payments on UK assets, both because they expected the Bank of England would have to raise borrowing costs to keep inflation under control — and because they had lost faith in the chancellor’s ability to reduce the UK’s budget deficit and public debt.

Getting the government’s books to add up and reduce debt over the medium term will be difficult for the chancellor, who will have to choose one or more of the following five routes to fiscal discipline.

Reverse more of the tax cuts

After two U-turns in two days, it is no longer impossible to believe that Kwarteng could reverse some of the other permanent tax cuts to bring the books back closer to balance. This would be very much a last resort.

With the Labour party supporting the cut in the basic rate of income tax and the reversal of this April’s rise in national insurance, the most likely action here would be to reinstate the previously planned rise in the corporate tax rate from 19 per cent to 25 per cent in 2023-24. That would raise £17bn a year.

However, this would undermine Kwarteng’s commitment to raising the UK’s economic growth rate through lower business taxes and cut across a promise made by Truss during the Tory leadership contest. Although economists do not think a lower corporate tax rate would have a big effect, most think it could raise growth slightly.

Stuart Adam, senior economist at the IFS, said: “Cancelling the rise in corporation tax will encourage investment in the UK, and therefore help to grow the economy — if companies believe it will last.”

Cut public spending

By reducing public expenditure compared with current plans and forecasts, Kwarteng could lower borrowing and bring the books closer to balance.

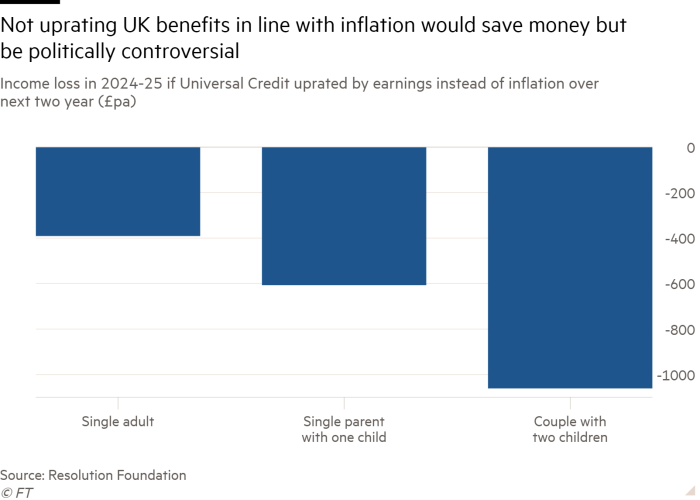

Neither Kwarteng nor Truss have committed to uprating non-pensioner welfare payments in line with inflation in April 2023, something the Resolution Foundation estimated could save £11bn a year. But these suggestions came in for sharp criticism on Tuesday, with Penny Mordaunt, leader of the House of Commons, among others, saying she thought benefits should rise with inflation.

“We are not trying to help people with one hand and take away with another,” she said.

The chancellor could also target banks. With interest rates having risen so sharply, lenders are receiving much higher returns on over £800bn they have parked at the BoE since 2009 as a result of quantitative easing programmes.

Instead of paying interest on these “reserves” at the bank’s official rate, the government could decide instead to force banks to hold the money at the central bank at a lower — or even a zero — interest rate.

Frank van Lerven, a senior economist at the New Economics Foundation, said that £200bn would be paid in interest to commercial banks by the end of 2026-27. “Instead of looking for funding cuts across the public services . . . it [the government] could stop paying interest altogether,” he said.

A third option would be to pencil in extremely tight spending plans for the years after the current spending review period, which ends in 2024-25. Kwarteng could simply tell the Office for Budget Responsibility that the government would freeze spending after the next election, sharply lowering borrowing forecasts. Even if the spending plans were not credible, the OBR is obliged to use them.

Make the fiscal rules easier to meet

Kwarteng set out an “ironclad commitment to fiscal discipline” in his speech to the Conservative party conference but he could move the goalposts and set new fiscal rules that did not bind his hands as tightly.

The chancellor has stated he wants to get debt down as a share of gross domestic product in the medium term, so he could extend the period over which the debt reduction criteria are measured. The current rule stipulates “three years ahead”, which has equated to 2024-25. But if that period were extended for five years — as expected — it would mean 2027-28.

Extending the rule would allow the chancellor to pencil in spending cuts later in the period, after a general election. For this to help Kwarteng, he would also have to ditch the current supplementary rule that commits the government to balancing the “current budget”, ensuring that tax revenues pay for day-to-day spending excluding capital investment. That is likely to become the more binding constraint over a five-year period.

“Three years is an odd period anyway,” said Julian Jessop, a fellow at the free market Institute of Economic Affairs. “Five years also allows more time for the benefits of supply-side reforms to come through.”

Persuade the OBR to forecast higher growth

If Kwarteng could persuade the OBR that the government’s policies would raise sustainable levels of economic growth, it would bring in more tax revenue, lower borrowing and help reduce debt.

In December 2013, the fiscal watchdog produced simulations of both higher and lower growth scenarios for the supply side of the economy. It found that higher sustainable growth ensured “the underlying fiscal position is stronger, given the boost to future potential output”.

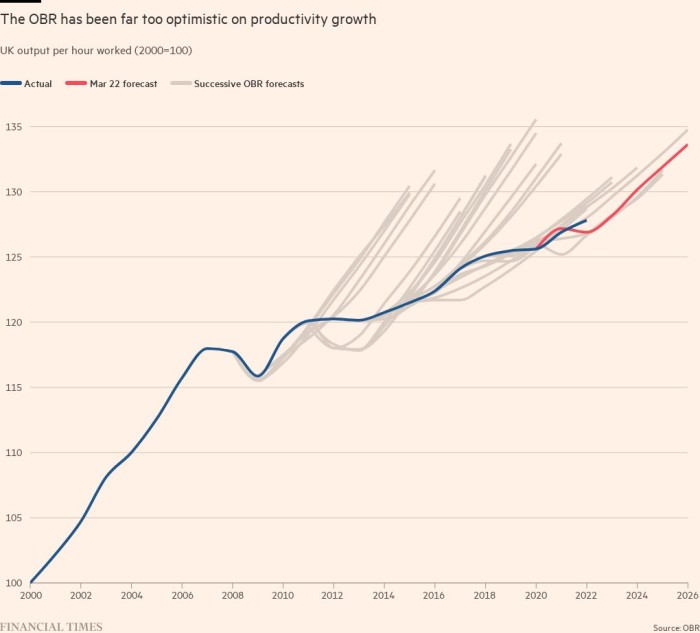

However, since it was founded in 2010, the OBR has overestimated productivity growth potential and would therefore be reluctant to raise it.

It would be “better if the chancellor and the OBR can agree” on the prospects for growth stemming from the government’s new plan, said Jessop. “I can already see the headlines if the government’s own fiscal watchdog questions the economic assumptions on which policy is made,” he added.

Accept disagreement with the OBR

There is no legal obligation for the government to produce a Budget that the OBR says meets its fiscal rules. The law simply states that the fiscal watchdog will produce a forecast and “an assessment of the extent to which the fiscal mandate has been, or is likely to be, achieved”.

It is fully compatible with the system for the chancellor to allow the OBR to say he is likely to break his fiscal rules but to disagree respectfully. This has happened fairly regularly in the past but would be a presentational challenge, given the current market turmoil.

One way to mitigate the difficulties would be for the OBR to produce a scenario of what the public finances would look like if the government achieved its ambition of a sustainable 2.5 per cent annual growth rate.

But as Torsten Bell, director of the Resolution Foundation, pointed out, in the past fiscal fudges and missing rules did not cause turmoil in markets as “it wasn’t a time of surging interest rates so attention was far less acute”.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.