The rescue of First Republic this week has failed to arrest a sell-off in regional bank shares, which plunged on Tuesday morning as investors digested JPMorgan’s takeover of the troubled Californian lender along with gloomy economic data.

Trading in PacWest, seen as one of the weakest of the mid-sized regional banks, was briefly halted for volatility and was down 35 per cent by mid-morning in New York. The fall put PacWest on course for its worst daily decline since March 10, when Silicon Valley Bank’s collapse heaped pressure on the entire sector. Western Alliance was down nearly 22 per cent.

Both banks have drawn scrutiny because of their similarities to SVB and First Republic, which were taken over by the Federal Deposit Insurance Corporation after they suffered huge deposit outflows and large paper losses on long-dated assets. JPMorgan bought First Republic’s deposits and most of its assets on Monday.

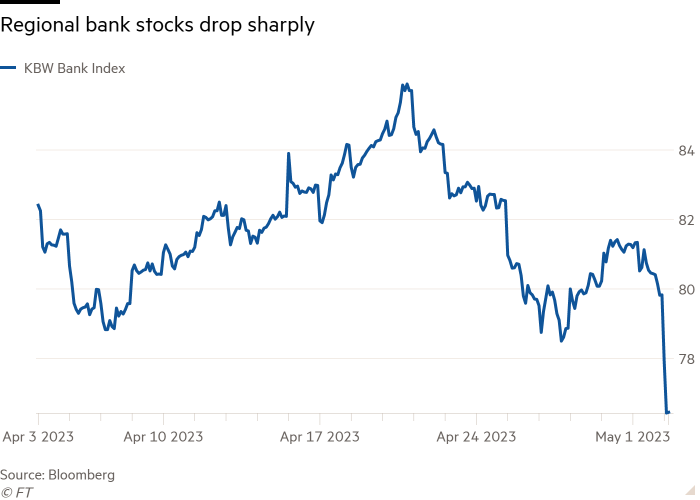

A KBW index of regional bank stocks slid more than 5 per cent in morning dealings.

Larger bank stocks were falling as well, although not as sharply, with Goldman Sachs and Morgan Stanley each down almost 3 per cent. JPMorgan dropped about 1.4 per cent.

Banking stocks tend to be highly cyclical and the Bureau of Labor Statistics reported on Tuesday that the number of job openings had fallen to the lowest level since May 2021.

Several top investors and executives have warned about the potential for further fallout from the spate of bank failures.

PGIM chief executive David Hunt told attendees at the Milken Institute conference in Beverly Hills on Monday that “we’re just starting [to see] the implications for the US economy”, while Investcorp co-chief Rishi Kapoor said there was “no doubt that the second- and third-order effect on the banking sector . . . is going to cause constraining financial conditions”.

Regional banks are particularly exposed to commercial real estate, which has recently emerged as an area of concern, because of its exposure to higher interest rates and fears that the prevalence of working from home will reduce demand for offices.

In an interview with the Financial Times over the weekend, Berkshire Hathaway’s Charlie Munger warned that regional banks were “full of” bad commercial property loans.

Investors have been heavily betting on further share declines in some of the mid-sized banks, with short interest in California-based PacWest particularly high. However, the level of shorting activity is little changed over the past month, according to Markit data.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.