Federal Reserve policymakers are about to extend their year-long campaign of raising interest rates to beat back still-stubborn inflation, even as risks to the US economy build.

At the same time, first-quarter growth figures this past week pointed to an economy that’s downshifting. The monthly jobs report on Friday will give a sense of how labor demand — a key support for the economy — is holding up.

)

Other data on the schedule include March job openings and April surveys of purchasing managers in manufacturing and services.

“Signs point to the FOMC raising rates by 25 basis points to 5.25% in the May 3 decision — despite ongoing turmoil in the banking system — and signaling that this will be the last hike for a while. The next phase of the tightening cycle will be to hold rates at that elevated level, while watching to see if inflation trends down.”

)

Europe, Middle East, Africa

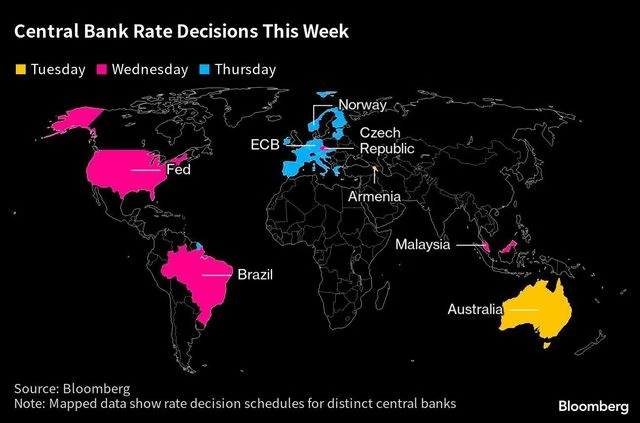

The ECB takes center stage on Thursday with a rate decision in the wake of the Fed the previous evening. Investors and economists anticipate a quarter-point hike, dialing down the pace of tightening as the central bank’s earlier moves impact the economy with a lag and lingering financial-stability worries dictate caution.

)

The consumer-price figures are anticipated by economists to show conflicting signals: the headline measure could accelerate for the first time in half a year, while an underlying index stripping out volatile items such as energy may show slowing.

)

Other monetary policy decisions are also due from across the region:

Earlier that day, Norway’s central bank may raise borrowing costs by a quarter point, keeping up pressure on inflation just as the economy proves more resilient than expected.

It’s a quieter week in the UK, where officials will enter a blackout period before their decision on May 11. Among data due there are shop prices from the British Retail Consortium, Nationwide house prices, and the Bank of England’s mortgage approval and consumer-credit data.

Turkish inflation is expected to remain high in data due Wednesday but price gains are anticipated to cool, with the Treasury Minister saying they’ll dip below 50%.

Asia

What are likely to be largely encouraging signs for the global economy from China may contrast with South Korean trade figures out Monday that are forecast to show a gloomier outlook.

)

Finance ministers and central bank governors are set to gather for the annual Asian Development Bank meeting in South Korea, with climate financing measures among the matters under discussion. Senior officials from both Japan and South Korea are expected to attend.

)

Malaysia’s central bank is also seen standing pat on Wednesday. Indonesia, Thailand and Taiwan are all due to release price data during the week.

The week kicks off with the April consumer price report for Peru’s capital, Lima, which likely slowed for a third month from 8.4% in March. Central bank chief Julio Velarde sees inflation hitting 3% by year-end.

)

Any drama will come from the post-decision communique: Brazil watchers will be on the lookout for shifts to a standing warning that the bank won’t hesitate to lift rates to counter resurgent inflation.

)

The week may, however, end on a propitious note. Data out of Colombia on Friday may show inflation slowed for the first time in 11 months from March’s 13.34%, perhaps even below 13%. With that, inflation in all five of Latin America’s big targeting economies would be falling simultaneously once again for the first time since April 2020.

–With assistance from Andrea Dudik, Robert Jameson, Malcolm Scott and Sylvia Westall.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.