Expectations for the US Federal Reserve to begin raising interest rates in March – a fringe call just weeks ago – are soaring in the wake of a slide in the US unemployment rate and fresh signs that central bankers are eager to wind back record policy stimulus to confront historically high inflation.

“It’s hard to avoid the conclusion that the labour market is very tight. We believe Fed officials are coming to the same conclusion, and that it may be a tough sell to hold off on the first hike until June, our prior call,” Michael Feroli, chief US economist at JPMorgan Chase & Co, wrote in a note Friday.

“We now see lift-off in March, followed by a quarterly pace of hikes thereafter.”

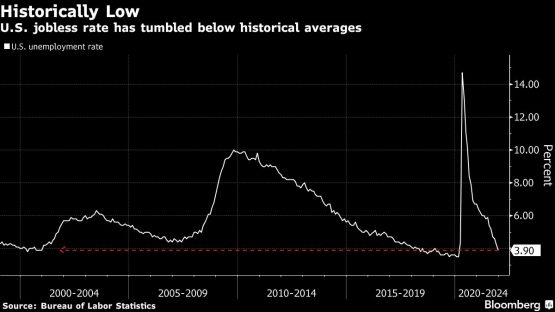

Deutsche Bank AG and Citigroup Inc economists updated their forecasts with exactly the same call for 2022 in the wake of a Friday report showing that the jobless rate fell to 3.9% in December.

That was the lowest since before the pandemic, and compares with an end-2022 Fed projection of 3.5%.

Image: Bloomberg

“The Fed will be very nimble in responding to the incoming data, making consecutive rate hikes or even larger increments possible,” Deutsche Bank economists including former Fed official Peter Hooper wrote in a note.

Just three weeks ago, almost all forecasters had predicted the Fed would wait at least until the second quarter before raising rates. Among the minority, Barclays plc had shifted to a March call in the wake of the November jobs report, which also had shown an unexpectedly large drop in the unemployment rate.

The rapid turnaround reflects conclusions that policy makers aren’t going to wait to boost borrowing costs until payrolls return to their pre-pandemic levels. Job rolls remain more than 3 million off where they were in February 2020.

Yields climb

While not his base-case forecast, Krishna Guha, head of central-bank strategy at Evercore ISI, on Friday raised the possibility that the Fed may decide at its January 25-26 meeting to pull forward the end of its bond-purchase programme. It’s now scheduled to conclude in mid-March.

The treasuries market had started turning even before the Wednesday release of minutes of the Federal Open Market Committee’s mid-December gathering – which showed that some officials thought that policy makers’ goal of achieving full employment before the first rate hike had already been achieved. Yields began climbing on Monday, and kept advancing through the week.

Ten-year yields punched through their 2021 highs on Friday to reach levels unseen since the pandemic struck, and were at 1.76% as of 16:38 in New York.

Interest-rate futures are now pricing in about 78% odds of a March Fed rate hike.

Markets may need to adjust even further, according to former Federal Reserve Bank of New York President William Dudley.

“I don’t think the market is yet of the view that the the Fed’s going to be really aggressive,” Dudley said in an interview with Bloomberg Television.

The continued spread of the omicron variant hasn’t forestalled the hawkish shift in expectations.

For his part, Federal Reserve Bank of St Louis President James Bullard – a voter on rates this year – suggested on Thursday that he didn’t see too much risk from omicron, noting that confirmed cases in South Africa have peaked and are falling and the US may follow that pattern.

San Francisco Fed President Mary Daly, meantime, flagged on Friday that she would favour beginning to shrink the central bank’s portfolio of bonds after only one or two rate hikes.

“I believe that we’re at a point in time that we need to adjust policy,” Daly, viewed as among the more dovish Fed officials, also said.

Economists are coalescing around the second half of the year for the Fed to start balance-sheet contraction. Deutsche Bank’s team anticipates that will begin in the third quarter. Barclays on Friday moved up its call to the third quarter, from the fourth. Citigroup now sees it starting in July.

With assistance from Olivia Rockeman and Michael Sasso.

© 2022 Bloomberg L.P.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.