As European telecoms executives champ at the bit to do more deals, they will be closely watching Luxembourg this week for a crucial decision that could unleash a wave of activity across the sector.

Advocate general at the EU Court of Justice Juliane Kokott will on Thursday deliver her opinion on whether Brussels made the right decision in blocking the proposed merger of the UK businesses of Telefónica’s O2 and CK Hutchison’s Three in 2016.

While harking back to a deal that collapsed six years ago, her verdict will be carefully monitored by France’s Orange and Spain’s MasMovil, who earlier this year announced they are in exclusive talks to combine their Spanish businesses.

Their proposed €19.6bn joint venture is likely to be the first of several attempts in the coming months to streamline what the industry argues is a fragmented market in Europe — but first the companies will have to convince EU regulators that a reduction in players will not harm consumers.

“This merger will be a test case for the industry,” said a person who has advised on telecoms deals in the past in Brussels. “We are at a moment.”

A final judgment by the ECJ is expected sometime next year and, while it is not bound by the advocate general’s opinion, in most cases it follows their recommendations.

Karen Egan, an analyst at Enders Analysis, said that the ECJ ruling next year is “going to be absolutely critical for European mergers”, adding that regulators’ view on the Orange-MasMovil deal is “more uncertain than the companies are portraying to the market”.

Depending on the outcome, the ECJ’s view may also improve the chances of a proposed merger between Vodafone and Three in the UK, which would create the biggest mobile operator in the country and is also regarded as a litmus test of investor appetite for consolidation.

“The decision next week is very important in our view here,” said an executive from Hong Kong conglomerate CK Hutchison.

At the heart of whether the Orange-MasMovil deal in Spain will be permitted is a long-running debate between operators and regulators over whether reducing the number of players in a market from four to three will harm consumers.

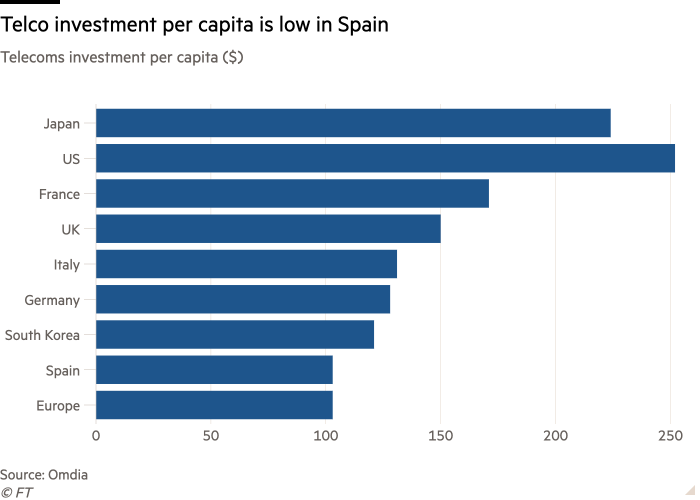

Defenders of the deal argue that like the rest of the continent the Spanish market has become fiercely competitive and a merger will lead to synergies, enabling the combined group to save on costs and invest in the country’s infrastructure — which will eventually benefit customers.

Telecoms executives have long argued that consolidation is the only viable way for Europe to keep up with the rapid pace of development in infrastructure seen in China and North America, both of which have three main mobile operators.

“If operators generate no cash flow, they simply can’t invest,” said Meinrad Spenger, founder and chief executive of MasMovil, in an interview with the Financial Times, adding that finding synergies between operators would be crucial to ensure investment. “Europe cannot afford to lose more speed in 5G development.”

But EU officials have pushed back against the premise that consolidation is necessary for innovation. Competition commissioner Margrethe Vestager argued recently that it is competition rather than mergers that leads to investment. She added that although there was no “magic number” in mind when it came to players in a country, regulators “get nervous” when the pool of operators shrinks. The cost of living crisis and surging inflation mean that any perception of anti-competitive practices and the risk of higher consumer prices are especially undesirable.

Those familiar with the thinking of regulators say the default has been to be sceptical about these deals. “The house view has been that a reduction of one competitor in the market — from four to three — is anti-competitive and therefore I need to prohibit it,” said a person with knowledge of the EU’s competition division. “This has been the dogma up to now.”

But others find this view outdated.

“Whether you’ve got three players desperately trying to fill their networks, or four, isn’t that different in terms of competitive intensity,” said Egan, pointing to markets such as Australia, Austria and Germany that have three players in mobile and yet still have prices below the OECD average.

The Orange-MasMovil tie-up is not the only one that will be faced with deep scrutiny. Last July, Brussels launched an in-depth probe into Orange’s acquisition of a stake in Belgian peer VOO over concerns that the transaction may hurt competition. “We will look at this deal very cautiously,” said a person with knowledge of the upcoming probe.

Those in the industry expect the Orange-MasMovil transaction will receive the same level of scrutiny.

MasMovil argues that a move from four to three mobile players is less relevant as a concern for the Spanish market as there are more companies that combine fixed and mobile services and that offer mobile services without owning the network infrastructure than “any other comparable market in Europe”.

“The merger of two operators would not significantly change the structure of the Spanish telecom market,” said Spenger.

Still, any clearance of the deal is likely to come with requirements for the two companies to sell some assets to create more competition. EU officials are already discussing the deal with the companies before it is officially submitted for consideration by the end of the year, said people with knowledge of the probe.

Elsewhere, a top 15 investor in Vodafone said that the British regulator Ofcom has made some statements to the effect that “the benefit to the consumer has not been apparent” for its proposed deal with CK Hutchison. They added: “I don’t think regulators will be a pushover, there will have to be some quite big concessions and promises made.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.