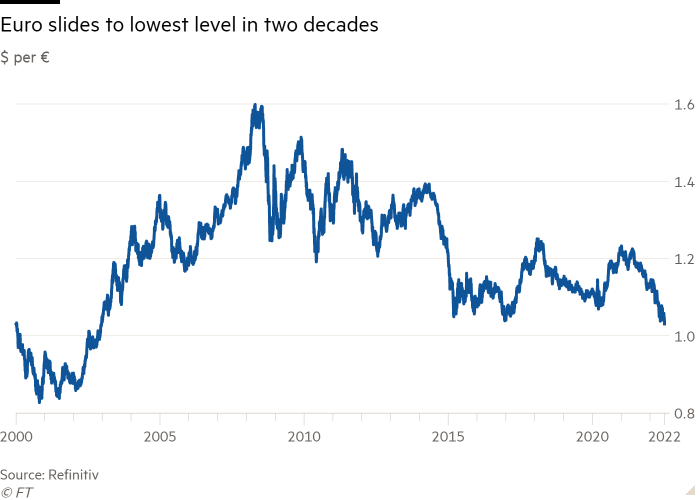

European shares and US stock futures fell on Tuesday, while the euro hit its weakest level against the dollar in two decades, as fears intensified about the health of the global economy.

The regional Stoxx Europe 600 equity index lost 0.8 per cent, after opening higher, while the FTSE 100 dropped 1.2 per cent. In Asia, Hong Kong’s Hang Seng closed up 0.1 per cent, trimming earlier gains, while mainland China’s CSI 300 slipped 0.1 per cent.

In a sign of worsening sentiment about the growth outlook, the euro dropped as much as 1.2 per cent against the dollar to $1.0296 — its lowest point since 2002.

Guilhem Savry, head of macro and dynamic allocation at Unigestion, suggested markets had further to fall. “The recessionary theme has made a comeback,” he said. “Although markets are now starting to price in a cooling of inflation and central bank hawkishness, we have yet to reach the lows in equity markets where we would be comfortable to re-engage risk.”

Futures contracts tracking Wall Street’s S&P 500 and the Nasdaq 100 lost 0.6 and 0.7 per cent, with US markets set to reopen on Tuesday after a holiday.

In government debt markets, the yield on the 10-year German Bund — seen as a proxy for borrowing costs across the eurozone — dropped 0.07 percentage points to 1.27 per cent. The shorter-dated two-year yield slipped 0.12 percentage points to 0.51 per cent. Bond yields fall as their prices rise.

Yields on Bunds and Treasury notes had marched higher earlier this year, as the European Central Bank and the US Federal Reserve signalled aggressive interest rate rises and the planned withdrawal of large bond-buying programmes in a bid to tackle scorching inflation.

The Fed lifted its benchmark rate by 0.75 percentage points in June, its largest such increase since 1994.

But investors have in recent weeks scaled back their expectations of how high the world’s most influential central bank will raise borrowing costs in the coming months, amid mounting evidence of an economic slowdown.

Details of the Fed’s most recent monetary policy meeting, due to be published on Wednesday, may give further clues about the extent to which the central bank is willing to tighten monetary policy. A closely watched US jobs report on Friday will also signal the level of heat in the country’s labour market, a criterion that may also influence Fed decision-making.

The S&P had closed higher on Friday, its last trading day before the long weekend, and bond markets had rallied after a gloomy report on America’s factory sector intensified worries about the economic outlook.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.