The winning streak for Indian stocks is losing momentum as sentiment sours on the prospect of tighter monetary policy and smaller stimulus spending in the coming year.

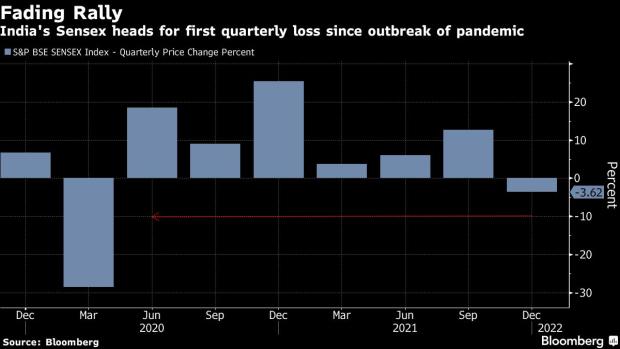

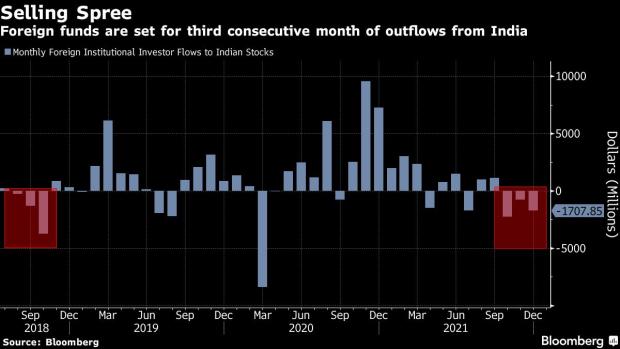

India’s benchmark S&P BSE Sensex has slumped 3.6% since the end of September, halting a rally that ran for six straight quarters and doubled the index’s value. Since reaching a record high in October, the gauge has approached a technical correction, with foreign investors pulling out more than $4 billion from market over the past three months.

Historically high valuations have also made some analysts cautious. India’s key equity gauges are trading at 20-21 times their estimated forward 12-month profits compared with 12 times for the MSCI Emerging Markets Index.

“Unwinding of monetary policy support and reduction in fiscal support in the upcoming year may have negative repercussions for global growth as well as equity valuations,” Credit Suisse Group AG analyst Jitendra Gohil and Premal Kamdar wrote in a note this week.

A withdrawal of monetary stimulus may cause a jump in volatility reminiscent of 2003 and 2009, when prices fluctuated while equity returns remained modest, according to Standard Chartered Plc’s India wealth unit.

India’s equity market will likely “transition from ‘early-cycle’ to ‘mid-cycle’ as monetary policy normalizes with central banks becoming less accommodative,” according to its research note.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.