Emmanuel “Manny” Roman is waiting for me at his table in Marino, an old Italian family restaurant in Hollywood. I am a few minutes late. If anyone has an excuse to be late, it is my guest, the chief executive of Pimco, the giant fund manager. It has some $2tn of assets under management and the markets are in turmoil. I am hotfoot, I explain, from the Getty Museum, on the far side of town.

With the same crisp precision that he might outline to investors his view on whether to stay invested in China or how much to worry about exposure to Russia — his answers, I learn later, are yes and not much — Roman rules on the merits of the Getty and the Los Angeles County Museum of Art. He then urges me to go to The Broad museum, though cautions it is “the collection of a very rich man so it’s incredibly predictable”.

I have come to LA to see another very rich man, but one whose tastes are anything but predictable. Roman is a cosmopolitan French financier who pre-2008 might have been dubbed a “Master of the Universe”. He is also a legendarily literary patron of the arts. I am keen to hear his thoughts on the global outlook at this turbulent time. But I also want to know how his worlds intersect — the world of trading and the world of ideas — if they do at all.

That morning’s front pages in the US are screaming warnings of recession. The decades-long bull run of the bond market which has served Pimco so well has been declared at an end. It is a critical moment for Pimco and for the 58-year-old Roman, who upped sticks from London six years ago, opting to live in LA rather than south of the city in conservative Newport Beach, where Pimco is based.

He is a picture of composure. In fact not once in our Lunch does he look at his phone. I am surprised, I say, he has not had to cancel. He deploys that half-smile that has disarmed so many — some to their cost — over the years. So do the movement of ideas and the movement of markets really come together, I ask? Roman doesn’t pause.

“They totally come together,” he says. “I think markets are a very complicated Impressionist painting. Different pieces contribute to the story.” He gives a whistle-stop tour of his philosophy. “By thinking through the various sectors, stories and people you meet you get a much more holistic picture of what is happening in the economy. Some of it is by data, some of it is by anecdotal stories, some it is by lateral thinking. They are all part of the picture.”

Marino is an oasis on a blazingly hot summer’s day. Mario Marino, one of the two brothers running the show, arrives with a delicate sponge-like cauliflower mushroom cooked in pistachio oil. It is exquisite. Roman signals his approval.

The last time I saw him was in his previous role as the chief executive of Man Group, one of the world’s biggest hedge fund managers, the then sponsor of the Booker Prize, when he presided over its award ceremonies. Publishers were startled to find this “hedgie” had not only read the shortlist but had strong opinions. I ask him to rule on the “Manny myth”: does he really read a new book a week?

It all started when he was growing up in Paris’s bohemian Montparnasse quarter, he says, mostly raised by his artist father. “He painted, the house was full of books, there was no TV, no car, so what does a boy do when options are fairly limited? I read and I read and I read.” And even now, I ask, running his empire and with a young (second) family?

“The trick is to be able to go lowbrow when you are tired and there’s too many things in your life,” he says. “I always have unread thrillers to hand if I don’t have the energy to read anything interesting.” I say I have devoted myself to Russian classics since the invasion of Ukraine and am travelling with Tolstoy’s short stories. His eyes narrow.

“The Death of Ivan Ilyich . . . That didn’t put you in the best possible mood.” We alight on a shared treasure, A Swim in a Pond in the Rain, a reflection on the art of the 19th-century Russian short story by the American writer George Saunders. “That’s part of what Russia is,” he says, sweeping back to the pressing issues of the day. “There’s a cultural heritage and a pride and a sense of the empire. When you talk of an Impressionist picture, that’s part of it.”

Sal Marino pops over from the kitchen with the second antipasto, raw kingfish. Its centrepiece looks like a minuscule sliced unripe acorn. It is a “green almond”, available for just a month at the start of an almond’s life. “It’s a superfood,” enthuses Sal. It is, also, exquisite, though I do wonder if I am eating the nut equivalent of veal.

I probe Roman’s Impressionist argument about the importance of nuance in investing. Ultimately, if you are trading, is it not also about splashy confident decisions — and timing?

Marino Restaurant

6001 Melrose Ave, Los Angeles 90038

Raw cauliflower mushroom, Santa Barbara pistachio (on the house)

Crudo di mare with green almonds x2 $44

Homemade gnocchi al pesto $26

Alaskan halibut with saffron sauce x2 $72

Elderflower blossom gelée with Royal Rainier cherry (on the house)

Acqua Panna $9

Sauvignon Blanc $18

Chenin Blanc $18

Double espresso x2 $12

Total (inc tax) $226.65

“People trade too much,” he replies. “In the next 12 months there’s going to be plenty of things to do because things break and they become cheap. The discipline is to say, right now not a lot is happening where we can do better than the market. Then all of a sudden it’s a totally different ballgame and you can deploy plenty of capital — and do it very well.

“So the pandemic, terrible as it was, gave a unique opportunity to invest money pretty well. It was a window where things became incredibly cheap. Same with 2008. Same with 2001.”

Where he does agree with me is on the role of timing. His career has coincided with years of loose monetary policy, ultra-low interest rates and quantitative easing, which have allowed firms such as Pimco to prosper despite the financial crisis and the pandemic.

“The post-Volcker years have been very good for financial markets and for our generation,” he says, referring to Paul Volcker, the Fed Reserve chair from 1979-1987 who was credited with ending high levels of inflation. “I call that generational luck.”

The big plays in his career have certainly been well-timed. After an 18-year stint at Goldman Sachs, he joined the swashbuckling hedge fund GLG in 2005, just as markets were reaching a peak, and then helped to prime it for a listing two years later, just before the crash of 2008. Two years later he orchestrated its sale to Man, which was very lucrative for him and his GLG colleagues but not for Man. It was soon clear it had overpaid. In a plot twist worthy of a Chekhov short story, Man had to take writedowns on the business, its chief executive headed to the sidelines . . . and Roman took the top job; the reverse takeover was complete.

It was his record as an unruffleable turnround agent at Man, where assets had risen 38 per cent in his three years in charge, that led to his 2016 appointment to run Pimco’s business and change the culture, with chief investment officer Dan Ivascyn running the money.

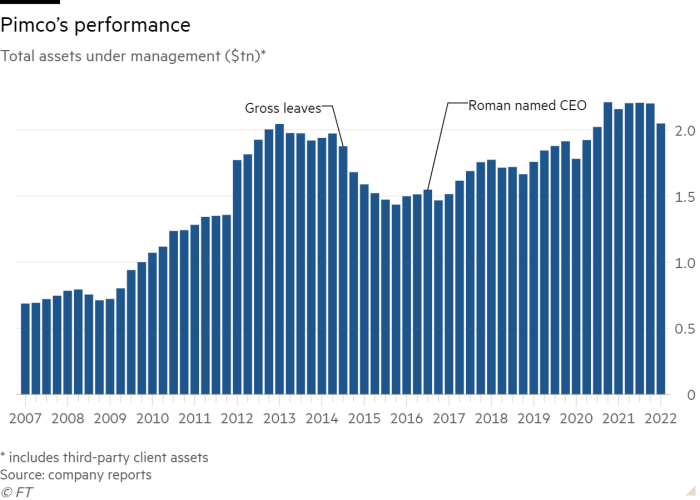

It was a troubled inheritance. Pimco’s longtime star, the “bond king” Bill Gross, who had been among the first to spot the trading potential of the bond market, had left in 2014 in a spectacular row. Pimco was known as a hard-charging place. Gross had loved to strut his stuff on the morning talk shows. Roman has kept a far lower public profile, but I am told he and Ivascyn brought a decisiveness after a period of drift. Pimco’s assets dropped precipitously in the 2010s after Gross left and in late 2020 returned to that level.

But does he listen enough? How do you avoid becoming too confident in your judgment, I ask?

“Overconfidence is one of the great sins of mankind — and fund managers,” he says. “It’s easy to build a narrative where you say I have seen this before.” Richard Thaler, the behavioural economist, a friend and a Pimco consultant, “constantly” reminds him “of the bias that all humans have”.

“It’s very hard to escape that sometimes . . . and that’s why thinking through portfolio construction and risk and debating it with people of different backgrounds and age groups is very important . . . And not just people in your own mould.”

His comments have an added relevance as Pimco’s leadership received a letter last year signed by 21 former and current female employees accusing the firm of abusive and discriminatory behaviour to women. Several have filed lawsuits against Pimco.

“It’s an ongoing investigation,” says Roman. “I believe we’ve done nothing wrong. We’ve done our own investigation, and we’ve commissioned a third-party report. What’s very hard to judge is what happened 10 years ago.

“What I try to do is focus on things under my control, which is to be incredibly focused on having a very diverse workforce. I argue that a diverse workforce stops groupthink. The bigger problem is a bunch of white middle-aged men who all think the same . . . and will hit the wall at the same time.”

Mario is back with our homemade gnocchi, cooked to perfection. He also bears two half glasses of an American-style French Sauvignon by Philippe Melka, the former winemaker from Petrus. Roman demurs at the idea of wine and then acquiesces; he did in his London years own one of the more famous cellars in the city.

Now, however, his life in LA with his second wife is very different. And it’s not just that his social life is more limited, his wine cellar is in storage and he has to watch his beloved Arsenal at unreasonable hours on TV. In 2021, a tumultuous year for bonds, Pimco’s third-party assets under management grew by around five per cent. But 2022 has been a shocker for the bond markets.

For Roman, it is inflation that keeps him awake at night. He seems sanguine about the shifting geopolitical tectonic plates, playing down Pimco’s exposure to Russia as “a very small factor in the overall picture”. In the context of emerging markets in general, he argues that predicting politics is a fool’s errand “unless you’re incredibly close to someone who makes the real decisions”. Pricing political risk, however, is a different matter, he says.

“The average yield of the big emerging market countries is 9 per cent instead of 4 per cent. That’s a reasonable argument to make.” As for China, “we are far less worried than other people. It’s a supertanker. Yes, they locked down, but they can push the accelerator and get to 4.5 per cent growth without too many problems.

“But the big existential risk for all fund managers is that something goes very wrong in the US. Because all of a sudden it’s not a small position. It’s a very big position. So housing for example is a near existential risk for everyone because it’s just so big and there are so many ramifications, the banks, the financial system and so on.”

Our main course arrives. Mario offers a crisp barrel-aged Chenin Blanc from the winemaker Arnaud Lambert. Roman sticks with his Sauvignon. I switch and am happier with that decision than the halibut: it is the first disappointment, overcooked we agree.

When I first plotted Lunch, I had imagined slipping to his homeland. Roman follows events there keenly. He is in despair about the travails of Emmanuel Macron.

“It’s highly disturbing that 43 per cent of the French people vote for a neo-fascist and she [Marine Le Pen] is. Macron’s super smart. He’s young, which is not his fault; and he rubs some people up the wrong way. I’m not sure I understand why.”

The more we talk, the more I find myself thinking of a Renoir portrait of a dandyish composer I had just seen at the Getty. Its bright blues and reds had seemed incongruous under the diamond-bright skies of LA — just as does the idea of this soigné Frenchman driving before dawn every day to Pimco’s HQ in Newport Beach, plotting how to stay one step ahead of the markets.

In the face of the bond rout, he inevitably faces renewed pressure to go the way of other big fund managers such as BlackRock and be more of a supermarket. Will he? His reply reminds me of Jeff Bezos’ early maxim: do what you are good at.

“We do a lot of things, everything from government bonds to municipalities to corporate bonds to high yield to private credit to real estate. But . . . we don’t want to be a supermarket. We want to do one thing.” Before he took the job, he and Ivascyn discussed the way ahead and agreed: “We’re not going to do things we don’t really know how to do or we’re not really good at.” The pair cut back a failed expansion into equities and put resources into alternative and private credit strategies that command higher fees.

Ultimately, however, his legacy may well be decided not by the markets but by a play which worked well for him at Man: an emphasis on technology. He has spent what one Pimco-watcher says is a “ton of money” on programmers and engineers in Austin, Texas. The theory is that instead of relying on analysts you turn to algorithms. But is he getting the return on the investment? Unsurprisingly he is bullish.

“We went from zero to 400 people in three years . . . I always say I’m afraid of underinvesting in tech rather than overspending. That’s why scale matters. The amount you have to spend on it is very big. It’s existential. It’s literally existential.”

Sal appears from the kitchen, with Mario and two saucers of elderberry blossom ice cream with royal Rainier cherry.

“Ooh la la,” says Roman.

I have one last go at trying to understand where Roman’s two worlds meet. Pimco is not a quoted company but is wholly owned by Allianz. This gives Roman’s investment managers great freedom, which is all very well when times are good . . . So where do investing ideas come from?

“You very rarely have one great idea,” he says. “You have hopefully a lot of great ideas that, put together in a portfolio, make a lot of sense. From time to time you have one great idea because things get so cheap it becomes an obvious situation . . . but most often markets don’t lead to an outcome where they become so cheap that you can buy them and buy them in size. A lot of the ideas come bottom up. They come sideways.”

We both need double espressos. I’m still not entirely sure if his two worlds intersect but the one does at least provide clues about the other. After I return to London I email him to check a few details and ask about his reading.

“The Murder Rule,” he replies. “Pretty good and more unpredictable than usual. What I need is a new Harry Bosch.” Thrillers by his bedside? Yes, a tricky time on the markets.

Alec Russell is the editor of FT Weekend

Follow @ftweekend on Twitter to find out about our latest stories first

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.