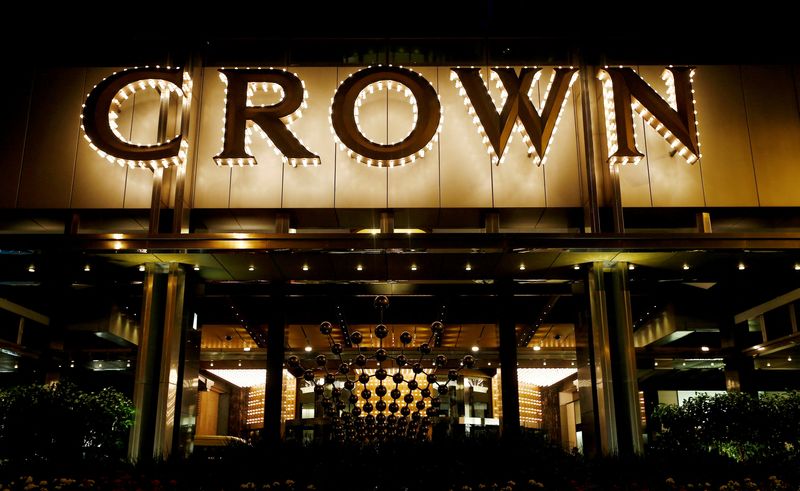

© Reuters. FILE PHOTO: The Crown Casino complex is pictured in Melbourne March 19, 2016. REUTERS/Jason Reed/File Photo

By Sameer Manekar and Scott Murdoch

(Reuters) -Australian casino firm Crown Resorts Ltd said on Thursday its board was likely to back an improved A$8.87 billion ($6.46 billion) buyout proposal from Blackstone (NYSE:) Inc unless a higher offer emerged.

Crown received the higher non-binding offer of A$13.10 per share, a fourth hike from Blackstone after its previous bid of A$12.50 a share was deemed as not “compelling https://www.reuters.com/business/australias-crown-says-blackstones-62-bln-buyout-offer-not-compelling-2021-12-01/#:~:text=N)%20%246.2%20billion%20buyout%20offer,inquiries%20for%20a%20revised%20proposal”.

A source familiar with the matter told Reuters the near 5% price rise agreed after initial due diligence was supported by major investors, including James Packer, who collectively own around 60% of the stock and there were hopes a deal could be signed by the end of January.

Crown shares jumped as much as 9% to A$12.68, their highest level since June 4, but still well below Blackstone’s indicative offer.

The revised offer puts Blackstone in the box seat to win control of Crown, which has faced devastating misconduct inquiries https://www.reuters.com/business/australias-crown-branded-disgraceful-gets-two-years-fix-melbourne-casino-2021-10-25 in every state it operates in, plus protracted COVID-19 lockdowns.

Following the latest offer, the casino operator said https://events.miraqle.com/DownloadFile.axd?file=/Report/ComNews/20220113/02475175.pdf it will engage with Blackstone on a non-exclusive basis and give the investment manager the opportunity to finalise due diligence.

Crown said if Blackstone makes a binding offer of at least A$13.10 per share and if there are no superior offers, its board intends to recommend shareholders vote in favour of the proposal.

“It is likely that a deal will get done,” said Steve Johnson, chief investment officer at Forager Funds Management, which owns Crown shares.

“The increase in offer price is a welcome step in the right direction and we are supportive of the board continuing a push for an appropriate firm offer for shareholders,” he said.

After an inquiry in July last year urged Crown be stripped of its gambling licence for its main Melbourne resort https://www.reuters.com/business/australia-inquiry-urged-strip-crown-resorts-licence-main-casino-2021-07-20, Australia’s No. 2 casino operator Star Entertainment Group withdrew https://www.reuters.com/business/australias-star-entertainment-abandons-66-bln-bid-crown-resorts-2021-07-22/#:~:text=July%2023%20(Reuters)%20-%20Australian,licence%2C%20sending%20its%20shares%20lower a A$9 billion buyout proposal.

However, Star has left open the possibility of re-entering the fray. In an emailed response to Reuters on Thursday, it reiterated it “remains open to exploring potential value enhancing opportunities with Crown.”

The company’s top shareholders, billionaire James Packer with a 37% stake and Blackstone and investment fund Perpetual with more than 9% each, did not respond immediately to requests for comment.

($1 = 1.3729 Australian dollars)

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.