Receive free Chinese trade updates

We’ll send you a myFT Daily Digest email rounding up the latest Chinese trade news every morning.

China’s exports have suffered their biggest year-on-year decline since the start of the coronavirus pandemic, adding to concerns over the growth trajectory of the world’s second-largest economy.

June exports declined 12.4 per cent year on year in dollar terms, official data showed on Thursday, the biggest drop since February 2020. Economists polled by Reuters expected declines of 9.5 per cent.

Imports fell 6.8 per cent, also exceeding expectations. In May, exports and imports fell 7.5 per cent and 4.5 per cent respectively.

China’s exports this year have been hit by weaker international demand at a time when the economy is already strained by a struggling property sector and a disappointing rebound after Covid-19 controls were lifted at the start of the year.

Youth unemployment has also reached its highest point since China started providing the data in 2018, while lacklustre consumer demand has helped to push the country to the brink of deflation.

“China has to depend on domestic demand,” said Zhiwei Zhang, president at Pinpoint Asset Management. “The big question in the next few months is whether domestic demand can rebound without much stimulus from the government.”

The General Administration of Customs on Thursday said trade growth faced “relatively big pressure” and cited economic and geopolitical risks. It said yuan-denominated exports grew 3.7 per cent in the first half of the year.

Gross domestic product data set to be released on Monday will shed further light on the health of the Chinese economy. The government has set an official growth target of 5 per cent for the full year, its lowest level in decades, after posting growth of just 3 per cent in 2022. Premier Li Qiang said last month that second-quarter performance would surpass the first quarter rate of 4.5 per cent.

Policymakers in China have so far stopped short of large-scale stimulus, instead easing key interest rates last month to support growth. They have also introduced cautious measures to support a property industry that accounts for more than a quarter of economic activity but is grappling with a wave of defaults.

Inflation data this week showed the country was on the cusp of consumer price deflation, implying continued weakness in domestic spending months after the anti-Covid regime was abandoned. Factory gate prices are already in negative territory.

After an initial decline, China’s exports surged in the early stages of the pandemic as consumption in other countries shifted towards goods and away from services. Official data often reflected double-digit percentage increases.

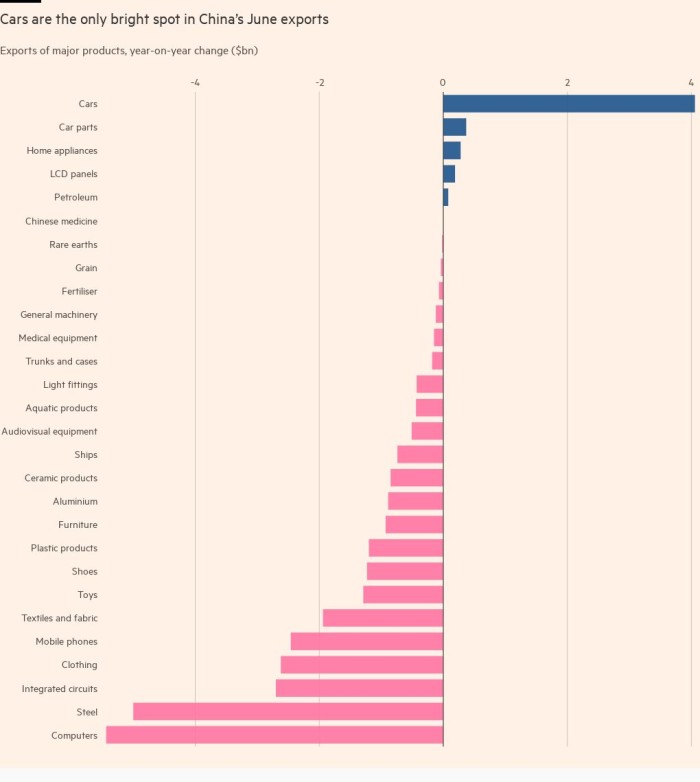

Thursday’s data showed a reversal, with widespread declines across categories including mobile phones, computers, steel and clothing exports.

One exception was car exports, which increased $4.1bn compared with the same period last year.

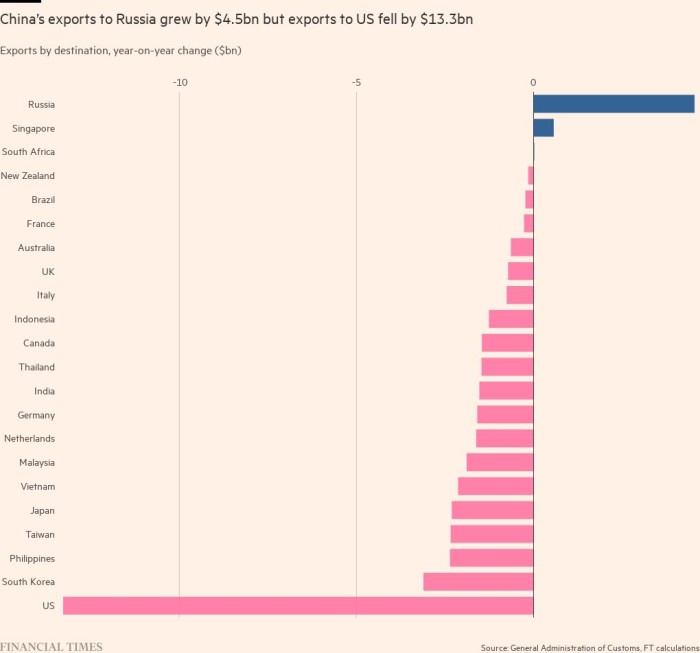

Exports to Russia and Singapore also increased in terms of dollar value, but goods to all other major economies declined.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.