The current investment landscape is challenging, filled with adverse market-moving news around every corner. It is well-documented that having a diversified portfolio will help you weather the squalls of storms that seem to be lashing portfolios.

Achieving diversification is mainly built on the premise that a balanced portfolio, constructed using a blend of cash, fixed income and equity, improves risk-weighted returns. Simply put, risk-weighted return is an assessment of how risky an asset or investment is relative to the possible returns that investment may achieve. As investors, we are constantly seeking investments with the highest possible return with the lowest possible risk.

ADVERTISEMENT

CONTINUE READING BELOW

Whilst having a well-diversified portfolio will reduce the size of the possible drawdowns in your portfolio, they will not eliminate the possibility that your initial investment is at risk of incurring a loss. This can be particularly distressing during periods of heightened market uncertainty. The question will be asked, when will we revert to ‘normal’ market conditions, with less adverse events negatively affecting stock market prices?

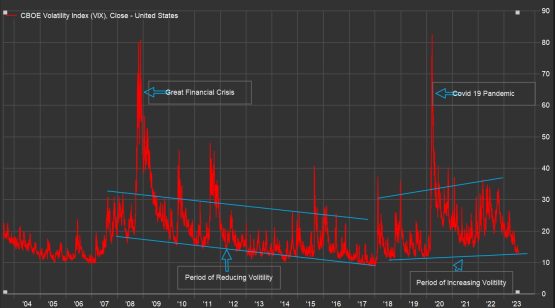

Market volatility increasing: Vix Index

Source: FactSet

Volatility, the measure of risk involved in an asset, also known as the degree of price movement over time, has been steadily drifting lower since the great central bank experiment that is quantitative easing (QE). QE started in 2008, as a response to the global financial crisis (GFC) and resulted in a flood of additional liquidity into the markets. This caused central bank balance sheets to balloon.

Many economists were left scratching their heads when this tsunami of liquidity did not result in elevated levels of inflation. The catalyst that would ultimately trigger a rise in inflation was the Covid-19 pandemic, followed by the Russia-Ukraine war. This heightened inflation has been felt heavily across the globe since these two events, with central banks now scrambling to raise rates. The unintended consequence of the speed of this rate hiking cycle has recently resulted in a new problem: smaller US regional banks struggling to manage their balance sheets, as the value of the securities held by these banks get revalued lower. The knock-on effect of this has been credit tightening, adding to recession fears in some of the biggest economies globally, the extent of which remains to be seen.

Big balance sheets servicing higher funding costs: US CPI vs money supply

Source: FactSet

It is against this backdrop that investors need to look for investments with improved risk-weighted returns – capital protection with the ability to still generate positive real returns.

Structured products (Notes) are an excellent investment option to consider in this regard and have grown in popularity in recent years. These products are typically issued in the form of a debt instrument, issued by an investment bank, designed to provide investors with a unique combination of attractive possible returns over a pre-defined period, with the payoff linked to the performance of an underlying asset.

Generally, these instruments reference equity, equity indices or multi-asset indices, while managing the investment risk through full or conditional capital partition with the issuing bank acting as the guarantor. These products continue to evolve at a rapid pace, with some referenced assets now being active equity offshore fund managers, affording investors the ability to gain access to actively managed equity-like returns, with imbedded capital protection, a powerful value proposition. Payoff profiles vary, from conditional income or coupons to notes that offer capital appreciation or participation. These varied payoff profiles and the deep pool of possible referenced assets mean that structured products can help investors match their individual investment preferences, allowing them or their advisors the ability to tailor solutions, helping to achieve financial goals while balancing risk and reward.

Let’s look at how an investment in both the S&P500 and Euro Stoxx would perform against a 100% five year capital guaranteed structured note linked to the same two indices.

The performance of this structured note has an index cap of 20%, and a participation rate of 375%. What this means is that at the end of the five year term, when the note matures, the index price (on a predefined date from the start) will be captured. That performance will then be multiplied by the participation rate to work out the return of the note. The note will not capture moves above 20% of the index due to the cap, the participation (gearing) rate does increase the possible returns to a maximum of 75%, an annualised rate of 11.84%, with 100% capital protection.

ADVERTISEMENT

CONTINUE READING BELOW

S&P500 (July 2018-July 2023)

Source: FactSet

Source: FactSet

Over the last five years the S&P500 has had a price return of 55%, with the Euro Stoxx return sitting at 21%. An investment in the note referencing the same two indices would have outperformed the direct investment by 37%. Strong note outperformance would also be observed in bearish and sideways markets.

*Equally weighted

What this illustrates is that only in exceptionally strong bull markets, a note would underperform. In most instances the note handsomely outperformed. It’s worth noting that in the event that the markets ended negative at the end of the five year term, investors will receive 100% of their capital back, and have the opportunity to buy the same indices they were invested in at a discount, in the example used above, a 30% discount. Having this optionality also offers a strong value proposition.

In summary, structured products (notes) can provide a range of benefits for investors looking to build a balanced portfolio with an enhanced risk-return profile, paving the road to financial prosperity. These products can offer attractive returns, downside protection, customisation and diversification opportunities.

However, it is crucial to note that structured products are complex financial instruments that require a thorough understanding of risk and reward. All structured notes have a specified maturity date or term. Investors should consider the maturity of the offering based on their own view of the markets, their anticipated future income, their liquidity needs and the creditworthiness of the issuer of the product. As such, investors are advised to work with a financial advisor with experience in these products to make informed decisions.

Darren Ashton is the head of structured solutions at Absa Private Wealth Banking.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.