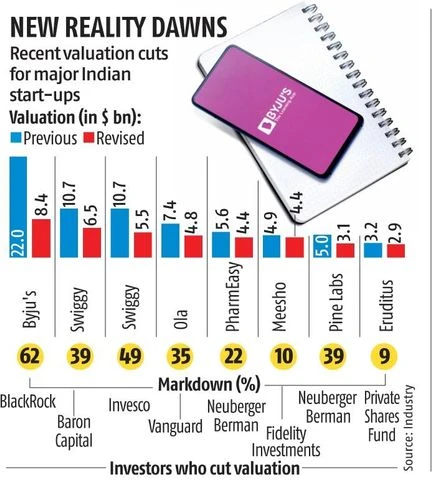

Byju’s latest valuation, as estimated by BlackRock, is around 62 per cent down from the peak of $22 billion in April 2022. Before this, BlackRock had reduced the start-up’s valuation to $11.5 billion (as of December 31,2022).

The edtech company declined to comment on this development. According to sources in Byju’s, Blackrock’s stake in the company is under 1 per cent and its valuation process varies among investors.

BlackRock reportedly pegged the value of its 2,279 shares in the company at $4,043,471, estimating Byju’s fair value at $8.4 billion as of March 31, 2023.

It joined Byju’s capitalisation table at a $12-billion valuation in 2020.

In April 2022, BlackRock was valuing its shares of Byju’s at nearly $4,660 per unit, valuing the company at about $22 billion. However, BlackRock reportedly marked down the value of its shares in Byju’s to $2,400 per share at the end of December 2022.

Markdown in valuation is not the only challenge for Byju’s. The company’s US entity Byju’s Alpha was recently sued in Delaware by an agent of lenders to whom the company owes $1.2 billion, after months of negotiations between creditors and the education technology firm. The lawsuit was filed by Glas Trust Company and investor Timothy R Pohl against Byju’s Alpha, Tangible Play, and Riju Ravindran. The two companies being sued are units of Think and Learn Private, edtech firm founded by Byju Raveendran.

Lenders have reportedly accused the company’s entity, which has no employee, of hiding $500 million as part of a battle between creditors and the edtech firm. The allegation was made during a court hearing this month in Delaware, where Alpha faces a lawsuit over who should control the firm. Lenders claim that because of a default earlier this year, they have the right to put their representative, Timothy R Pohl, in charge.

Byju’s recently said a Delaware core gave an interim order asking the edtech firm to maintain the status quo with Byju’s Alpha, an inoperative US entity set up to receive a loan, and refuted the claims by litigants as “bewildering”.

BlackRock’s latest markdown in valuation also comes at a time when Byju’s is raising Rs 2,000 crore ($250 million) from Davidson Kempner Capital Management, a US-based investment firm, in a structured instruments deal, according to people familiar with the matter.

This is part of an ongoing $1-billion funding round the firm is raising in a mix of equity and structured instruments at a valuation of $22 billion. Around $700 million of $1 billion is expected to come through equity, for which Byju’s is in talks with existing and new investors. These include investors like Abu Dhabi’s sovereign wealth fund ADQ.

The firm is also planning an Rs 8,000-crore initial public offering (IPO) of its subsidiary, Aakash, according to the sources. Aakash was acquired by Byju’s for $1 billion in 2021.

Another challenge is that the Enforcement Directorate (ED) recently conducted search and seizure operations at three premises of Byju’s under the Foreign Exchange Management Act (FEMA). These searches allegedly revealed that the company received foreign direct investments of about Rs 28,000 crore between 2011 and 2023. Byju’s has made several overseas acquisitions (investing an amount of approximately Rs 9,000 crore) over the years as part of its growth strategy.

)

Also, Byju’s is still to file its FY22 results with the Ministry of Corporate Affairs (MCA). Other edtech unicorns, such as Unacademy, upGrad, Vedantu, PhysicsWallah, and Eruditus, have already filed their FY22 financials. The company should have filed its annual results with the MCA by September last year. But, it has been delaying that for over seven months now. Before this, the company filed its FY21 results in September 2022, after a nearly 18-month delay.

The firm was targeting to be profitable by March this year. Byju’s posted losses of Rs 4,588 crore in FY21, 19 times more than the preceding year, according to the latest available financial report.

Byju’s has raised $5.8 billion in total from investors like Qatar Investment Authority (QIA), Sumeru Ventures, Vitruvian Partners, BlackRock, Chan Zuckerberg Initiative, Sequoia, Silver Lake, Bond Capital, Tencent, General Atlantic, and Tiger Global. The firm has over 150 million learners.

Earlier this year, Byju’s handed the pink slip to 900-1,000 employees in a fresh round of layoffs, according to media reports, although sources in the company said the move was part of the “optimisation” strategy that the edtech giant had announced last year that included sacking 2,500 workers.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.