By Jeremy Hill and Lucca De Paoli

Richard Cooper’s phone is something of an early alarm bell for the global economy. Lately, it’s been ringing a lot.

A partner at Cleary Gottlieb, a top law firm for corporate bankruptcies, he’s advised businesses worldwide for decades on what to do when they’re drowning in debt. He did it through the global financial crisis, the oil bust in 2016 and Covid-19. And he’s doing it again now, in a year when big corporate bankruptcies are piling up at the second-fastest pace since 2008, eclipsed only by the early days of the pandemic.

“It feels different than prior cycles,” Cooper said. “You’re going to see a lot of defaults.”

His perch has given him a preview of the more than $500 billion storm of corporate-debt distress that’s already starting to make landfall across the globe, according to data compiled by Bloomberg. The tally is all but certain to grow. And that’s deepening worries on Wall Street by threatening to slow economic growth and strain credit markets just emerging from the deepest losses in decades.

On the surface, much of it looks like the usual churn of capitalism, of companies undermined by forces like technological change or the rise of remote work that has emptied office buildings in Hong Kong, London and San Francisco.

Yet underneath there’s often a deeper, and more troubling, through-line: Debt loads that swelled during an era of unusually cheap money. Now, that’s becoming a heavier burden as central banks ratchet up interest rates and appear set to hold them there for longer than nearly everyone on Wall Street expected.

)

The rising tide of distress is, of course, to a certain degree by design. Caught by surprise as inflation surged, monetary policymakers have been aggressively draining cash from the world’s financial system, intentionally seeking to slow their economies by stanching the flow of credit to businesses. Inevitably, that means some will fail.

But pockets of corporate credit look particularly vulnerable after ballooning during the years of rock-bottom interest rates, when even faltering companies could easily borrow to delay the reckoning.

In the US, the amount of high-yield bonds and leveraged loans — which are owed by riskier, less creditworthy businesses — more than doubled from 2008 to $3 trillion in 2021, before the Federal Reserve started its steepest rate hikes in a generation, according to S&P Global data. Over the same period, the debts of non-financial Chinese companies surged relative to the size of that nation’s economy. And in Europe, junk-bond sales jumped over 40% in 2021 alone. A lot of those securities will need to be repaid in the next few years, contributing to a $785 billion wall of debt that’s coming due.

With growth cooling in China and Europe — and the Fed expected to continue raising rates — those repayments may be too much for some businesses to bear. In the Americas alone, the pile of troubled bonds and loans has already surged over 360% since 2021, the data show. If it continues to spread, that could lead to the first broad-based cycle of defaults since the Great Financial Crisis.

“It’s like an elastic band,” says Carla Matthews, who heads contentious insolvency and asset recovery at consulting firm PwC in the UK. “You can get away with a certain amount of tension. But there will be a point where it snaps.”

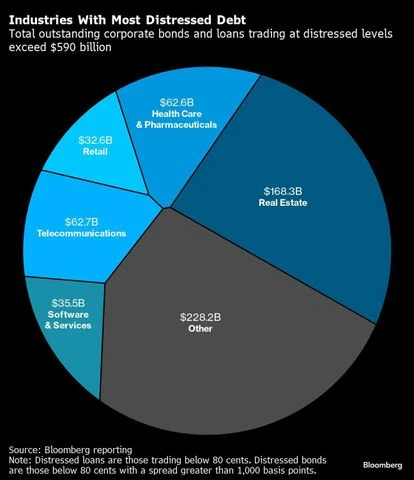

That’s starting to happen already, with more than 120 big bankruptcies in the US alone already this year. Even so, less than 15% of the nearly $600 billion of debt trading at distressed levels globally have actually defaulted, the data show. That means companies that owe more than half-a-trillion dollars may be unable to repay it — or at least struggle to do so.

This week, Moody’s Investors Service said the default rate for speculative-grade companies worldwide is expected to hit 5.1% next year, up from 3.8% in the 12 months ended in June. Under the most pessimistic scenario, it could jump as high as 13.7% — exceeding the level reached during the 2008-2009 credit crash.

Of course, much remains uncertain. The US economy, for one, has remained surprisingly resilient in the face of higher borrowing costs, and the steady slowdown in inflation is raising speculation the Fed may be steering the economy to a soft landing. Yield spreads in the US junk-bond market — a key measure of the perceived risk — have also narrowed since March, when the collapse of Silicon Valley Bank briefly sowed fears of a credit crisis that never materialized.

Yet even a relatively modest uptick in defaults would add another challenge to the economy. The more defaults rise, the more investors and banks may pull back on lending, in turn pushing more companies into distress as financing options disappear. The resulting bankruptcies would also pressure the labor market as employees are let go, with a corresponding drag on consumer spending.

“You’re going to see situations — for example, in the retail sector — where the business just doesn’t make sense and no amount of balance sheet fixing will cure the ills of a particular debtor,” Cleary Gottlieb’s Cooper said.

Post-Pandemic Reality

In London’s Canary Wharf, HSBC’s name is emblazoned on the top of the 45-story office tower that’s been its headquarters for two decades. It’s one in a constellation of big banks that turned the once-derelict riverside in east London into a world financial center.

Even before the pandemic, banks were quietly scaling back on office space in London, reflecting both cost cuts and the UK’s exit from the European Union. Remote work has accelerated it.

That’s fallen particularly hard on Canary Wharf. Two buildings owned by Chinese property developer Cheung Kei Group were taken over by receivers after loan payments weren’t made. In June came more bad news: HSBC said it’s planning to leave by late 2026. That’s another blow for Canary Wharf Group, the developer whose credit rating has already been cut deep into junk as vacancy rates rise and retailers there struggle. It has more than £1.4 billion (about $1.8 billion) of debt coming due in 2024 and 2025.

No other industry is facing pressure as acute as commercial real estate due to the slow return to offices that’s emptied buildings and thinned out downtowns. More than a quarter of the distressed debt worldwide — or about $168 billion — are tied to the real estate sector, more than any other single group, the data show.

There seems to be little relief on the horizon. A survey by property broker Knight Frank found that half of the international firms it surveyed are planning to cut down on office space. Coaxing tenants back can be expensive, particularly as businesses look for more environmentally friendly workspaces.

“Tenants have bargaining power now,” said Euan Gatfield, a managing director at Fitch Ratings.

Most of the distressed debt linked to the property sector is a result of the real estate bust in China. As China Evergrande Group restructures its debt, major companies like Dalian Wanda Group Co. and Country Garden Holdings Co. have seen the prices of their debt tumble. In the US, co-working giant WeWork Inc., whose losses have piled up since its 2020 IPO, has bonds due 2025 that currently yield around 70%.

As demand for office space wanes, Canary Wharf Group is seeking to cut the district’s reliance on the finance industry, with plans to draw life-sciences companies and build more residences. Investors have doubts: One of the company’s bonds, which matures in 2028, is being traded at around 68% of its face value. Canary Wharf and the other companies declined to comment.

The Buyout Machine

Private equity firms thrived on easy credit thanks to a simple recipe: Find a company to buy, borrow money from Wall Street, then cut costs to make a profit. That often left those companies deeply indebted, frequently with floating-rate loans.

It mattered little when the Fed pinned interest rates close to zero, and some buyout firms appeared to see little risk that rates would rise — opting to not even buy relatively low-cost hedges that would safeguard their companies. Now, interest bills are now surging on those floating-rate loans, pushing many of those businesses to the brink.

)

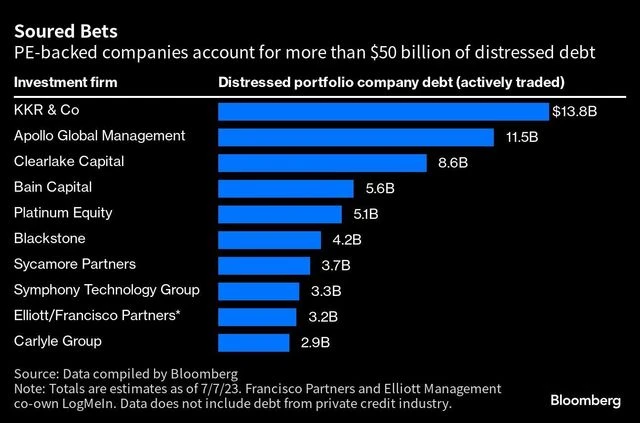

More than $70 billion of debt from private equity owned companies is trading at distressed levels. Shutterfly LLC, the online photo-printing company, is one of them.

Apollo Global Management bought Shutterfly about four years ago for about $2.7 billion, much of it bankrolled with debt. When it refinanced in 2021, the interest rate on its roughly $1 billion term loan was only about 5%. At the time, Moody’s expected the debt would become more manageable as the business improved.

That didn’t happen. Instead, Shutterfly burned through cash as inflation squeezed consumers and businesses.

Meanwhile, the rate on the loan jumped to around 10% this year. With the company’s financial outlook darkening, its lenders agreed to swap the loan for new obligations that will push out its debt bills. Moody’s said the deal is akin to a default and rated the new debt deeply into junk grade. Apollo didn’t respond to requests to comment on Shutterfly. Shutterfly declined to comment.

Brewing Troubles

Rising rates are dealing a twin threat to companies tied to consumer spending as higher-bills squeeze household budgets.

Advertising is among the earliest expenses companies cut when they brace for a recession, and that may ripple down to those like Audacy Inc. One of the US’s biggest radio-station owners, Audacy has more than $800 million of debt due next year. In May, S&P slashed the company’s rating further into junk, predicting it will be forced to restructure its debt as the economy slows. Audacy said in a statement that it’s currently talking with lenders about refinancing options. Its bonds due 2029 last changed hands for less than 5 cents on the dollar.

Elsewhere, the debt woes of French grocer Casino Guichard-Perrachon SA have been building for years. Under Jean-Charles Naouri, it embarked on series of acquisitions to expand into new markets, including Brazil. As the business grew, debt swelled. Then, the pandemic dealt new challenges: Casino’s concentration in tourist districts backfired during lockdowns, as did its price hikes during the inflation that followed.

Naouri now looks set to lose his grip on the company, which has more than €3 billion (about $3.4 billion) of debt maturing over the next two years and is engaged in court-overseen debt-restructuring talks. Czech investor Daniel Kretinsky is in position to take control of Casino after gaining support from key creditors for an offer to inject €1.2 billion into the grocer. Creditors would swap some of their debt for equity.

Casino declined to comment.

–With assistance from Jack Sidders, Irene Garcia Perez, Steven Church and Emma Dong.

To contact the authors of this story:

Jeremy Hill in New York at [email protected]

Lucca De Paoli in London at [email protected]

© 2023 Bloomberg L.P.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.