Meetings, events and consequently group pricing power at hotels shows no signs of slowing down going into 2023, according to a new report from American Express Meetings & Events.

Amex M&E’s 2023 Global Meeting and Events Forecast is based on survey fielded in May and June of 580 global meetings and events professionals across five continents and 23 countries, along with trends observed by Amex M&E and its technology, airline, hospitality and travel safety and security partners.

The report points to rising meetings volumes, while not yet surpassing pre-pandemic levels, still overwhelming a market struggling to ramp up venue availability and services after the shutdown. That, in turn, is pushing group pricing, according to IHG VP of global sales strategy Jonathan Kaplan.

“Average rates continue to rise due to higher labor, food and other fixed costs, along with the impact of inflation,” Kaplan said in the report. “We believe that trend will continue with high demand.”

Survey respondents predicted the imbalance would subside over the next 12 to 24 months. For now, the industry will continue to experience staffing shortages, limited inventory to meet pent-up demand and a rush to acquire and book meeting space—the latter subject to straying outside of policy.

“In the clamor to book in-person meetings, budgets and policies are not necessarily being adhered to during the approval process,” according to the report, a situation also noted by BCD Meetings & Events in its recent meetings industry trend report.

Survey respondents forecast that situation would stabilize in 2023, as meeting organizers spend time in 2022 planning budgets and priorities for next year.

Post-Pandemic Meeting Trends

The report highlighted several trends as the volume of in-person corporate meetings climbs back from their pandemic depths.

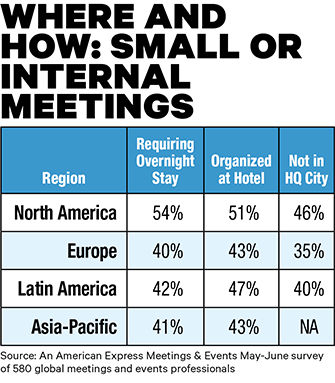

• Small and internal meetings are dominating the recovery. The number of internal, small and simple meetings in several regions have surpassed 2019 levels by as much as 25 percent among some Amex M&E clients and will “continue to be the fastest growing category in 2023 across all regions,” according to the report, which pegged North America with the sharpest growth trajectory, followed by Latin America, Europe and Asia-Pacific. This trend is partially driven by the fact that nearly half of survey respondents’ organizations now operate with a dispersed workforce and require such events to build corporate culture.

• Sustainability is a key concern across regions. Sustainability concerns have peaked among organizations that participated in the Amex M&E survey. Seventy-one percent of North America respondents said their organization considers sustainability when planning a meeting or event. That compares to 76 percent of European respondents and 86 percent each for Latin America and Asia-Pacific. Each region prioritizes tactics for achieving sustainability goals, like choosing certified sustainable suppliers, minimizing paper usage and applying energy-saving and waste-reduction practices. Europe, however, has the highest share of companies (28 percent) calculating the carbon emissions associated with their events.

Striving for diversity, equity and inclusion. Eighty-one percent of North American respondents said their organization “actively strives” to incorporate DE&I into its meetings and events. That compares to 82 percent in Europe, 96 percent in Latin America and 92 percent in Asia-Pacific. The ways in which each region focuses on DE&I and the aspects they choose to address with planning and programming differ significantly. U.S. respondents said they focused on representation of minority groups as speakers and panelists and strives to source goods and services from minority-owned companies. European respondents focused more on accessibility, underlining virtual components as a way to extend access to those can’t attend in person, but also focusing on accessibility issues on site. Latin American respondents said they concentrated on accessibility and alternative forms of communication, to assist attendees with hearing challenges. Asia-Pacific respondents said they looked to diverse speakers and entertainment programming as well as diversity sourcing strategies for meetings.

Global and Regional Snapshot

The growing focus on sustainability and the meeting experience for both in-person and virtual attendees combined with overall rising supplier costs is pushing meetings spend higher. Globally, 65 percent of respondents project meeting spending to increase in 2023, while 35 percent said they expect it will stay the same or decrease. Amex M&E forecast 2023 average overall global meeting spend would tick up by 3.1 percent year over year, which it noted was the same prediction for 2022. Pricing increases will differ by region and by meeting type, but with more meetings, more attendees and rising costs, budget pressure is guaranteed across the board.

North America can expect the highest rate increases going into 2023, according to the report. Amex M&E forecast 2023 meeting spend in this region to increase by 3.8 percent year over year and pegged projected average group hotel rates to increase 7.4 percent and group airfares to increase 7.8 percent. Survey respondents expected increased volume for every type of in-person meeting in 2023 compared with 2022, with the largest increase expected to be in small and simple meetings, at 4.7 percent. Virtual and hybrid events are projected to decrease. Even facing steep pricing increases and competition for venues and space, North American meeting professionals are optimistic, with 65 percent rating their career outlook at an eight or higher on an ascending scale of one to 10; 72 percent rated meetings industry health at eight or higher.

European respondents also feel pricing pains but are similarly optimistic about the return to meetings. They predicted increased year-over-year volume for in every type of in-person meeting in 2023, ranging from 3.4 percent for product launches to 4.7 percent for small or internal meetings. Amex M&E projects group hotel rates to rise 4.8 percent from 2022, with group airfares increasing by 5.2 percent. The company expects virtual and hybrid meetings to stay at current levels in the region for 2023. Among European survey respondents, 75 percent rated meetings industry optimism at eight or higher, and 58 percent rated their career opportunities the same.

Meeting professionals in Latin America are “feeling extremely positive about what 2023 will bring,” according to the report. Ninety percent of respondents in the region pegged their optimism for the industry at eight or higher on a scale of one to 10—the highest among all regions. And 82 percent said their career optimism was at the same level. Latin America expects to see “more of every meeting type”—with a slight rise even in virtual and hybrid. But even for in-person events, organizers expect the number of attendees to increase by “more than 5 percent” across the board. Amex M&E projects group hotel rates in the region in 2023 are expected to rise about 3.7 percent year over year and airfares for the region about 4 percent.

Seventy-four percent of survey respondents in Asia-Pacific pegged their personal meetings industry optimism at an eight or higher on a scale of one to 10. Still, the region is the most cautious with organizing in-person meetings and events. According to the report, “Supplier flexibility followed closely by confidence in duty-of-care components are the top two factors that influence planning in-person events versus virtual ones” in the region. Virtual meetings continue as government-driven immigration requirements and some city closures—particularly in China—pose an ongoing challenge to meeting demand. About 61 percent of respondents predicted in-person per-meeting attendee numbers to return to 2019 levels in the next two years. Overall, respondents in the region expect more of every type of meeting in 2023 compared to 2022 volumes—whether in-person, virtual or hybrid.

Moving Forward: Meetings Management, Technology is Key

Strong meetings demand is creating a market for automation and strong supplier relationships to work together to navigate challenges and greater control over the booking process, according to the report. Currently, longer-than-expected request-for-proposal response times are plaguing meetings organizers as they jockey for prime meetings space, often with one-off event requests. These challenges are sending meeting organizers around policy guardrails just to make a meeting happen.

Amex M&E suggested that strong meetings management that automates policy and approvals and minimizes administrative headaches will be key to capturing data and advancing meetings strategies, and that includes the small meetings segment. Specialized small meetings tools emerged prior to the pandemic but are gaining more traction now given the new environment, according to the report. While such tools sometimes diverted the meetings-management process away specialists and toward meeting owners, with strong policy guidance built in these tools can optimize guidance and data collection among ad hoc event organizers, allowing meeting program managers more visibility into the total meetings portfolio, according to the report.

“As meeting owners continue to demand more autonomy over the booking process, driving adoption for simple meeting technology will be crucial in the next few years,” Cvent president and co-founder Chuck Ghoorah said in the report.

While the U.S. long has been most mature in its meetings management, Europe is coming on strong. European survey responses showed meetings management components have penetrated most organizations. Nearly two-thirds of respondents said they have “adopted a formal policy for meetings,” and specified the aspects most likely addressed within such policies are safety and security requirements, the use of meetings technologies and the use of preferred suppliers. More than 70 percent of European survey respondents said they at least have implemented meetings approval processes.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.