Watch | Union Budget 2023: key updates on personal income tax

Finance Minister Nirmala Sitharaman on Wednesday announced that those earning up to ₹7 lakh a year need not pay any income tax under the new tax regime, giving a push for the regime which disallows all exemptions on investments.

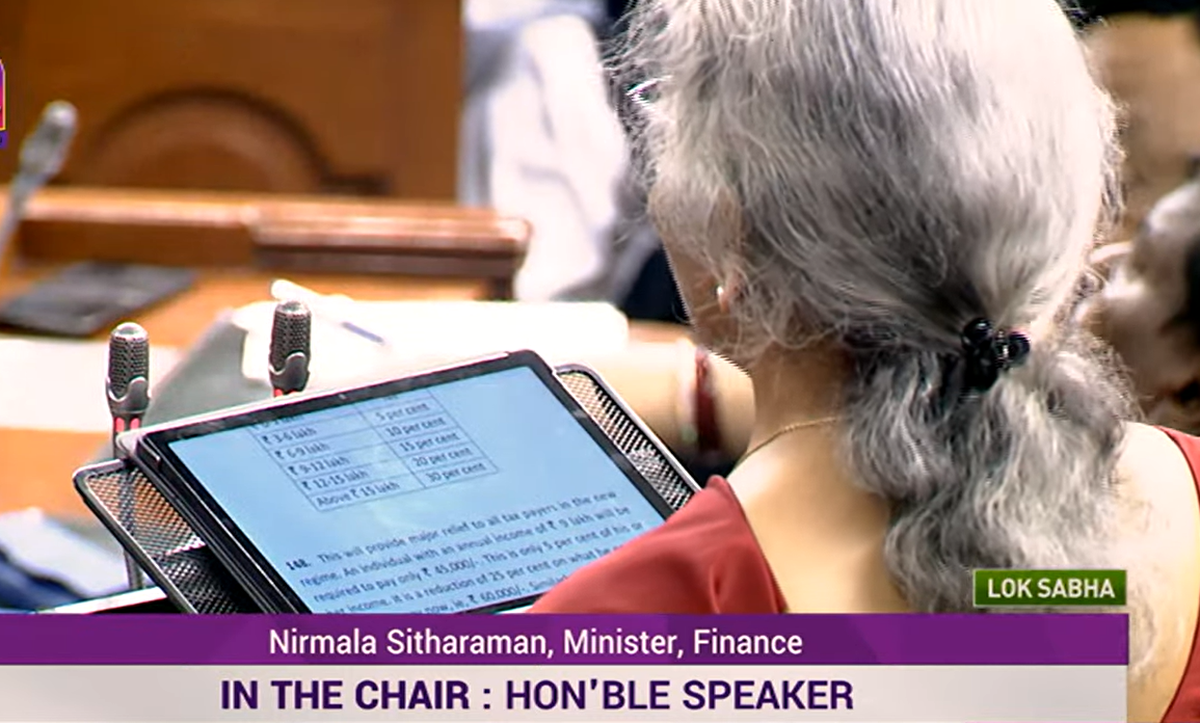

Finance Minister announcing the new tax slabs. Photo: Screenshot via YouTube/Sansad TV

Stating that the new regime would become the default, the Minister said taxpayers could, however, still opt to file under the old regime, which allows for tax exemptions and deductions on investments and expenses such as HRA (house rent allowance). The Budget offered no changes for those opting to stay with the old regime.

Those switching to the new tax regime can also hereafter avail of the ₹50,000 standard deduction.

Those earning up to ₹7 lakh annually and opting for new tax regime, could save ₹33,800. Those with income up to ₹10 lakh would save ₹23,400 and ₹49,400 saving would accrue to those earning up to ₹15 lakh.

Ms. Sitharaman also cut surcharge from 37% to 25% for individuals with income above ₹2 crore.

This would translate into a saving of about ₹20 lakh for those having a salary income of about ₹5.5 crore.

In her Budget speech, Ms. Sitharaman said currently individuals with total income of up to ₹5 lakh do not pay any tax due to rebate.

“It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to ₹7 lakh,” Ms. Sitharaman explained.

The Minister added that the number of slabs would be reduced to five.

The new slabs will come into force with effect from April 1.

Here is a list of announcements relating to the Income Tax, announced in the Budget.

- There were six income slabs starting from ₹2.5 lakh. Now, the tax slabs have been reduced and the limit has been raised the limit to ₹3 lakh.

- No tax for income up to ₹3 lakh; 5% tax on ₹3-6 lakh; 10% tax on ₹6-9 lakh, 15% tax on ₹9-12 lakh, 20% tax on ₹12-15 lakh and 30% on income above ₹15 lakh under new I-T regime.

- The limit of ₹3 lakh for tax exemption on leave encashment on government salaried employees. That was set in 2002 when government salaries were lower and is now being raised to ₹25 lakh.

- The Government proposes to increase the income tax rebate limit from ₹5 lakh to ₹7 lakh in the new tax regime.

- A person earning ₹9 lakh a year will now be paying just ₹45,000 instead of ₹60,000 currently. An individual with income of ₹15 lakh will have to pay ₹1.5 lakh tax down from ₹1.87 lakh under new tax structure.

- The highest tax rate in our country is 42.74%, it is among the highest in the world. The highest surcharge rate will be reduced from 37% to 25% in the new tax regime. This will result in the reduction of the maximum tax rate to 39%.

- Proposal to extend ₹50,000 standard deductions to salary earners under the new tax regime.

- The new income tax regime will now become the default option, but people will still have the option to go for earlier regime.

Income Tax Announcements in the Union Budget 2023-24

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.