The boss of Britain’s largest sandwich-maker says price negotiations with supermarkets have become so strained amid the inflation crisis that sometimes walking away is the only option.

Article content

(Bloomberg) — The boss of Britain’s largest sandwich-maker says price negotiations with supermarkets have become so strained amid the inflation crisis that sometimes walking away is the only option.

Advertisement 2

Article content

“In certain cases we’ve said to people ‘If you’re not prepared to take this price, we’re not prepared to supply you’,” said Dalton Philips, Chief Executive Officer at Greencore Plc, speaking on the sidelines of the company’s annual meeting on Thursday. “In fact, we’ve just done that with a very large customer.”

Article content

Dublin-based Philips, who previously ran Morrisons supermarket in the UK, declined to name the retailer but said it’s clear there’s “real pressure in the supply chain.”

The dispute is the latest evidence of increasingly fraught negotiations between retailers and producers as both parties seek to protect their margins from growing costs. A record spike in food prices at a time when Britons’ incomes are falling in real terms means supermarkets have to fight hard to keep prices down or risk losing market share to cheaper rivals.

Advertisement 3

Article content

Grocers are now demanding more detail from food producers to justify why their prices are rising and suppliers are trying to push through multiple pricing requests a year, up from one annual round before the cost-of-living crisis. The pressure is only likely to continue this year with food prices still rising despite signs that broader measures of UK inflation are starting to ease.

Feeling the Squeeze

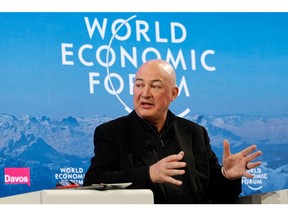

“We are certainly nowhere close to peak prices,” Unilever Plc Chief Executive Officer Alan Jope said recently at the World Economic Forum in Davos. “The consumer is going to see the cost of food, personal care products, everyday commodities continuing to rise and I think most households, particularly in Europe, are going to feel the squeeze.”

Advertisement 4

Article content

Some of the world’s biggest consumer groups have been warning for some time that rising energy and labor bills mean prices will have to rise further in 2023. Last year Kraft Heinz Co. temporarily stopped supplying ketchup and baked beans to Tesco as disputes over pricing started to escalate. For a spell Mars Inc. also stopped supplying its pet food brands Whiskas and Pedigree to Tesco after a separate tussle over costs.

Tesco chairman John Allan thinks more than just normal supply chain tensions are at play here. Last week he said Britain’s largest grocer had “fallen out” with “a number of suppliers” and suggested some producers are profiteering from the worst inflation in four decades by ramping up prices more than necessary.

Advertisement 5

Article content

The comments drew a backlash with The National Farmers Union accusing Allan of almost “living in a parallel universe,” while the Food & Drink Federation listed all the input costs that have risen for suppliers: ingredients, energy, transport, packaging, labor. The problem is that those costs have risen for supermarkets too and many grocers sell own-label equivalents of branded products giving them an insight into how cheaply they can source items themselves.

Margin Pressures

One of the key tensions at the heart of the negotiations is that supermarkets feel harder done by than big producers whose double-digit profit margins often dwarf those of their retail customers. Unilever’s operating margin is about 16% but has been under pressure as record price increases have not fully offset its own cost price inflation. By comparison, Tesco reported a margin of about 4% at the half year.

Advertisement 6

Article content

Read More: Inflation Solves Grocers Revenue Leaving Wages to Trouble Margin

Jope said the maker of Dove soap and Knorr stock cubes doesn’t take decisions on pricing lightly and always tries to make productivity savings elsewhere first. Consumer companies also have to be wary of shoppers trading down.

“The last thing we want to do is take prices up. It affects competitiveness, it disturbs volume in the market,” he said at Davos. Unilever still expects its margin to grow in 2023 and 2024 through pricing, reducing pack sizes and cost-cutting.

Price Acceleration

In December food costs in UK stores accelerated by nearly 17%, the quickest pace since records started in 1989, according to the Office for National Statistics. The war in Ukraine has pushed up the price of fertilizer and animal feed as well as energy and that’s meant that suppliers are having to approach the supermarkets far more frequently.

Associated British Foods Plc, whose products include Twinings tea, Kingsmill bread and Silver Spoon sugar, said it’s engaging with supermarkets sometimes two or three times a year on some products as there’s a “huge amount of input cost inflation to recover.”

“Engagement with the supermarkets is way, way higher than it was before,” finance director John Bason said in a phone interview. “Food pricing negotiations with the supermarkets is always a tough commercial discussion.”

—With assistance from Dasha Afanasieva, Agnieszka de Sousa and Sabah Meddings.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.