Shares of UTI Asset Management Company (AMC) on Tuesday climbed 15 per cent, following reports that Tata Group is eyeing 45 per cent stake in the investment manager.

According to reports, Tata AMC plans to acquire the shares held by four public sector undertakings (PSUs) in the fund house that manages assets worth Rs 2.24 trillion.

If the deal goes through, the combined assets under management (AUM) of UTI AMC and Tata AMC will make them the sixth-largest fund house in the country.

Currently, UTI AMC is ranked eighth, while Tata AMC is in 13th position with an AUM of Rs 88,400 crore.

Both Tata AMC and UTI AMC refused to comment on market speculation.

“Tata Group has still not made it big in the financial services space. The thinking is that acquiring a well-established brand and franchise like UTI AMC will help enhance their presence in this space,” said a person who has worked with one of the AMCs.

The deal, however, may be complicated for a number of reasons.

With UTI AMC being a listed entity, an acquisition of 25 per cent or more stake will trigger an open offer, which may increase the cost of acquisition.

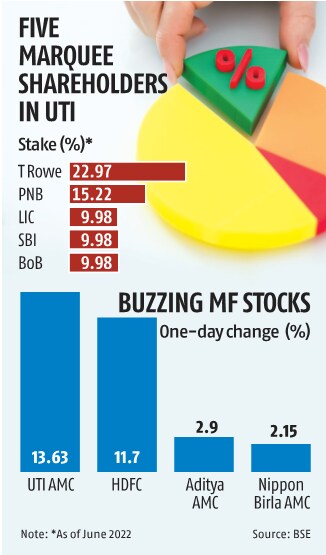

Also, five marquee shareholders hold substantial stake in the fund house, who in the past have had differences over divestment and governance issues.

Currently, Punjab National Bank holds 15.22 per cent stake in UTI AMC. Life Insurance Corporation (LIC) of India, State Bank of India (SBI), and Bank of Baroda (BoB) hold 9.98 per cent each. US-based T Rowe Price holds 22.97 per cent.

It remains to be seen if the four PSU shareholders are able to obtain government nod to divest entirely from the fund house with a strong legacy.

Prior to UTI AMC’s initial public offering in 2020, all four PSU stakeholders held 18.24 per cent stake in the AMC.

LIC, SBI, and BoB had to pare their holdings below 10 per cent to comply with the cross-holding norms. Markets regulator Securities and Exchange Board of India doesn’t allow a single entity to hold more than 10 per cent stake in more than one AMC.

This rule could also be an impediment to Tata Group that already has presence in the AMC space. As a result, the group may have to merge both UTI AMC and Tata AMC. This will require regulatory approvals and require the asset manager to provide an exit opportunity to existing unitholders.

Given the rise in UTI AMC’s share price, the market is optimistic about the deal.

Shares of other AMCs also received a fillip, with HDFC AMC’s stock jumping close to 12 per cent and that of Aditya Birla AMC and Nippon India AMC rising over 2 per cent each.

Shares of AMCs have underperformed over the past year amid pressure on profitability and regulatory tightening.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.