Source: J.D. Power

In its recent 2022 U.S. Direct Banking Satisfaction Study, J.D. Power found that established brands diving into the digital banking space are doing better than traditional banks and neobanks in terms of supporting their customers. According to J.D. Power, 27% of American banking customers are using a digital-only bank.

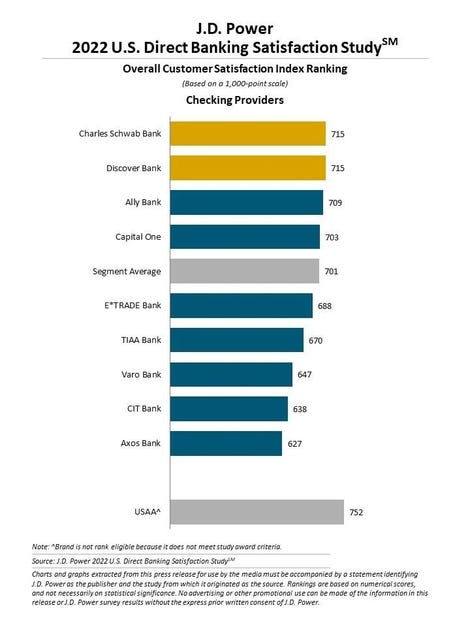

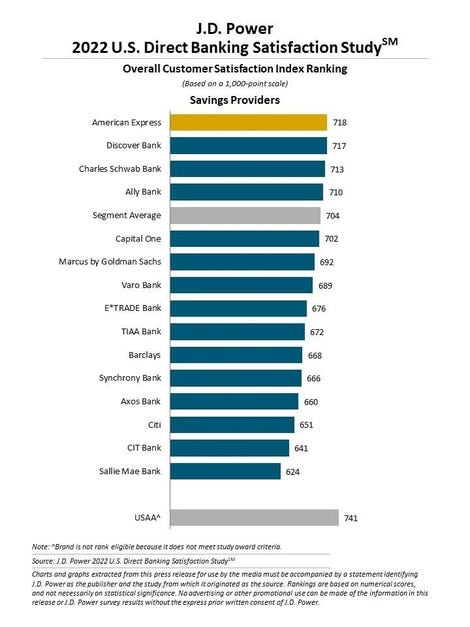

Brands like American Express, Discover, and Charles Schwab are at the top of J.D. Powers’ direct banking satisfaction ranking chart, outpacing both traditional banks and newer neobanks like SoFi, Chime, and Cash App.

Discover and Charles Schwab are tied for the number one spot when it comes to checking account providers, and American Express holds the number one spot among savings account providers.

J.D. Power defines direct banks as branchless, digital-only banking options with federal banking charters from either the Federal Reserve Board, the Office of the Comptroller of the Currency (OCC) or the Federal Deposit Insurance Corporation (FDIC). The company defines neobanks as digital banking alternatives that have not yet received federal banking charters, such as SoFi and Chime.

According to the study, 88% of direct banking checking and savings customers said their bank is easy to do business with. 85% indicated there are no hidden fees, and only 6% of respondents said that their direct bank does not put their needs first.

The study also found that direct banks put customer service at the forefront of their business. The study found that 59% of respondents have never had an issue with their direct bank, and among those that did have an issue within the last 12 months, 83% said it was convenient to reach customer service and 88% indicated that their most recent problem was resolved.

The study measured the brands on several metrics:

- Customer service

- Ease of moving money

- How effectively the brand helps grow money

- Level of trust

- Ease of account management via mobile app

- Ease of account management via website

- Reduced banking fees

The study found that brands at the top of the ranking chart outperformed all the rest in terms of customer service, transparency, and how supported customers felt through economic hardship. These direct or digital banks provided a higher level of customer service to their customers than traditional banks, like Bank of America and Citi.

Source: J.D. Power

“There are two main types of customers who are attracted to these accounts and online-only digital banks,” Paul McAdam, senior director of Banking & Payments Intelligence at J.D. Power, told ZDNet. “There’s a group of customers who are savings oriented, and they’re looking for an interest rate higher than a basis point or ten basis points, so that absolutely has a lot to do with it. But there’s also a set of customers who are fee sensitive, and are looking for fee reduction.”

Nearly all of the digital or direct banking options available to consumers today have transparent fee structures, lack minimum balance requirements, have strong overdraft protections, offer two-day cushion periods around potential fees, and provide a level of personalization to clients that most traditional banks have yet to match.

Additionally, digital banks largely offer a far higher annual percentage yield (APY) on savings accounts when compared to traditional banks. For example, American Express, ranked number one in satisfaction for savings account offerings, has a savings account that features an APY of .6% compared to a Bank of America savings account that has an APY of .01%.

Also: The 5 best high yield savings accounts: Not your standard savings

“Customers are largely getting what they want when they establish these relationships with direct banks. We’ve always seen higher satisfaction [from customers who use] direct banks [rather] than traditional retail banks. They’re a great deal for customers,” McAdam said. “We have customers who largely know what they want. They’ve done their research, they’re doing this for a reason. They know they can get a better interest rate on their savings, they know they can get a really attractive fee policy, and those are definite advantages over a traditional bank.”

The J.D. Power study also found that direct banks do well with making customers feel supported during times of financial hardship. With a potential recession looming, the cost of living steadily increasing, inflation and gas prices on the rise, and federal interest rate hikes by the Fed, this metric ranked heavily in the study.

That said, according to McAdam, helping out during trying economic times could take many forms, from account problems to being in dire need of financial assistance.

Direct banks rank better than traditional banks in terms of helping clients. It’s important that clients feel that the bank has their back when they need it. “When I need that help, how easy is it to reach [the bank], and how was that experience and how was the problem resolved?” he said. Another crucial part of feeling supported is if the bank is offering clients advice.

“Helping [customers] to avoid fees, the two-day payday advance, the non-sufficient funds (NSF) assistance, are a big part of it. There’s the problems in service, there’s the advice piece, and then the other thing that comes into it is the fees and funds availability,” McAdam said.

When consumers make a deposit or transfer money, and the funds take longer than anticipated to become available, it understandably causes them a good deal of dissatisfaction.

“This combination of funds availability and fees are a third big piece of that equation that goes into the calculus customers do when they’re thinking about, is this brand supporting me?” McAdam said.

Another big part of why consumers are feeling higher rates of satisfaction with direct banks is the level of personalization they receive. And, despite what people may think when they hear ‘personalization’, it has more to do with helping customers avoid fees and other actionable advice than it does with the bank greeting them by name.

“The reason customers feel these banks are more personalized is because the customers are more likely to feel that the bank is helping them to avoid fees, and that the bank gives them opportunities to receive proactive communication when they run into trouble with their balances or their payments,” McAdam said.

So how long until traditional banks catch up? According to McAdam, it’s only a matter of time before we see big banks begin to adopt practices that are commonplace with direct banks.

“None of this happens overnight, but you can see with Capital One and Huntington and other big banks [that they are] talking about it and thinking about it. One can see how this direct bank and neobank movement is just going to continue to push the incumbents to a clearer value proposition around the way they charge fees,” he said.

Traditional banks will need to put a greater emphasis on customer service, how easy they are to reach, how effective they are at solving customer issues, fee transparency, and actionable advice on how customers can better avoid fees and put their money to work for them. For now, customers looking for a bank that checks all the boxes should consider a digital or direct banking option.

“For a customer who’s looking around, and weighing the choice between [direct banks and traditional banks], I would highly encourage consumers to give these incumbent providers a look, because other customers are indicating that the satisfaction levels are higher,” McAdam said.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.