You’re reading Entrepreneur United States, an international franchise of Entrepreneur Media.

This story originally appeared on Zacks

Pinnacle West Capital Corporation’s PNW planned investments in strengthening its infrastructure and an increasing focus on renewable sources for power generation will help it take advantage of the expected demand surge for clean energy. Also, PNW’s efforts to reduce costs will drive its earnings.

The Zacks Consensus Estimate for 2021 earnings is pegged at $5.08 per share, indicating growth of 4.31% from the year-ago quarter’s reported figure. Also, the consensus mark for current-year revenues stands at $3.62 billion, suggesting 0.97% growth from the prior-year period’s reported number. Additionally, long-term (three-five years) earnings growth is pegged at 5%.

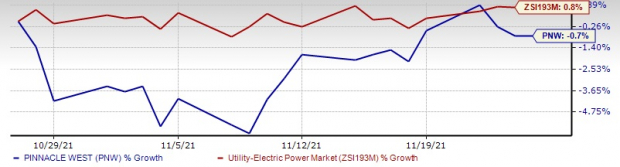

In the past month, shares of this currently Zacks Rank #3 (Hold) Pinnacle West have lost 0.7% against the industry’s growth of 0.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

– Zacks

One Months Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Tailwinds

Pinnacle West’s investments in clean power generation, and transmission and distribution lines will help it expand its customer base with better efficiency. PNW spent $1,006.4 million in the first nine months of 2021 and has plans to spend $6,210 million during the 2021-2024 forecast period with the current-year expectation being $1,500 million to strengthen and expand its existing infrastructure. Moreover, PNW is working ontrimming costs, which will help keep the customer rates low as well as enhance its customer benefits and shareholder value.

Apart from growing its utility infrastructure, Pinnacle West continues focusing on expanding its generation from renewable sources. In the 2021-2024 time frame, PNW will invest $1,487 million in increasing clean power generationand plans to deliver 100% carbon-free electricity to its customers by 2050. This includes a near-term target of attaining a resource mix within 2030 comprising 65% clean energy and 45% renewable sources.

Other electric utilities also adopting measures to supply clean and reliable energy to their customers include the likes of Duke Energy DUK, DTE Energy DTE and Alliant Energy LNT. While DUK and DTE carry a Zacks Rank#3 at present, LNT holds a Zacks Rank #2 (Buy). All three stocks are planning to provide absolute clean energy by 2050.

DTE Energy remains committed to reducing carbon emissions of its electric utility operations by 32% within 2023, 50% by 2030 and 80% by 2040 from the 2005 carbon emissions levels. Duke Energy plans to reduce carbon footprint between approximately 55% and 75% through 2035. Alliant Energy intends to retire all the existing coal-fired generation units by 2040 with an objective to lower emissions from the 2005 baseline by 50% within 2030.

Headwinds

Pinnacle West’s progress could be hindered by fluctuations in commodity prices, stringent environmental regulations and unplanned outages in nuclear-generation facilities.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Duke Energy Corporation (DUK): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW): Free Stock Analysis Report

Alliant Energy Corporation (LNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.