Carmakers are no longer just struggling to match Tesla on electric vehicle technology, but are scrambling to come close on production too.

For years it had been assumed that the main carmakers that build millions of combustion engine cars a year could rapidly scale up their EV production — as soon as they nailed battery technology and enough consumers showed an interest.

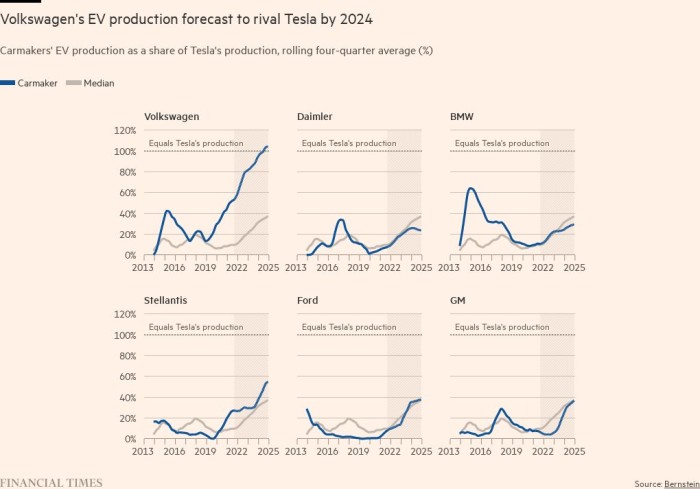

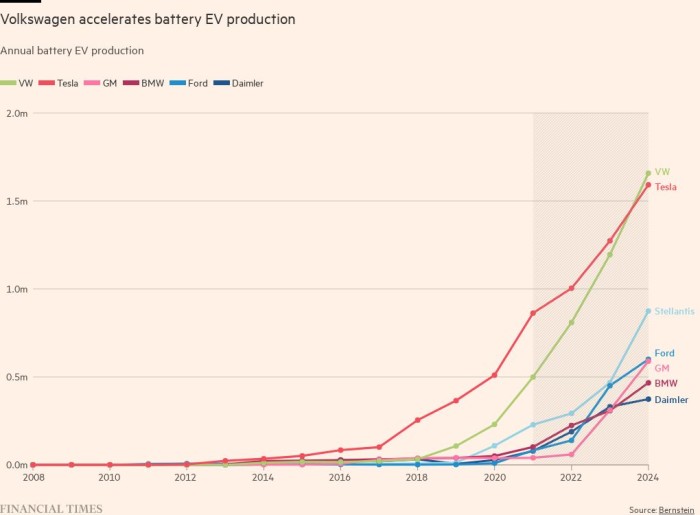

But forecasts for six big car groups out to 2024 indicate that Volkswagen is the only legacy carmaker on track to overtake Tesla for EV production. While the others are expected to rapidly increase the number of EVs they sell, none will come close to rivalling Tesla, according to forecasts from Bernstein, IHS and EV-Volumes.com.

Last month, Elon Musk boasted that Tesla’s vehicle production had increased by an average of 71 per cent a year over the past half-decade. “I feel confident of being able to maintain something like this, at least above 50 per cent for quite a while,” he said

EVs are a niche but growing product. They made up just 3 per cent of the global passenger market in 2020 and Tesla delivered about half a million vehicles. But they are expected to take 11.4 per cent of the global market this quarter, according to EV-Volumes.com, while Tesla is producing at a rate that equates to about 1m a year and its factory near Berlin is just coming online.

Between 2017 and 2020, Ford’s electric vehicle production was less than 2 per cent of Tesla’s. This year its volumes have ballooned thanks to the Mustang Mach-E. Its 2021 production rate is 83,000, or 10 per cent of Tesla’s, according to Bernstein. Ford raised its forecast this week and said it would produce 600,000 EVs a year by the end of 2023 — still just half of Tesla’s forecast production. However, Bernstein predicts the figure will fall short and be closer to 450,000.

Meanwhile, as Ford CEO Jim Farley told employees this month, Tesla’s Model 3 is now the best-selling vehicle in both Europe and the UK. “Not electric. Flat out,” he said. “If we’re going to succeed, we can’t ignore this competition any more.”

Volkswagen’s Herbert Diess has for years been the only incumbent CEO taking Tesla seriously as a rival. In 2017, as head of the VW brand, he laid out a plan to “leapfrog” Tesla by 2025, touting cost advantages in scaling up production that would let VW build EVs “for millions, not for millionaires”.

But VW’s progress has been mixed. Bernstein projects the group will sell 450,000 EVs this year, short of an original target of 600,000, partly because of semiconductor shortages, which have not hit Tesla as hard.

“This year isn’t the end of the world but it’s also not quite a reason to celebrate,” said Bernstein’s Arndt Ellinghorst, who expects VW Group to outsell Tesla in EVs by early 2024.

For BMW and Mercedes, the world’s leading luxury carmakers by volume, their combined production of EVs is less than one-fifth of Tesla’s this year, even though Mercedes has launched its flagship electric S-Class equivalent, the EQS.

Some of that lag may be down to a reluctance to prematurely phase out the production of higher margin combustion engine cars. Earlier this year, Mercedes-Benz owner Daimler said petrol and diesel models were a “cash machine” that would help fund the transition to cleaner transport.

BMW has also expressed doubts about the projected growth of the electric vehicle market and highlighted its ability to generate cash and maintain profit margins by taking a more cautious approach.

But Diess has admitted that Tesla is “setting the standard” when it comes to production. In a continuing dispute with VW’s powerful unions, he has pointed out that Tesla builds a car in ten hours, while VW currently requires 30 hours to build its ID. 3 and ID. 4 models.

“We think Tesla has a lot of advantages, being more vertically integrated and having more control over the supply chain,” said Viktor Irle, director of EV-Volumes.com.

Irle also credits Tesla for its simple production line-up. Tesla has just four models in its portfolio and for much of this year only models Y and 3 were being produced at volume as the S and X underwent refreshes. By contrast, VW has more than 20 EVs on the market.

Irle is less optimistic about whether others can catch up Tesla in the foreseeable future. “Tesla is growing a little bit slower, but volume wise they are still growing more,” he said. “We don’t see anyone going to cross Tesla in sales volumes through 2026.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.