Liz Truss’s government set out the most radical package of tax cuts for the UK since 1972, reducing levies both on worker pay and companies in an effort to boost the long term potential of the economy.

Article content

(Bloomberg) —

Advertisement 2

Article content

Liz Truss’s government set out the most radical package of tax cuts for the UK since 1972, reducing levies both on worker pay and companies in an effort to boost the long term potential of the economy.

Article content

Chancellor of the Exchequer Kwasi Kwarteng also cut stamp duty on property purchases and confirmed support for households and businesses from spiraling energy bills at a cost of £60 billion ($67 billion) over the next six months.

https://t.co/ltTy3MUtXY pic.twitter.com/8T8OaFANg2

— Bloomberg UK (@BloombergUK) September 23, 2022

“We promised to prioritize growth,” Kwarteng told Parliament in London on Friday. “We promised a new approach for a new era.”

The measures are aimed preventing a recession that the Bank of England says has already started and to increase productivity, which fallen behind other Group of Seven nations. Economists are concerned that the package is unaffordable and will trigger a currency crisis as investors realize the Treasury’s debt load will keep rising.

Advertisement 3

Article content

Kwarteng’s moves mark thee biggest tax cuts since Nigel Lawson’s budget in 1988. That both lifted the economy and sent inflation soaring, prompting the Bank of England to raise interest rates to a peak of 15% in 1989.

He also announced:

- Cutting the main income tax rate for workers a year earlier than planned, leaving the headline rate at 19% n 2023 and scrapping the 45% top rate of tax

- Removing a 1.25% increase in National Insurance taxes

- Ending a planned increase in corporation tax, leaving the headline rate at 19%

- Easing stamp duty on home purchases, a decision that lifted the shares of homebuilders, relieving the burden on 200,000 buyers a year

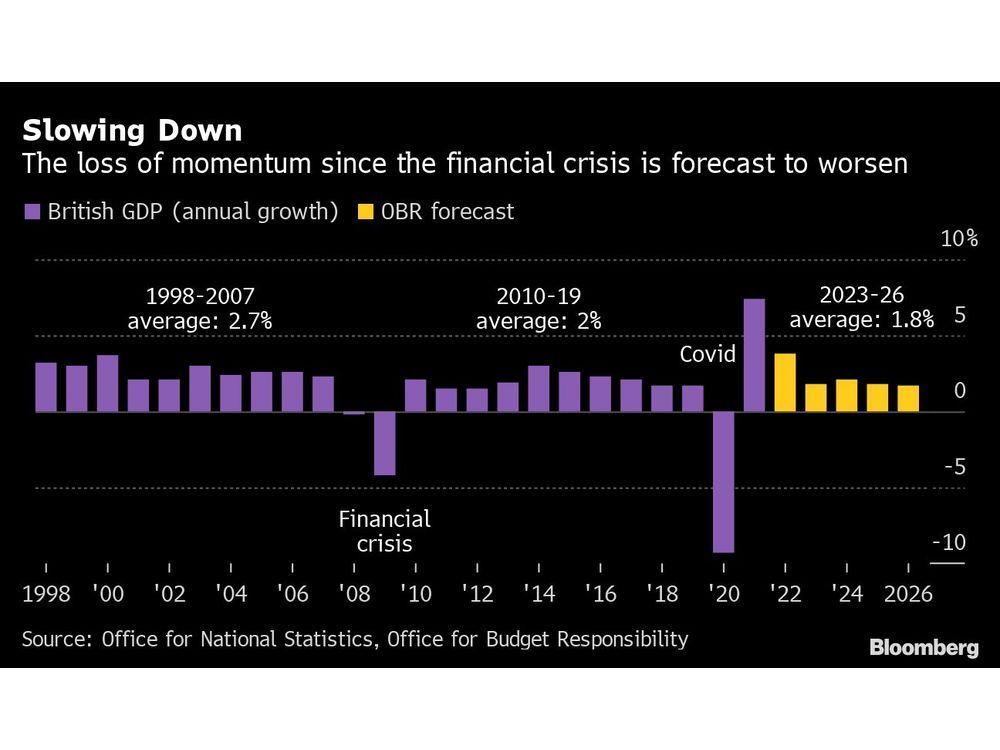

- A target for the UK economy to grow 2.5% a year, a level not achieved for more than a decade

- Steps to reduce planning restrictions for land use, “getting out of the way to get Britain building”

- Scrapping a cap on bonus payments to bankers

- Creating new “investment zones” with lower regulations for those who build businesses

- Cancelling a planned increase in duties on alcohol

Advertisement 4

Article content

https://t.co/ltTy3MUtXY pic.twitter.com/KXHYsWhhle

— Bloomberg UK (@BloombergUK) September 23, 2022

Truss and her allies say the measures they’re announcing won’t spur inflation and that cutting taxes and bureaucracy will allow businesses to expand and draw more people into work, lifting tax revenue in the process.

“What we’ve seen today is a significant shift in economic policy in the UK, and I think it’s the right one,” Gerard Lyons, chief economic strategist at Netwealth Investments Ltd. and an adviser to Truss, said on Bloomberg Radio. “If the policy is right for economy, then also it should be right for the markets as well.”

Economists and former Bank of England officials attacked the plans even before Kwarteng appeared in the House of Commons on Friday. Martin Weale, who served at the BOE from 2010, said the government plans will “end in tears,” while Danny Blanchflower, a policy maker during the global financial crisis more than a decade ago, said investors should short the pound in response.

Advertisement 5

Article content

The Institute for Fiscal Studies and others have warned that the package will put the public finances on an unsustainable path, with borrowing about £60 billion a year higher than previously forecast.

“This is biggest tax cutting event since 1972,” Paul Johnson, director of the IFS said in a tweet after the statement. “That budget is now known as the worst of modern times. Genuinely, I hope this one works very much better.”

What Bloomberg Economics Says …

“The government also looks set to pivot from fiscal conservatism toward efforts to stimulate long-run economic growth. With tax cuts alone unlikely to deliver that goal, our concern is that the package will keep inflation above 2% for longer and shift the public finances onto an unsustainable path.”

—Dan Hanson, Bloomberg Economics. Click for the PREVIEW.

Other critics include the Resolution Foundation, which points out the measure will widen inequality, handing more benefits to the richest people in society and costing those on lower incomes more.

Advertisement

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.