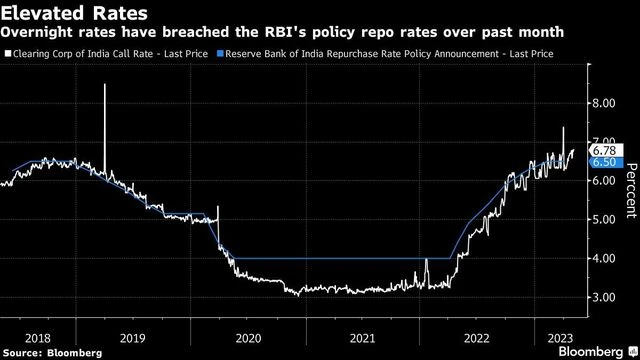

The weighted average call rate, an overnight funding cost rate the central bank monitors, was at 6.78% on Wednesday, above the upper band of the Reserve Bank of India’s interest rate corridor, of 6.75%.

)

Excess cash that banks park with the RBI has dwindled to 788 billion rupees, from as high as 9 trillion rupees in 2022, driving up the funding costs. However, the liquidity crunch may ease soon as the central bank’s dollar purchases in the forex market is adding cash and its dividend payment to the government is due.

“The current liquidity tightness phase is being driven by diminishing core liquidity unlike previous recent episodes which were more owing to higher government cash balances,” said Suyash Choudhary, head of fixed income at Bandhan Asset Management. “Thus this requires more permanent solutions and cannot be termed as ‘frictional.”

First Published: May 11 2023 | 1:31 PM IST

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.