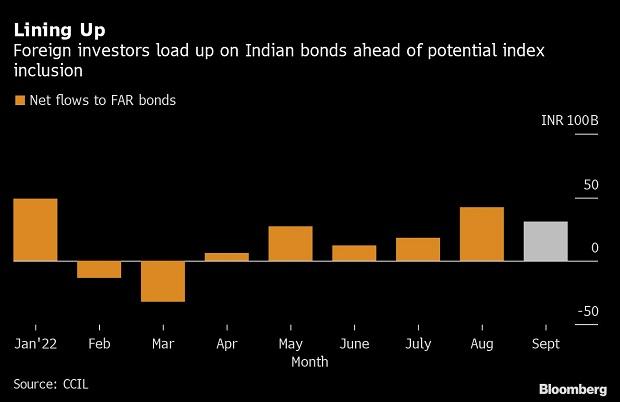

Overseas investors are pouring into Indian bonds, putting the securities at risk of losses if a long-awaited inclusion into global indexes once again fails to take place.

Bond purchases by global funds under the so-called Fully Accessible Route jumped to 42 billion rupees ($529 million) in August, the most since January. They have already snapped up an additional 31 billion rupees of the securities in September.

The inflows have added fuel to a bond rally driven by optimism that JPMorgan Chase & Co. will announce the inclusion of Indian debt in its emerging-markets index as early as the middle of this month. Any disappointment may damp sentiment and lead to a selloff, according to Quantum Asset Management Co..

India’s benchmark 10-year yields have dropped about 50 basis points from their June high of 7.62%, to close at 7.12% on Wednesday. In contrast, similar-maturity US Treasury yields jumped about 40 basis points since the end of that month.

“The only thing driving the Indian bond market is the index-inclusion theme,” said Pankaj Pathak, a fixed-income fund manager at Quantum Asset in Mumbai. “If by any chance we don’t get that, I wouldn’t be surprised to see 10-year yields returning to 7.50%.”

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.