AT&T’s WarnerMedia and Discovery unveiled their blockbuster $43-billion union Monday, a combination that would bring some of the biggest names in television — HBO, CNN, HGTV, Animal Planet and Food Network — and the Warner Bros. movie studio under one roof.

As part of the all-stock deal, AT&T shareholders would own 71% of the new company and Discovery shareholders 29%. AT&T also would receive about $43 billion in cash, debt securities and other consideration. The boards of both AT&T and Discovery approved the transaction over the weekend.

The proposed media marriage comes amid upheaval in the industry as traditional TV giants grapple with declining ratings, consumer cord-cutting and the rising threat posed by Netflix, Hulu, Disney+ and other streaming services.

If approved by investors and regulators, the deal would create a new company that would generate more than $50 billion a year in revenue, housing the D.C. comics franchise, Harry Potter, “Game of Thrones,” “Cake Boss,” “100 Day Dream Home” and “Pit Bulls and Parolees.”

Discovery Chief Executive David Zaslav, 61, will run the combined company. The veteran executive has been leading Discovery since 2007. A lawyer by training, he helped take the company public in 2008 and was an architect of its transformative $12-billion purchase of Food Network and HGTV in 2018.

“During my many conversations with John [Stankey, AT&T’s CEO], we always come back to the same simple and powerful strategic principle: These assets are better and more valuable together,” Zaslav said in a statement. “It is super exciting to combine such historic brands, world class journalism and iconic franchises under one roof and unlock so much value and opportunity.”

Zaslav said in a news conference that he would have an office on the historic Warner Bros. lot in Burbank.

The spinoff move marks a significant retreat for AT&T, which spent $85 billion three years ago to buy the Time Warner media properties. It battled in court for more than a year with the U.S. Justice Department as former President Trump, a CNN critic, wanted the deal killed. AT&T won a judge’s approval and finalized the deal in June 2018.

But that merger been a rocky ride, marked by an exodus of top executives almost from the beginning.

Now, the Dallas telecommunications company is betting that its entertainment assets will be worth more in a stand-alone company than as a division within the phone colossus. AT&T also was motivated to remove some of its $180-billion in debt from its balance sheet.

“This agreement unites two entertainment leaders with complementary content strengths and positions the new company to be one of the leading global direct-to-consumer streaming platforms,” Stankey said in a statement. “It will support the fantastic growth and international launch of HBO Max with Discovery’s global footprint and create efficiencies which can be re-invested in producing more great content to give consumers what they want.”

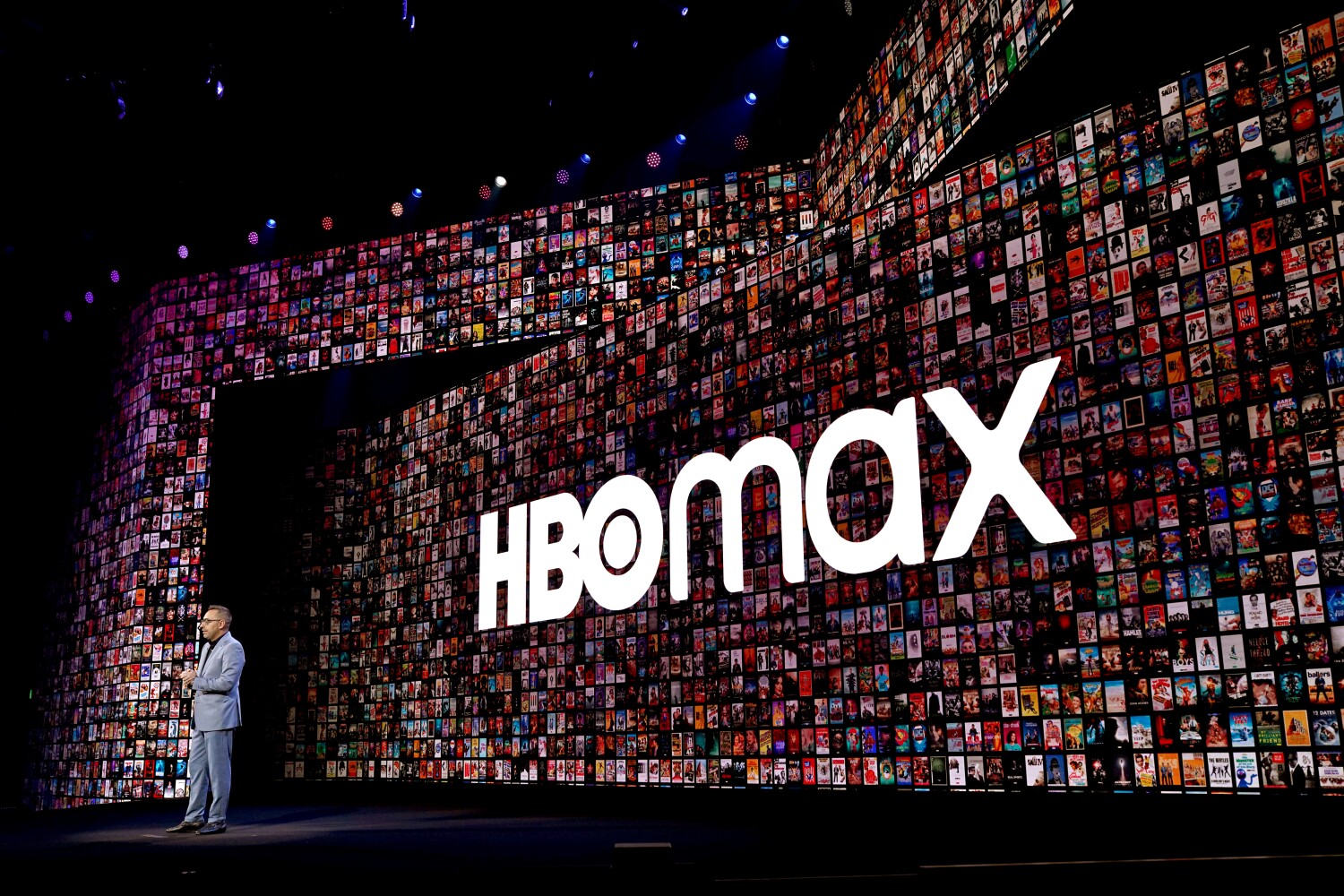

Although AT&T had hoped for ways to connect its phone subscribers with its entertainment offerings, it found itself stretched financially as it simultaneously tried to build a nationwide 5G telephone network while also trying to ramp up spending on its year-old streaming service, HBO Max.

The proposed deal with Discovery comes just three months after AT&T said it would spin off another troubled asset, El Segundo-based DirecTV, into a stand-alone company, co-owned by TPG Capital. With the twin moves, AT&T is doubling down on its core business: providing consumers with phone and data service.

The WarnerMedia-Discovery deal will be subject to a regulatory review that could last at least a year. The two companies’ TV channels draw about 30% of the cable television audience and both operate nascent streaming services with growing subscriber bases. HBO and HBO Max combined have about 44 million subscribers. Discovery+ has about 15 million subscribers worldwide.

The two companies also own some of the most popular cable channels, including TBS, TNT, CNN, Cartoon Network, HGTV, OWN and Investigation Discovery.

“The scale certainly would be imposing,” Cowen & Co. media analyst Doug Creutz wrote in a research note Sunday. “However, the companies have very different cultures and competencies. The combination looks unwieldy, with close to 30 different cable networks owned in the U.S., plus many more owned internationally.”

Discovery has been growing its business internationally, particularly in Europe. It is a part-owner of a streaming service in Germany.

Discovery’s chairman is John Malone, a shrewd investor who is largely credited as one of the pioneers of the pay-TV business. In 1999, he sold his cable TV business to AT&T for $55 billion, becoming AT&T’s largest investor, but Malone eventually wound down his stake to concentrate on his Liberty Global business. In recent years, Malone, who controls Liberty Global, has been outspoken about the need for consolidation, arguing that small, unaffiliated media companies will be unable to compete against tech giants.

The proposed merger comes amid a flurry of consolidation in the entertainment industry.

Two years ago, Walt Disney Co. paid $71 billion to buy much of Rupert Murdoch’s entertainment empire. And in the past year, legacy media companies have laid off thousands of workers amid the COVID-19 pandemic as theme parks and TV and movie production stalled. WarnerMedia alone cut about 2,000 positions.

“A merger would also cause a lot of internal stresses given the likelihood of job eliminations (particularly at WarnerMedia, which has already been through a couple rounds of upheaval since the AT&T acquisition),” analyst Creutz wrote.

Earlier this month, AT&T competitor Verizon announced that it was selling most of its media assets, including Yahoo and AOL, for $5 billion. The telecommunications market is fiercely competitive, and T-Mobile has been making gains with its 5G phone service, challenging the two longtime leaders, Verizon and AT&T.

window.fbAsyncInit = function() { FB.init({

appId : '134435029966155',

xfbml : true, version : 'v2.9' }); };

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Entertainment News Click Here

For the latest news and updates, follow us on Google News.